Key takeaways

- The share of dividend payouts in Russia may for the first time exceed 4% of GDP by the end of 2021, compared with 2.7% of 2020.

- Record payouts are expected both for the third quarter of 2021, and cumulatively for 2021.

- It will be hard to exceed the expected total payouts for 2021, but it will be possible to achieve a similar amount at the end of 2022, given higher demand for hydrocarbons and their deficit, which will remain at least until the end of 2022.

- Russia has entered the top 10 countries by the volume of payouts and has become the first in terms of yields, surpassing all-time highs, which is also driven by record corporate earnings in 2021, mainly of exporters, which may post similar figures at the end of 2022.

- Exporters account for over 80% of dividend payouts in Russia, this ratio will remain going forward, in this regard the market is contracting.

- The net effect on the rouble from dividends is becoming more positive, given the synergy with tax payments

- Exporters generously distribute their profits, but continue to reduce currency sales due to sterilization of FX liquidity, which is expected to decrease next year due to continued growth of oil and gas production, which will provide additional support to the rouble.

Summary

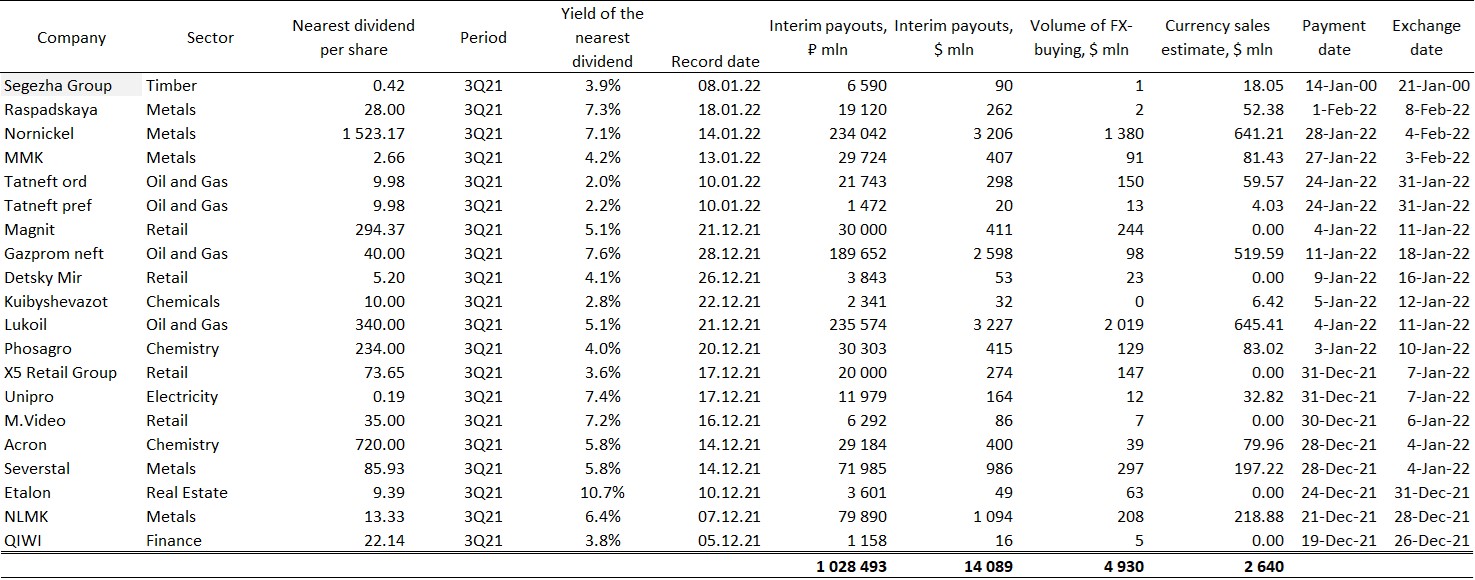

Dividends for the third quarter of 2021, which will exceed ₽1 trln ($14 bln), will be the highest interim dividends ever paid by Russian companies. The final dividends, including interim and annual dividends in 2021, according to our estimates, will also renew the all-time high and top ₽4.5 trln (more than $60 bln), up 50% from 2020 and up 35% from the previous all-time high of $45 bln in 2019.

In addition to record payouts, 2021 is expected to see a record dividend yield, which could reach around 10% compared to 9% for 2019. The P/E discount to emerging markets rose to 55% in the past two months, and to 40% to developed markets due to the sovereign risk premium.

Exporters generously distribute record earnings

The previous all-time high in annual dividends for 2019 resulted from record net income of ₽16,242 bln posted by Russian companies. However, given the surge in oil, gas and metal prices, which significantly exceed 2019 levels, 2021 is also expected to see record net profits. Gazprom's net profit alone in 2021 is projected to reach ₽2,400 bln, up 90% from 2019, and the company's dividend payouts are expected to triple from 2019.

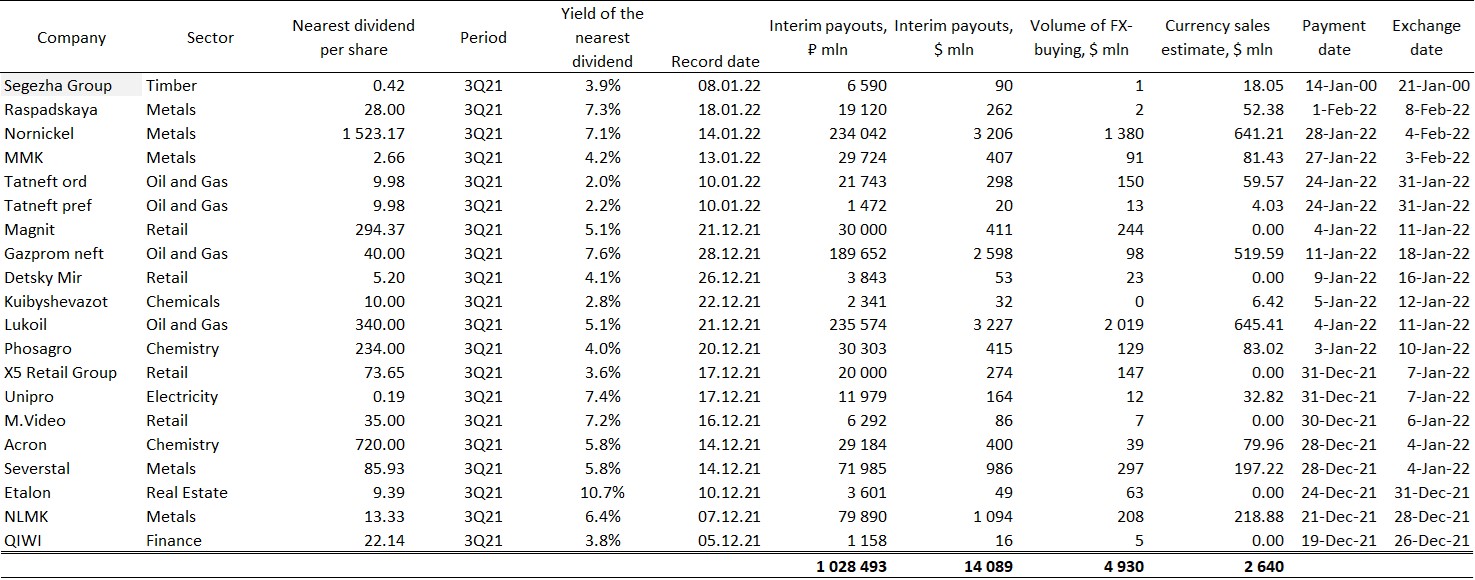

The record dividend growth is entirely driven by payouts from exporters, whose share in cumulative payouts is projected to renew a record and exceed 80% (the highest since 2010), compared to 64% in 2020. Such growth should not be a particular surprise, as we wrote about it back in the summer of 2020; what is certainly surprising is the actual size of the payout, as Russia may peak in the top-10 payers, surpassing Canada, Germany, Taiwan, Australia, and Switzerland. In terms of payout in 2021, Russia will be second among emerging countries after China, and first in the world in terms of dividend yield.

Total annual dividend payouts in Russia, ₽ bln

Source: ITI Capital, Bloomberg

Expected total dividends for 2021 (the bulk is paid in 2022), $ bln

-140.jpg)

Source: Bloomberg, MSCI, ITI Capital

Therefore, the dividends will have a far bigger impact on interbank liquidity and, first of all, on the RUBUSD next year. We already saw a significant positive impact last month, during the interim payout for 1H21, combined with other positive factors, but it materializes in the absence of geopolitical risks and other risk-off factors. We will prepare a separate 2021 annual dividend note on this topic, but for now we will focus on the key 2021 interim dividend and its impact on the rouble rate.

Impact of interim dividend payouts on the rouble rate

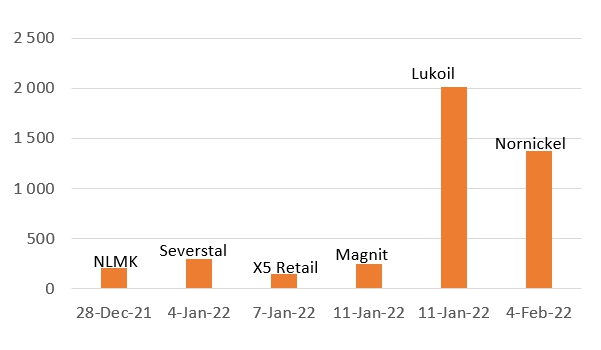

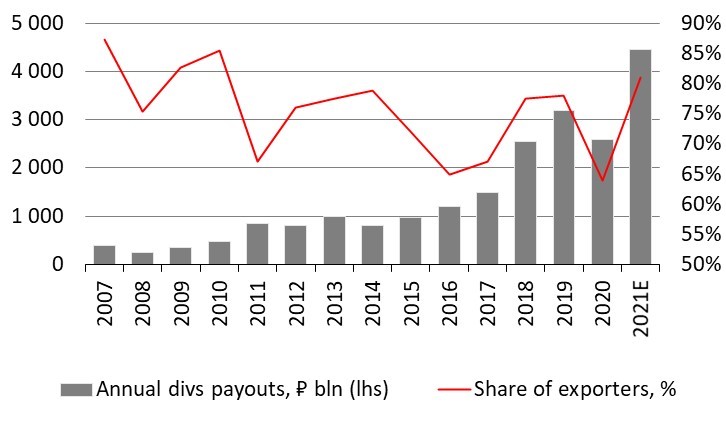

According to our estimates, Q3 2021 interim dividend payouts will exceed ₽1 trln ($14 bln), about half of which will be paid by end-December (provided that dividends due before January 3-4 will be paid before year end), with the remaining part paid before end-January.

According to our estimates, out of ₽1 trln ($14 bln) exporters would sell $2.6 bln to buy roubles, as dividends are first paid in roubles, excluding Russian companies with tax residency outside Russia, and only then converted to hard currency for dividends payouts to foreign holders and foreign funds, which is negative for the rouble; in the third quarter, FX-purchases for dividend payouts may amount to $4,930 mln.

Roughly half of the rouble payouts will account for Lukoil and Norilsk, which will each sell over $640 mln of hard currency, according to our estimates. But unlike the November 1H21 interim dividend conversions, most of which took place late in the month, the upcoming payouts will be spread from late December to late January. The record-breaking tax payments for December (about ₽2.8 trln) are expected to have an additional impact on the market.

Main positive currency flows for the rest of the year

Of all the tax payments, we are mostly interested in the MET and excise tax payments amounting to ₽950 bln ($13 bln), as exporters traditionally sell currency for these payouts, out of this amount about $2.6 bln are projected to converted into roubles, the total is over $3.8 bln including interim payments - all payments are scheduled to be made next week. Also next week, as before, the Ministry of Finance will continue FX-buying at ₽23 bln a day, i.e. at the end of the week the volume will reach ₽115 bln ($1.6 bln), while the net effect is $3.8 bln - $1.6 bln = $2.2 bln. Volatility and limited liquidity in non-resident transactions is also possible, as they account for half of all FX-flows due to the Christmas holidays in Europe and the US.

Therefore, the synergies which could have a positive impact on the market largely depend on geopolitics. We maintain our year-end USDRUB forecast of ₽71-72/$.

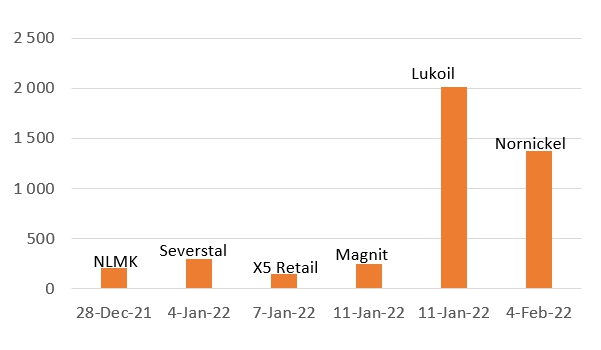

Estimated FX-sales for interim dividend pay-outs for 3Q21, $ mln

-930.jpg)

Source: ITI Capital, Company data, Bloomberg

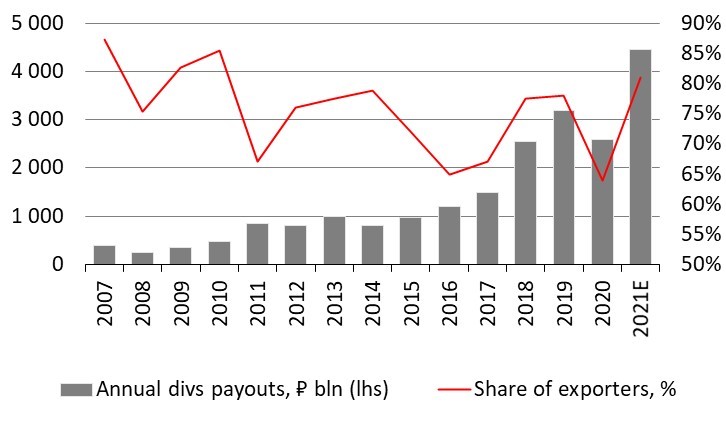

Negative impact of dividends payouts on the rouble next year

Negative effect on the rouble is related to the second stage of dividend payouts, which assumes conversion of roubles into currency for payouts to foreign investors (GDR holders and foreign funds).

According to our estimates, the amount of payouts may reach about $5 bln, most of the dividends will be paid from January to February, which will have a negative impact on the RUBUSD. In January, these purchases will partially offset the remaining $1.4 bln in FX-sales for dividend payouts.

Estimated FX-buying and deadlines of interim dividends payouts for 3Q21, $ mln

Source: ITI Capital, Company data, Bloomberg

Dividend payouts schedule for 3Q21

Source: ITI Capital, Company data, Bloomberg

-140.jpg)

-930.jpg)