Softline 1H21 IFRS Results: M&As, IT Services, EBITDA Boost

Softline published strong 1H21 IFRS numbers with 51% YoY (66% YoY including 1H21 M&As) EBITDA boost on the back of the robust IT market digitalization trend. The company’s financial mid-term guidance assumes further growth and profitability improvement. Softline’s active M&As policy in the Emerging Markets (EMs) allows to capitalize on the global trend, particularly given the fact that a significant share of Softline’s addressable markets is in its early IT development stage. Softline is to become a true international IT blue chip stock, in our view and expansion into lucrative developed markets (DMs) could not be ruled out. Meanwhile, the announced shares buy-back programme could be a supportive measure in case of the stock market volatility and to offset the impact of the shares issuance for the LTI program. The latter is designed to attract best IT talents and is expected to cover 100% of the personal.

Extraordinary Growth in 1H21

Strong sales growth and profitability improvement Softline’s turnover increased by 26% YoY (32% YoY including 1H21 M&As) to $976mn in 1H21, reflecting Emerging Markets (EMs) Digitalization boom and active M&As policy. Revenues surged by 34% YoY to $868mn, while adjusted EBITDA skyrocketed even higher by 51% YoY (66% YoY including M&As 1H21) to $28mn, assuming EBITDA margin increase by 0.8 ppt YoY to 21,6%. Notably, in 2Q21 adjusted EBITDA was up by 72% YoY vs 2Q20 to $15.1mn

Softline 1H21 IFRS: EBITDA Boosted

-808.jpg)

Gross margin as % of turnover

EBITDA adj. margin as % of gross profit

SG&A as % of sales

Source: ITI Capital

Meeting Management’s IPO Guidance

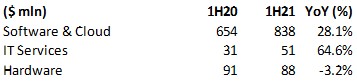

Services boosted by 65% YoY (vs 26% YoY total turnover increase), reflecting the company’s strategic focus and acquisitions made. An increase in the share of services naturally supports profitability. To illustrate, IT services amounted to 5% in the turnover mix and 31% in the gross profit mix in 1H21 (4% and 26% respectively in 2020). Softline increased its service delivery headcount by 40% YoY in 1H21 to match the customers’ demand. Softline’s IT business sector is usually called as Modern IT Solution Provider. The added value services include IT consulting, integration of complex IT solutions and cloud infrastructure, 24/7 support, customized product offerings.

In contrast, Hardware segment slipped by 3% YoY mostly as of (i) the world-wide logistic problems, led to the global chip shortage, and (ii) on the backdrop of high base in 1H20, inflated by the Covid-related demand.

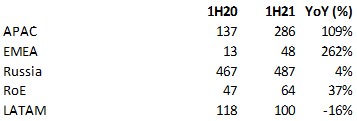

International arm now accounts for over 50% in total turnover, in line with Softline’s strategy to diversify away from the original Russian market. The trend could be taken positively by international investors, given the discounts associated with the Russian stocks nowadays. What is more important, the addressable international IT market is 16 times larger than the Russian market, that leaves an ample room for growth.

In terms of the turnover mix by geographies, the negative trend materialized only in LATAM driven by the Brazil challenging macro conditions.

Share of recurring turnover increased to 59% in 1H21 vs 56% in 2020, that is in line with the management’s guidance during the IPO. As such, the transparency and predictability of the company’s cash flows steadily enhances.

Net debt stood at $214mn in 1H21 (vs $109mn in 1H20) and at $119mn if adjusted for Softline’s 6% stake in Crayon, a public company.

Capex stood at $13.6mn or 10.6% of the Gross Profit vs the historical 4% ratio. The capex increase is largely attributed to the M&As expansion policy.

Effective tax rate was 26%, compared to 35% for H1 last year. Management previously projected the effective tax rate at mid-teens over the next 3-5 years.

Bullish Financial Outlook

Softline reiterated its guidance:

- Mid-20% turnover growth in 2021;

- Gross Profit within 13% to 14% margin over the medium-term;

- Adjusted EBITDA margin (Gross Profit based) is to reach the low-30% range over the medium-term (vs 21,6% in 1H21).

Buy-back programme

Buy-back programme is to support the shares in case of stock market volatility Softline is to launch a 12-month GDR buyback programme in the near term, subject to the necessary approvals and for up to 10% of the capital (the maximum allowance under the Cypriot legislation). The buy-back is designed to offset the impact of the issuance of shares for the LTI program.

We believe the buy-back is not the management’s ultimate goal, particularly right after the IPO, but a natural hedge for Softline shares vs potential stock market volatility.

Strengthening Further Partnership with Microsoft

Softline became a member of the Microsoft Intelligent Security Association (MISA) in November. The admission is important for the investors’ sentiment, in our view, as Softline’s dependence on Microsoft was considered as one of its core business risks. Softline received the Technology Partner of the Year award – Security in India as well.

To remind, Softline is a major player for Microsoft in the Emerging markets. Thus, Softline is a top two IT solution provider in Microsoft’s addressable cloud solutions and licensing & subscriptions businesses within EMs, according to AMR. Softline is one of only ten companies worldwide holding the Globally Managed Partner designation.

M&As in 1H21: Make Hay while the Sun Shines

Softline’s expansion was ongoing in 1H21 and Softline’s jurisdictions coverage increased from 53 in 2020 to 56. Softline is gradually moving to become a global IT company.

Digitech. APAC Digital transformation agent, leading and fastest growing Microsoft partners in Egypt that holds both, Microsoft Cloud Solution Provider and Licensing Solution Provider status. Digitech has deep expertise in cloud (Azure and M365). Egypt with it population of over 100 mn has a strategic importance from the Middle East coverage perspective.

Squalio. Eastern Europe International data technology company currently operating in Latvia, Lithuania, Belarus and Estonia. It has developed a dominant licensing business through its first-class licensing expertise, and multiple certifications with key strategic vendors, such as Microsoft, Adobe, Oracle, IBM, Google and other cloud and security solutions leading players. Traditionally Eastern Europe is characterized by it strong IT professionals.

Belitsoft, Belarus An off-shore software development services provider. It has an attractive customer footprint in the UK, USA, Israel and Denmark. The transaction is to strengthen Softline own IP custom software development capacity by a team of more 300 world class technology specialists.

Looking at the Belitsoft acquisition one could think of another software developer - EPAM – an offshore programming company with the Belarussian roots and DM’s extensive footprint and the Mkt Cap of $35bn.

The Develop & Built IT segment move is almost imminent Acquisition of Belitsoft and expansion into the software developer segment looks rational for Softline, which already developed its own IP products in the cloud segment. Controlling “last mile access” to customers, knowing their needs, enforced by access to the cost-competitive expertise will contribute to developing its own IP to benefit from the Develop & Build subsegment of the IT market.

DM Expansion Over the Horizon?

During the conference call the management confirmed its focus on EMs. That said, the management didn’t rule out entering DMs over the next 3-5 years.

Entering lucrative DMs would be quite organic The biggest (80+%) part of the global IT market accounts for the DM countries. Once the growth boom slows down the importance of the efficiency in operations will increase. The similarity of IT products both in DM and EM together with lower costs in EMs could give Softline a competitive advantage over its peers.

Geographical and Business Segment Expansion Seems Justified

The market consolidation continues The Modern IT Solution Provider segment ongoing consolidation and an increase in complexity of clients’ IT needs are pushing IT solution providers to expand their value offerings to provide a wider range of IT services and solutions and accelerate geographic expansion.

Low expansion risks A classic Modern IT Solution Provider is an intermediary between vendors and clients which does not require significant investments. The underlying market is growing. As such, the risks are limited and expansion into new business segments and geographies is more than justified.

In addition, the local players’ readiness to be acquired at an average EV/EBITDA 5x (vs the Modern IT Solution Provider segment average of around 21x) reduces Softline’s expansion risks, in our view.

Turnover by region

Source: Softline, ITI Capital

Turnover by IT Segments: Boost in IT Services

Source: Softline, ITI Capital