Target price: $26.01 (+10% dividends included, till year-end)

Current price: $23.68

Support: $22.23

- The shares of MMC Norilsk Nornickel (MMC NN), the world’s largest producer of nickel and palladium, look attractive given strong financial results, higher nickel demand going forward given recent supply squeeze in Indonesia and appealing dividend yield

- On August 20, Nornickel (MMC NN) reported 2Q19 IFRS results above Bloomberg's estimate. Revenue was $6.3 bln (+8% yoy), EBITDA – $3.7 bln (+21%), net income – $3 bln (+81% yoy), EBITDA margin – 59%, ROE – 99%

- The board recommended 1H19 interim dividends of $1.34 per DR, above ITI Capital's estimate of $1.25 per DR . Total pay-out amounts to $2.1 bln (FCF for 1H19: $2.2 bln)

- The dividend yield may reach 5.9%, the record date is October 7, 2019. We assume that 2H dividends may equal or top 1H, bringing the annual dividend yield to 12–13%

Major triggers for MMC NN

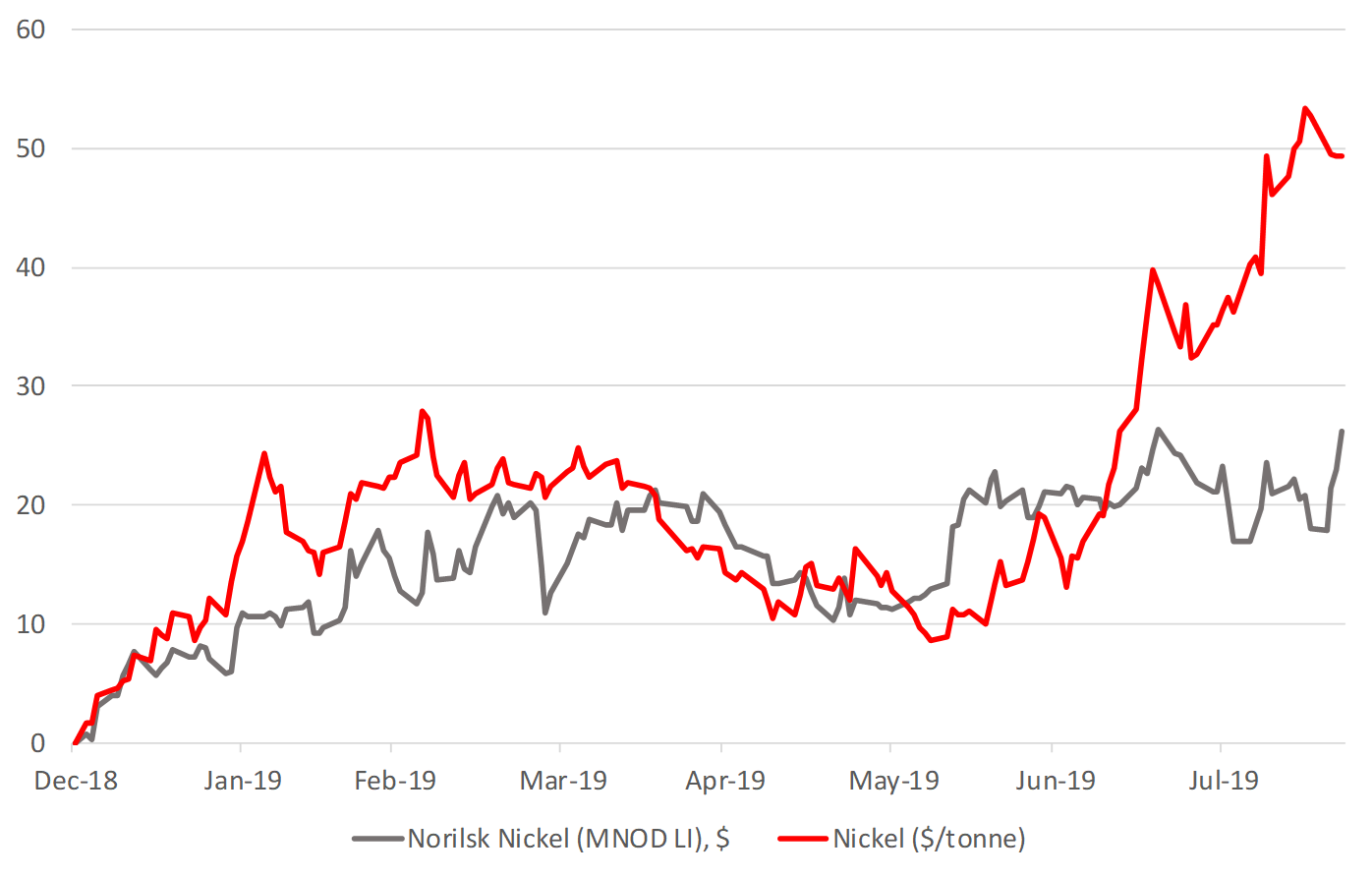

- Nornickel shares have been lagging behind nickel prices. Nornickel advanced 26% year-to-date, while nickel surged 49%, gaining 25% since early July. Nickel has benefited from prospects for a demand boost from its use in electric-vehicle batteries, as well as concerns that Indonesia (the world's biggest nickel ore exporter) could bring forward a previously announced ban on exports of nickel ore by 2022

- We expect Nornickel's shares prices to reach $26-27 till year-end and catch up with the metal prices

The performance gap between equity of MMC NN and its base asset (Norilsk, $/tonne) have been widening recently reaching historical high