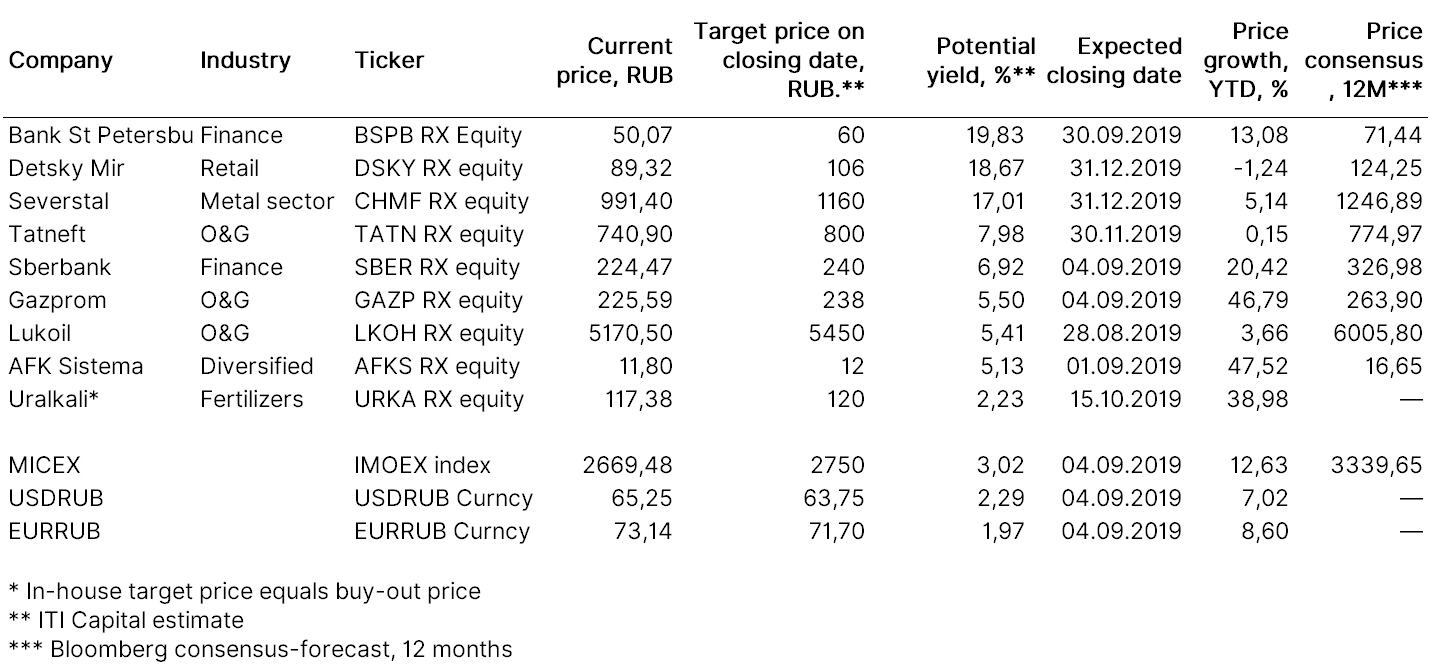

Please see below the latest trade ideas with attractive yields in the Russian market:

Source: Bloomberg, ITI Capital

Polyus gold

- Today we are closing a trade idea “Buy Polyus shares” and opening the idea “Buy Uralkali shares to participate in the mandatory buyout”

- Polyus reached 6,943 roubles, well above the target level for our trade idea of July 4, amid higher gold prices and strong 2Q19 earnings. The trade idea we’re closing today yielded +14.4% over 33 days

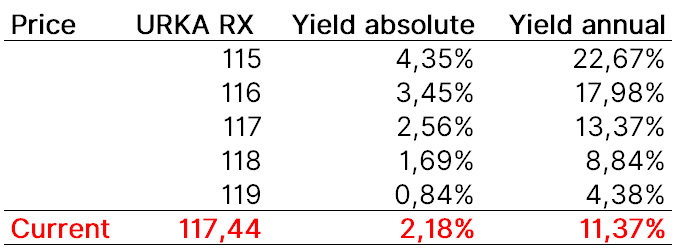

Uralkali

- Cyprus-based Rinsoco Trading, owner of 96.73% of Uralkali, made a mandatory offer to minority shareholders to buy their stock at 120 roubles per share, Uralkali disclosed late on Monday in a regulatory filing. The share register for buyout will be closed on September 20, and payments for the acquired shares will be made no later than October 15. Buying Uralkali shares to participate in the buy-back may secure a 2.2% yield in 70 days, roughly 12% per annum

Gazprom and Sberbank

Gazprom and Sberbank shares may rise to 238 and 240 roubles respectively in the coming month, paring recent losses, according to our projections. Much of rebound will be technical driven as market volatility will ease and risks of harsher sanctions against Russia is fading.

Lukoil

- Our target price for Lukoil corresponds to the current offer price – the company is acquiring 35 mln of its own shares from Lukoil Securities. The shareholders may file an application for sale of shares for 5450 roubles to the registrar of the company – LLC "Registrar "Garant” through August 14, but the applications will be granted proportionally to the number of submitted applications. The number of shares subject to buy-out from each shareholder will be set after the offer is reviewed, the payments will be made not later than August 28. We believe Lukoil may rise 15% this year amid expectations of a new buy-back programme and strong financial performance due to higher share of high-margin barrels in total production

Tatneft

- The board of directors of Tatneft recommended at a meeting on August 5 that the oil company pay dividends for the first half of 2019 in the amount of 40.11 roubles per share on all types of shares, in line with our estimates (100% net profit under the Russian Accounting Standards). Dividend yield on ordinary shares may amount to 5.6%, we also expect strong IFRS reporting for 2Q19

Bank of St. Petersburg

- Bank of St. Petersburg’s announcement of a 12 mln shares buy-back (1% of the share capital) at 53.5 roubles per share (a premium of 19.83% to the current level) is expected to support the bank's shares. The buyback will take place from September 6 to October 7, 2019

TMK

- Completion of acquisition of TMK’s IPSCO Tubulars (US subsidiary) by Tenaris for $1.2 bn is the key driver for the company’s shares, as the deal will significantly reduce TMK's debt burden

Severstal and Detskiy Mir

- We maintain our recommendations on buying Severstal and Detsky Mir shares, amid expected positive financial performance and attractive interim dividends

Buying Uralkali

Buying at current prices: 117.4 roubles

Target price: 120 roubles

Expected yield: +12% pa

Hold till October 15

Cyprus-based Rinsoco Trading, owner of 96.73% of Uralkali, made a mandatory offer to minority shareholders to buy their stock at 120 roubles per share, at a 2.25% premium to the current price. The share register for buyout will be closed on September 20, and payments for the acquired shares will be made no later than October 15. Buying Uralkali shares to participate in the buy-back may secure a 2.2% yield in 70 days, roughly 12% per annum.

Share price – August 2018 – August 2019

Iskander Lutsko