On November 7, MSCI will announce the results of the 2019 Semi-Annual Index Review for the Global Equity Indices. The effective date is November 27, 2019. We don’t expect inclusions/exclusions for MSCI Russia during semi-annual rebalancing in November, but in May 2020 the Index’ structure may undergo dramatic changes.

- The standard cut off dates for the prices used for calculating minimum requirements including minimum free-float market capitalization requirement are any one of the last business days of October (October 21 – 31) for the November Semi‐Annual Index Review (SAIR)

- We estimate minimum market capitalization required for inclusion in MSCI Russia is $3.2 bln, the minimum free-float adjusted capitalization is $1.6 bln

- We estimate minimum market capitalization required for exclusion from the index is $2.14 mln and $1.07 mln respectively

- One of the key events is the final stage of inclusion of China A shares in the index, that will bring the aggregate weight to 3.3%. After implementation, the MSCI Emerging Markets Index will include 253 Large and 168 Mid Cap China A shares, including 27 ChiNext shares, model-based predictions suggest. As part of the transition, the MSCI All China Indexes will be discontinued effective November 27, 2019

- All inclusions since May will bring up to $4 bln in inflows, out of which $960 mln are expected in May after increase of FIF (the proportion of shares outstanding that is available for purchase in the public equity markets by international investors) from 15% to 20%

- This may trigger $80 mln outflow from MSCI Russia, not much, given that Russia accounts for $5 bln of passive capital and lead to decline in weight of some Russian issuers, which, in turn, will have an impact on certain stocks and the market in general

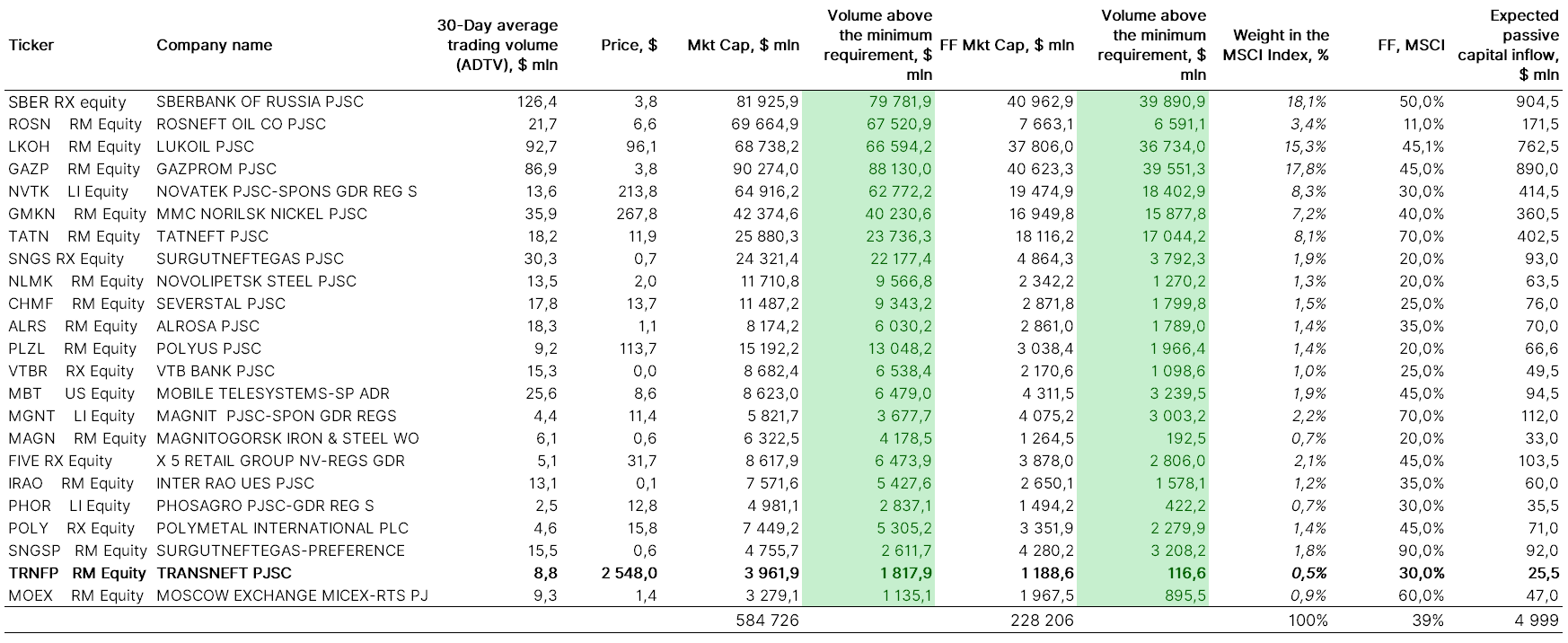

Candidates for delisting in November 2019 and May 2020

Transneft: Bladerunning continues

- Transneft pref has the lowest weight in the index (0.53%), it was 0.61% at the beginning of the year

- Transneft is the most likely candidate for de-listing, it survived the six-month review in November 2018 and in May 2019 is likely to do it again in November 2019 due to a rally on October 16 (for a few days since the calculation period) that pushed the shares up 8% for no apparent reason

- Free float capitalization is the company’s weakest point. It stands at $1,188 mln, just $117 mln above the minimum requirement (8%). Transneft exclusion may trigger an outflow in $50 mln, that is 5-6 times as large as the ADTV in USD

MMK is a new candidate for inclusion in May 2020

- MMK is facing the biggest exclusion risks. Free float capitalization is the company’s weakest point. It stands at $1,270 mln, just $200 mln above the minimum requirement (16%)

- MMK exclusion may trigger an outflow in $60 mln, that is 5-6 times as large as the ADTV in USD

Candidates for inclusion in November 2020

Источник: ITI Capital, Bloomberg, MSCI

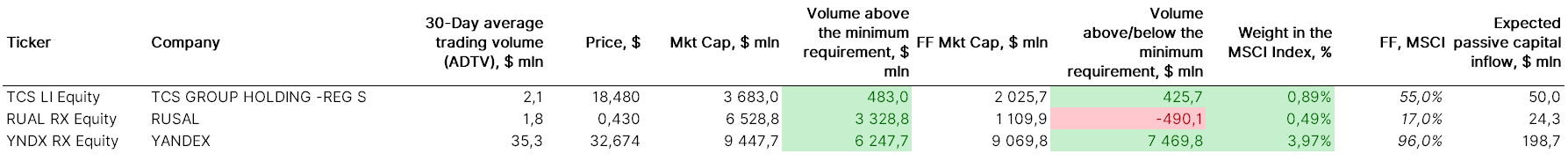

Tinkoff – shares may climb above 20% if the company is included in the MSCI Russia index.

- Tinkoff (TCS LI) is a new promising candidate for inclusion. TCS Group Holding GDRs have been listed and included in the first level quotation list, trading started on October 28. The company meets all minimum capitalization requirements ($3,683 mln) and free-float-adjusted capitalization requirements ($2,026 mln). The current average daily liquidity exceeds $2 mln, while the liquidity level (ATVR) exceeds 25% as compared to MSCI minimum liquidity level of 15%. Tinkoff should maintain the minimum level of liquidity amid GDRs listing

- Tinkoff’s case echoes that of X5 Retail Group that was included in the index in May 2018 after GDR’s local listing

- We estimate the potential weight in the index at 0.9%, which implies a potential inflow in $50 of passive funds, which is 23 times the current average daily trading volume (ADTV). This weight exceeds the weight of Transneft, roughly equalling that of Moscow Exchange

Yandex – inclusion not earlier than November 2020

- In addition to Tinkoff, we believe that Yandex still looks like a promising candidate, but the company lacks local liquidity due to high free-float (96%)

- According to our estimates, the average daily liquidity for each quarter should not drop below $6 mln, so the current trend began only in the third quarter and should continue until the third quarter of 2020

-676.png)

Source: ITI Capital, Bloomberg

Rostelecom meets the liquidity requirements, the main issue is the free float-adjusted market capitalization, which should add 20%.

Quarterly liquidity calculation based on MSCI AVTR, %

-870.png)

Source: ITI Capital, Bloomberg

Rusal inclusion is subject to meeting the minimum requirement (MSCI FF-adjusted cap).

As for Rusal, the company met the minimum liquidity requirements and its ATVR ratio exceeded 15% from the first quarter to the third quarter of 2019, but free float-adjusted capitalization should increase by 30% from current levels.

Quarterly liquidity calculation based on MSCI AVTR, %

-896.png)

Source: ITI Capital, Bloomberg

What is MSCI and why it matters?

- The MSCI Indices are globally recognized benchmarks, against which some $14 trln in investors' assets are tracked

- MSCI (Morgan Stanley Capital International) financial indices are among the most recognized global indicators

- They are ideally suited for hedge funds, ETFs, investment vehicles; reflect the macroeconomic climate; more solid as compared to "proprietary" indices of exchanges.

- When Index Review changes take effect, the weight’s drop/growth leads to an outflow/inflow of capital from passive funds amounting to $6–7 mln every time the weight changes by 0.1%

- Daily trading volume may be up to 10 times the average 30-day trading turnover

Russia in MSCI, %

-228.png)

Source: ITI Capital, Bloomberg

MSCI index structure

Source: MSCI, ITI Capital, Bloomberg