Ukrainian sovereign Eurobonds surged 25% year-to-date, the most on record, and are second only to Costa Rica’s (+26%) now. The main growth drivers have been undervalued price levels, demand for high-yield assets and the victory of pro-Western candidate Vladimir Zelensky in the presidential election.

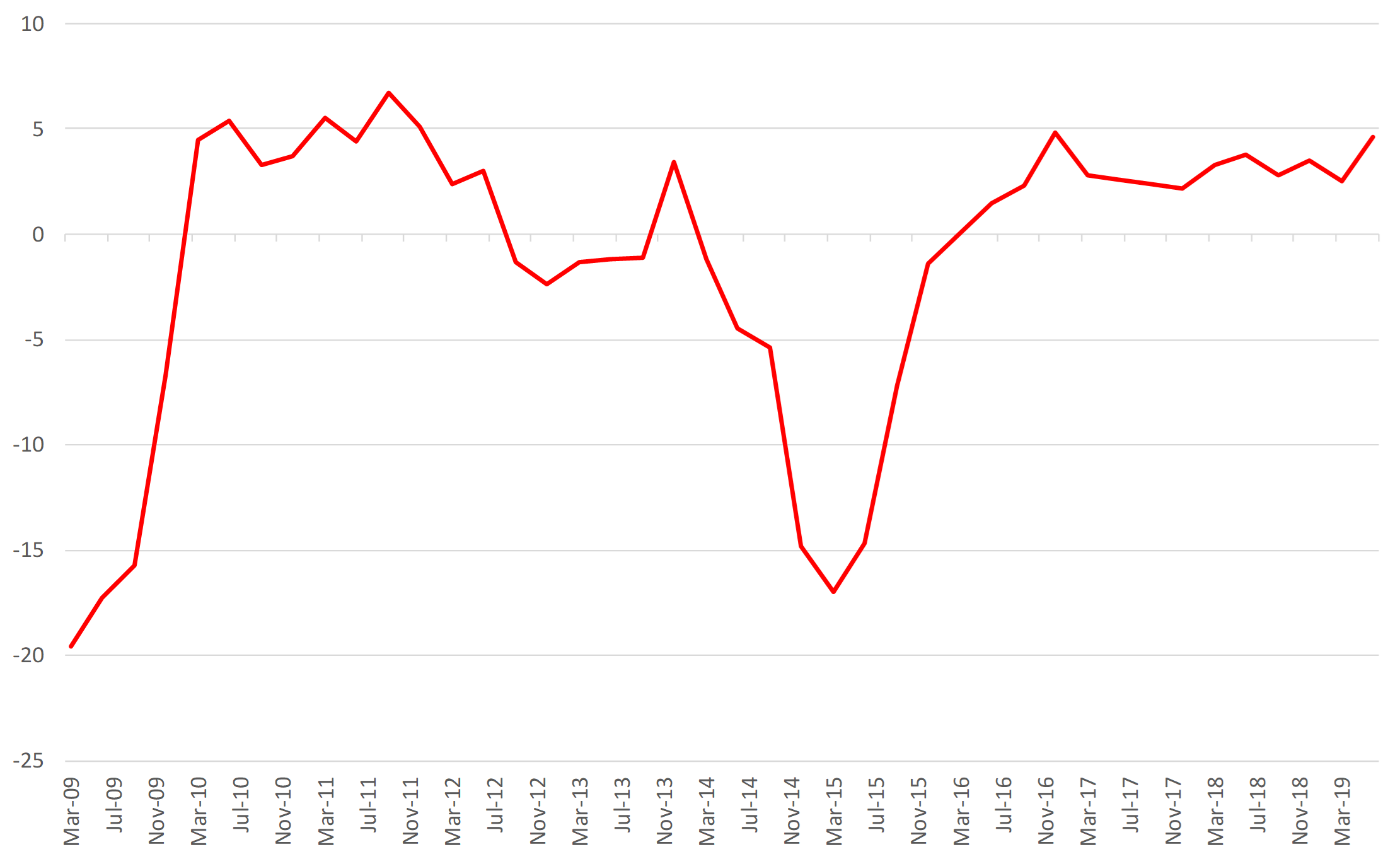

All in all, we believe that the upside potential is still strong due to the low base effect in previous years — during the crisis of 2015 GDP dropped to annual rate of −15%, and after four years of stagnation the economy has bound back with the growth rate of 5% in the first half of 2019.

Ukraine's long-term bonds now yield 400-500 bps lower of what they did eight months ago due to recent strong surge in demand.

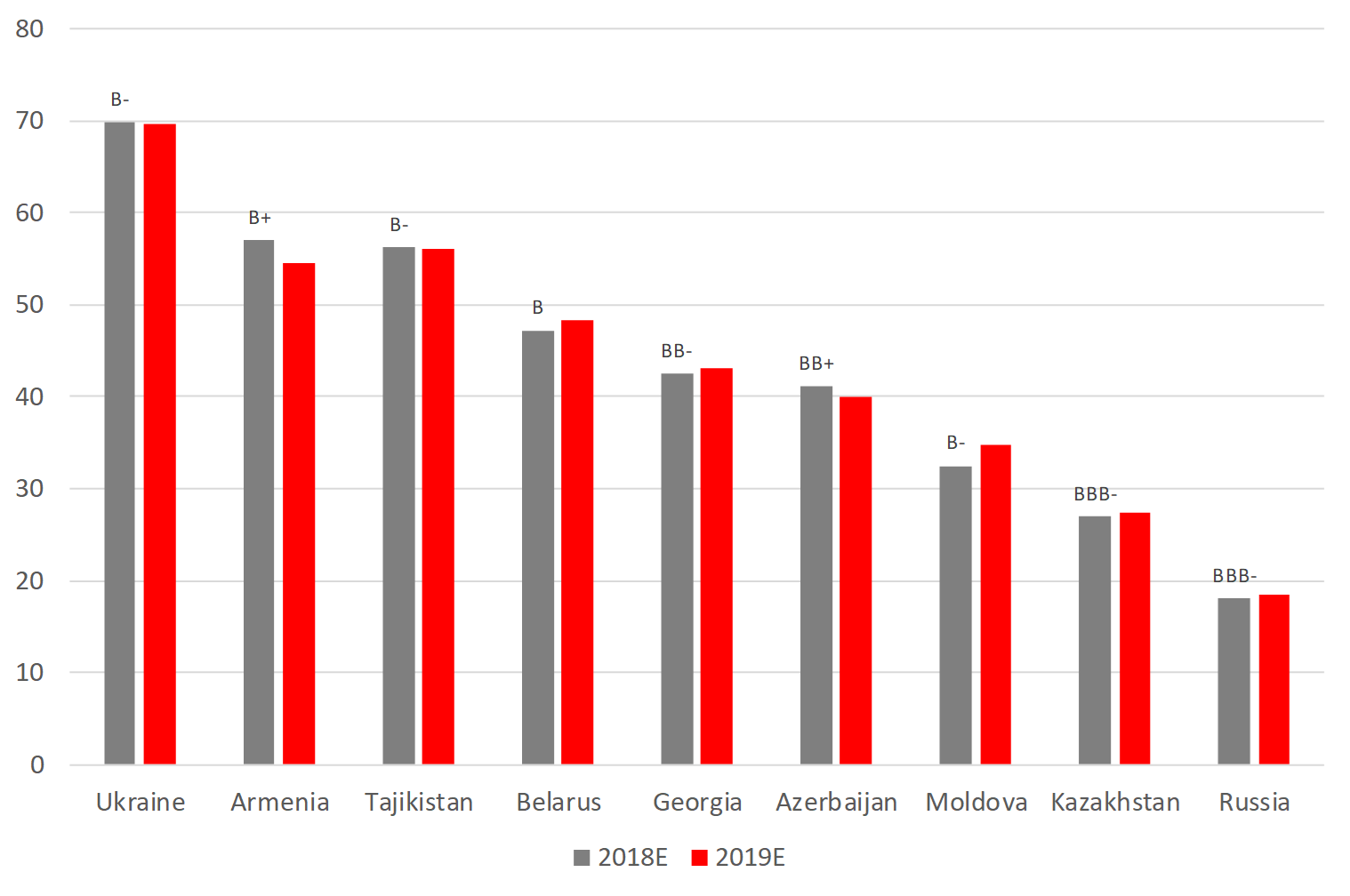

With the economy picking up, we expect real GDP to grow 3% in 2019, the current account deficit to shrink to −1%, the budget balance to improve to −2% and debts to decline partially amid of one of the highest debt/GDP ratios among CIS countries.

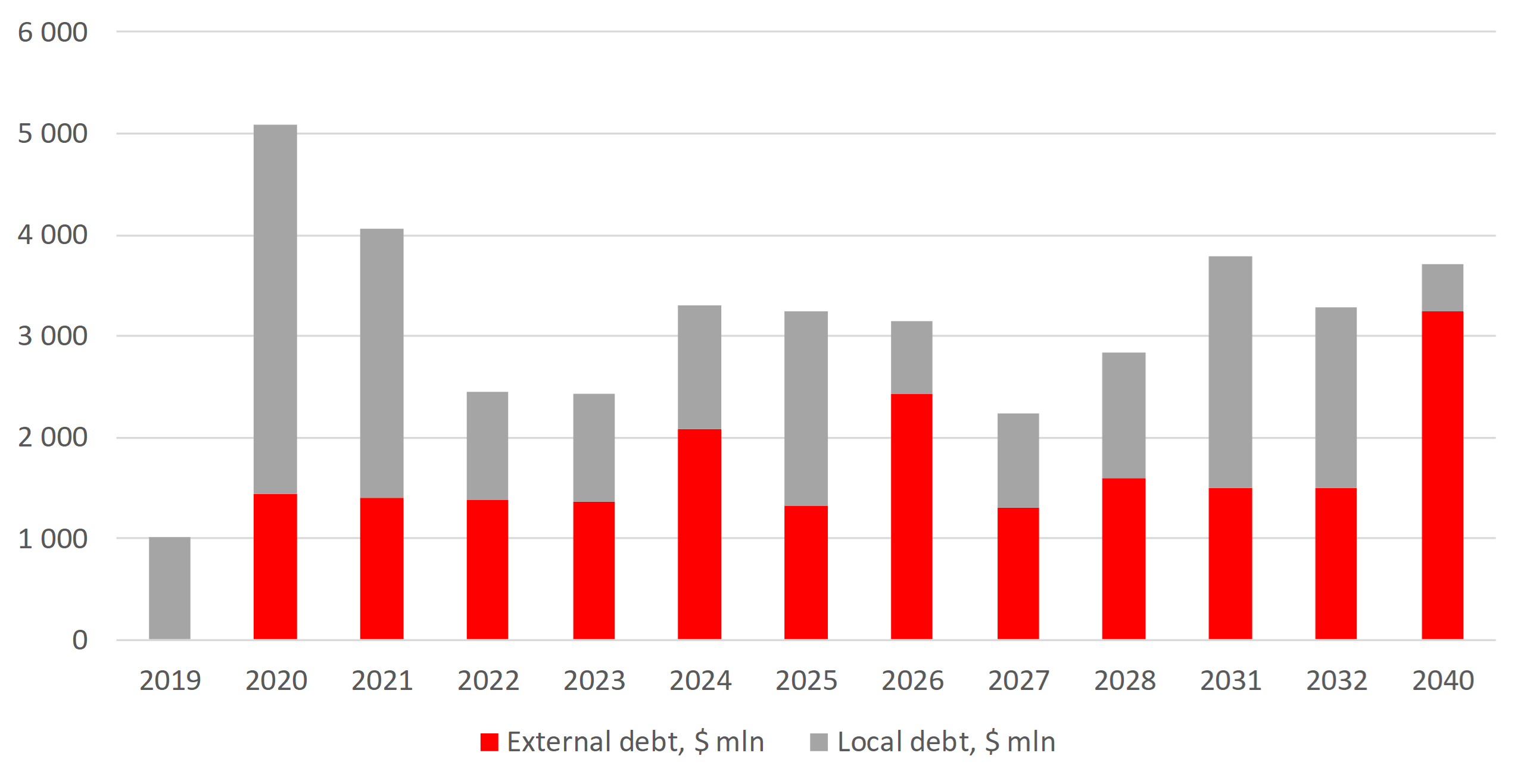

FX reserves increased by $5 bln to $21 bln over the past 12 months, the government’s short-term and mid-term bonds (up to 5 yrs maturity) now amount to $18 bln, long-term liabilities (over 5 yrs maturity) amount to $22 bln, a total of slightly above $40 bln.

Ukraine external debt payments, $ mln

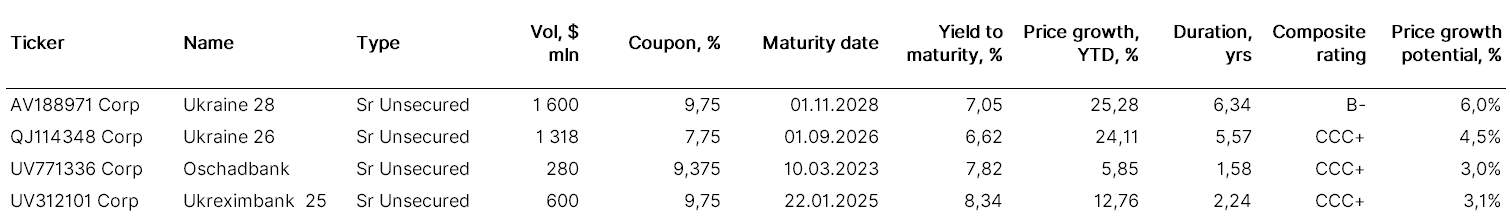

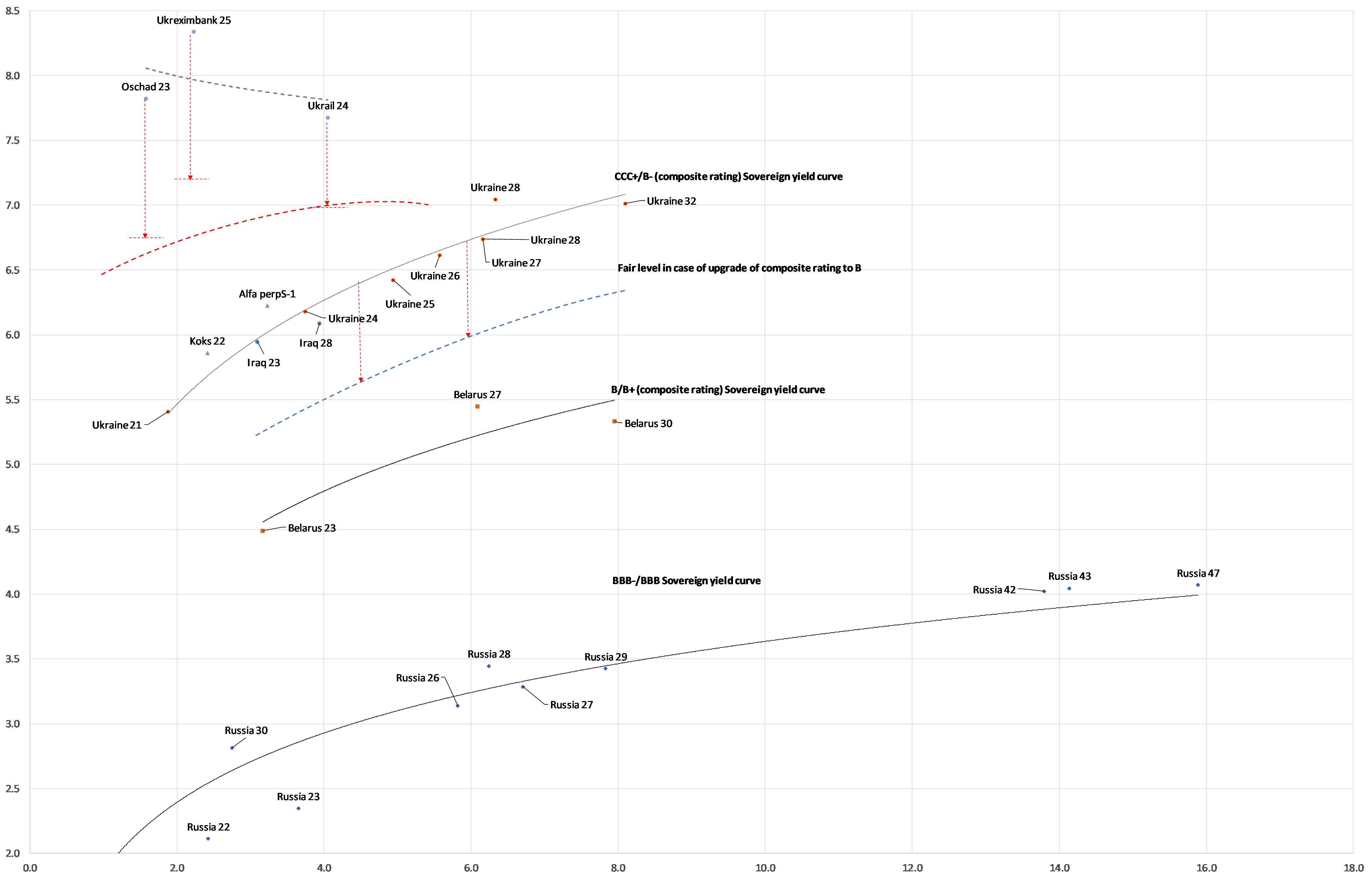

One of the key factors that may drive further growth is a possible upgrade of the long-term sovereign rating to B (Belarus level), from the current CCC+/B-, in the near term.

Moreover, given Ukraine's debt/GDP ratio is lower than Belarus’ by 20 pp, we believe that if the spread remains, it should narrow significantly.

Growth drivers

- Ukraine is rated below Belarus by one notch. Ukraine’s current long-term bonds premium of 120 bps should not effectively exceed 50 bps. Therefore, we expect the bonds’ price to climb by 5%

- Some Ukrainian state-owned entities look even more attractive, such as Ukreximbank with potential yield downside of 150 bps, and a 3% price upside; Oschadbank and, to a lesser extent, the Ukrainian railways

- We believe that on the price side, Ukraine's quasi-sovereign bonds lag significantly behind the sovereign bonds, and the latter, in turn, lag behind other similar rating CIS states’ bonds

Top picks

Ukraine and CIS yields curve

Source: National statistics agencies, IMF, ITI capital

Given that high debt/GDP ratio is Ukraine's major challenge, the country’s FX bonds coverage ratio is slightly below Argentina’s, standing at 80%.

Source: IMF, ITI capital

Ukraine’s GDP

Source: Bloomberg, ITI Capital