The Missing 2%

Gazprom is considering a sale of a remaining package of its own quasi-treasury shares, Bloomberg reported on Wednesday, 7 August, citing two people familiar with the plans. The company’s units now hold a 3.7% stake, according to Bloomberg calculations and Gazprom’s statement published following a 2.93% stake sale in late July.

''The free float of Gazprom will increase to 46.02% of the charter capital upon completion of the placement'', the company said in an official press-release. Therefore, a stake held by affiliated legal entities and individuals is estimated at 3.75% (50.23% is owned by the state).

However, our analysis of Gazprom’s affiliates disclosed on 30.06.2019 shows that they own as little as 1.62% of the company’s shares (net of the shares sold recently by Gazprom Gerosgaz and Rosingaz). The following are affiliate holders of the largest stakes in Gazprom: Gazprom Gazoraspredelenie (0.89%), Gazprombank (0.49%), Stroygazconsulting (0.11%), Gazprom Mezhregiongaz (0.06%). We have failed to identify ownership of the remaining 2%, which can be considered quasi-treasury shares. It therefore raises questions about transparency of Gazprom's shareholder structure and amount of shares that may be subject to sale.

Gazprom remains the fastest growing blue chip year-to-date (+50% in rubles). Consensus-forecast for 12 months barely exceeds 260 roubles. We believe that there’ll be little enthusiasm in the market for the new placement — the recent sale of 2.93% at a discount price did not meet market standards leaving many potential investors, especially non-residents, disappointed. Foreigners own the bulk of Gazprom’s free-float (70%) worth $29 bln trading in the market.

We’re not ruling out that the next quasi-treasury shares placement will also be offered to a narrow pool of investors, and the deal therefore will not be able to meet market standards, according to our estimates.

Impact on MSCI Russia

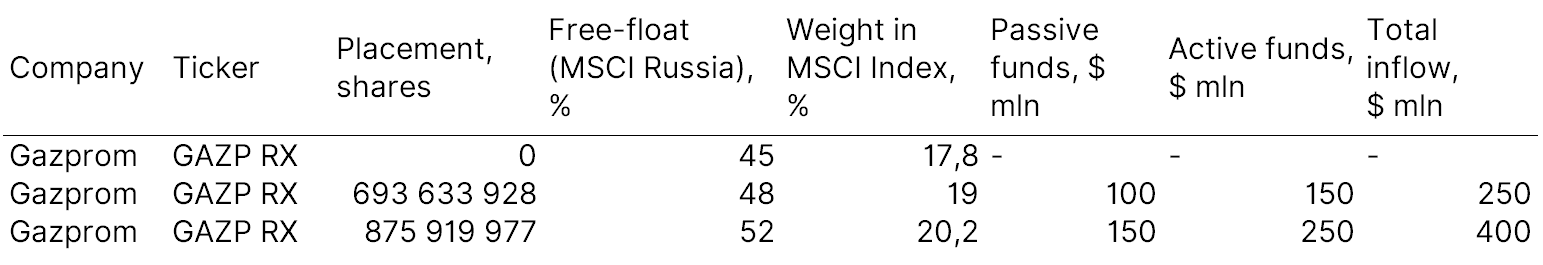

The new placement of 875,000 shares (3.7%) may draw $400 mln (active funds included) into Gazprom shares through MSCI Russia. The first placement may draw $250 mln into the company’s shares, according to our estimates. Gazprom’s weight in the MSCI Russia was 17.8% as of early August. After the new placement the company’s free float may go up from the current 10,653,080,805 to 12,222,634,710, bringing Gazprom’s weight in the index to 20.2%. The inflow of funds following the new placement will exceed the average free float by 1.5 times, following the two placements combined — by 2.3 times. The results of this corporate action will most likely be announced following Semi-Annual Index Review on 7 November and will take effect on 27 November.

Research department