We suggest exploring the idea of buying Eurobonds of Vedanta Group, one of the India’s largest diversified holdings. The company's dollar issues yield attractive return with moderate credit profile risks. In terms of relative value, we like VEDLN 23 Finance (YTM 8.1%) issue that is traded at a notable premium to its own curve. The security’s upside is at least 3% (up the target of 103.0%), according to our estimates.

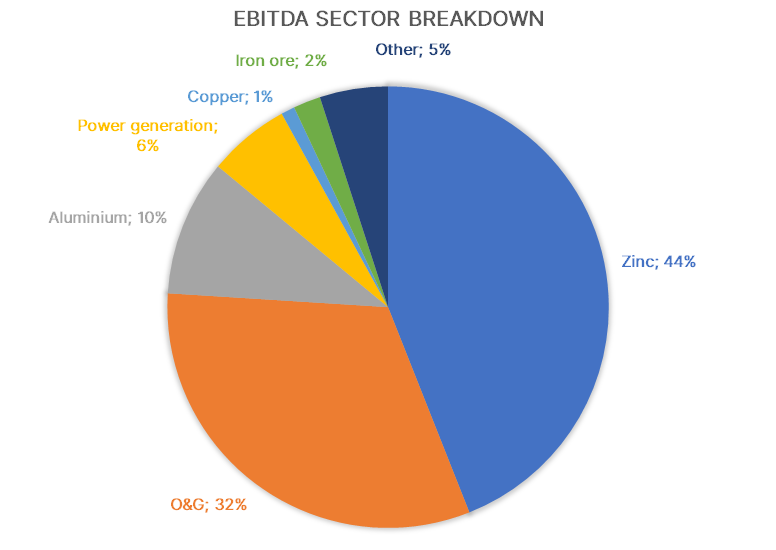

- Vedanta (B2/B/-) – is a major diversified holding that brings together companies from various regions with the bulk of operations in the mining and oil and gas sectors. A major portion of its operating assets is located in India (domestic sales account for approximately 60% of revenues), where the group was set up in 1976 as a scrap-metal dealership. In addition, production sites are located in China, Malaysia, UAE, Australia, Zambia, etc. Vedanta is India's largest private producer of crude oil, accounting about a quarter of the market. The group is also India’s leading producer of zinc, aluminium, copper and iron ore. Rampura Agucha is the second largest zinc mine in the world. Vedanta is a private company wholly owned by its founder Anil Agarwal (his worth is estimated at $4 bln). The company delisted from the LSE in 2018

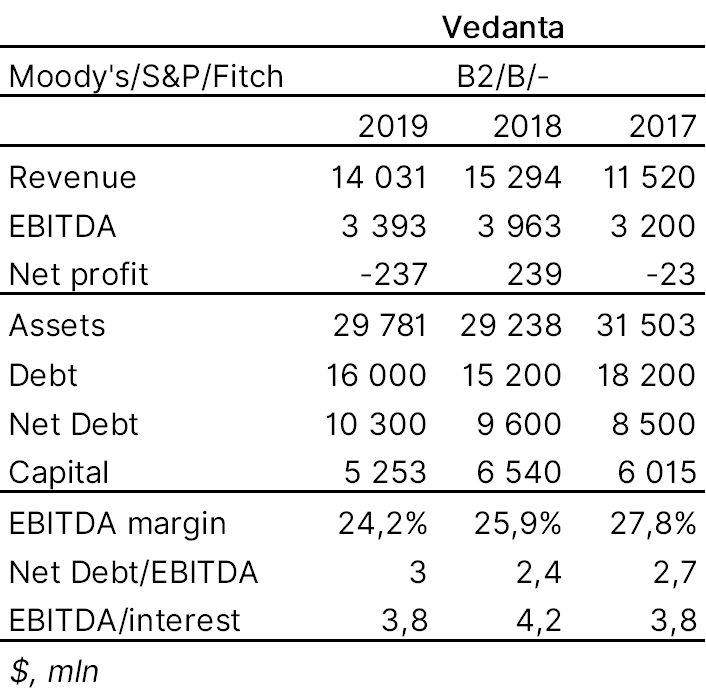

- We are upbeat about Vedanta's credit profile, despite its inherent risks, primarily due to its products sensitive to the business cycle. The group's debts look moderate - the net debt/EBITDA ratio stands at 3x in 2019. The debts repayment schedule is quite comfortable - payments due next year account for no more than 18% of the total portfolio. At the same time, the leverage indicators have remained stable over the past few years, despite the active phase of the investment cycle. Completion of the capital expenditure programme in 2020 is expected to have a positive impact on production and, consequently, on the issuer's credit metrics

- In September 2019, the Indian government unveiled fiscal stimulus to spur the national economy. In particular, the effective corporate income tax rate, including additional levies, was cut to 25% from 30%. The step is meant to promote growth that, in turn, is expected to improve operational climate for local firms (rebound of consumer demand). In terms of direct impact on Vedanta's balance sheet, this means a tax saving of 3-4% of annual EBITDA

- International public bonds issued by Indian corporates, including Vedanta bonds, look cheap as compared to EM peers (across comparable rating groups) partly due to the absence of a sovereign dollar benchmark and, in general, low demand for the Indian risk from foreign investors

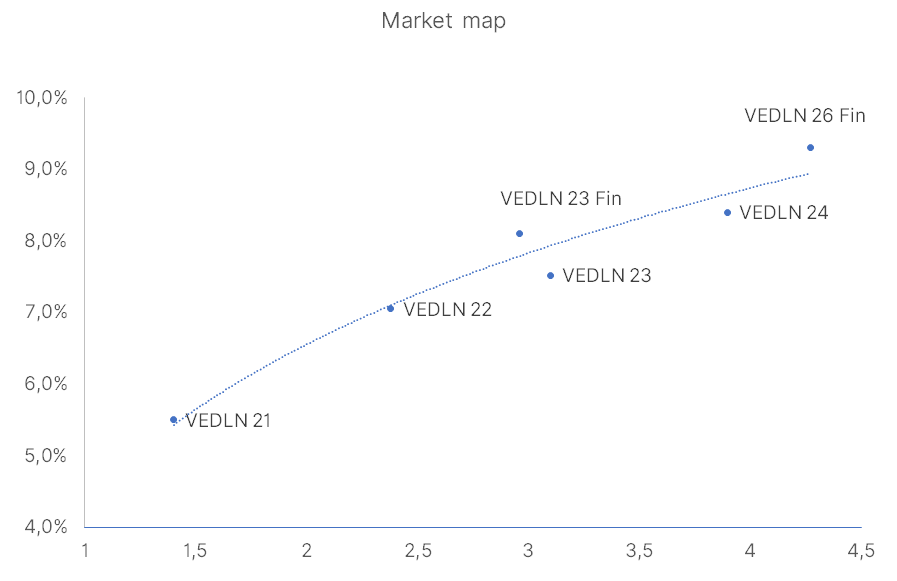

- Vedanta has six issues of USD Eurobonds outstanding with maturities up to 2026 and 5.5-9.3% yields per annum. The issuer curve has a very steep slope, i.e. implying significant duration premiums. At the same time, bonds of global peers in the metal industry yield an average return of 4-6%. We like VEDLN 23 Finance (YTM 8.1%) issue placed in April 2019. The yield exceeds that of a slightly shorter VEDLN 22 (YTM 7.05%) issue amounting to over 100 bps. The security’s upside is at least 3%, according to our assessments

Olga Nikolaeva, Senior Fixed Income Analyst