Russian real estate developer PIK is holding a roadshow of its debut USD Eurobond issue now. The indicative volume of senior five-year securities is expected to be placed shortly. The projected yield has not yet been announced.

The company will use the proceeds from the placement to repay its debt and expand overseas (primarily in the South East Asia), as well as to meet its general corporate needs. The notes will be the company's first public external debt.

PIK has nine outstanding bond issues in the local Russian market (including PIK Corporation loans) totalling ₽90.5 bln. Most of the securities are due within 12 months. The yield of the longest issue with a two-year duration is YTW 9.9% p.a. (the premium to the OFZ market is about 170 bps).

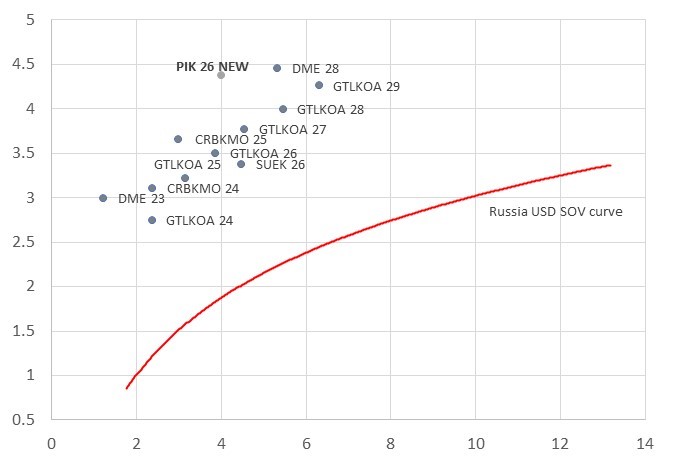

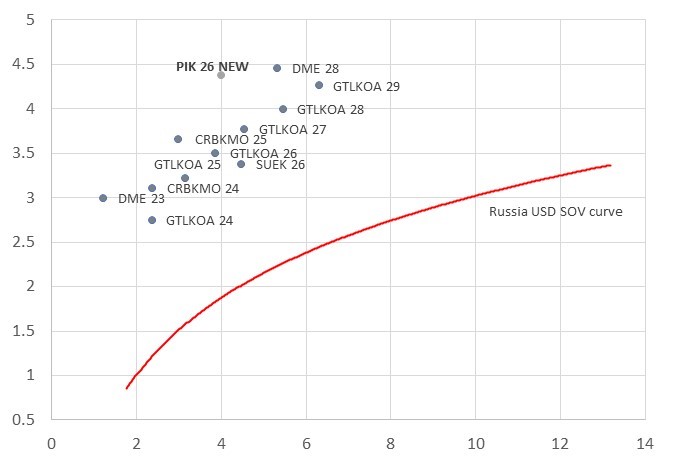

It is difficult to find a comparable peer in the emerging markets (EM) space. The yield of 'BB' rated companies averages 3.7% p.a. now. We estimate that PIK's debut dollar-denominated notes should yield at least 4.25-4.5% p.a. This seems justified, taking into account the debut premium. The yield of state-owned leasing company GTLK's B-rated bonds due in 2026 (GTLKOA 26) stands at YTM 3.5%.

Market map of Russian issuers’ double-B Eurobonds

Source: Bloomberg, ITI Capital estimate

About company PIK is Russia's largest developer (with construction volumes almost double those of its nearest competitor as of early September 2021) with a particular focus on the Moscow city (43% of total construction area), the Moscow Region (27%), and some other Russian regions. The group's land bank was around 21.5 mln sq. m. (+30% YTD) at the beginning of 3Q21.

PIK focuses on mass-market construction. New contracts in 9M21 amounted to 1.7 mln sq. m. (+13% year-on-year). Total cash collections for the period increased by 50% to ₽342 bln. Mortgage transactions account for 77% of total sales. PIK Group is owned by Sergei Gordeev (60.1%) and VTB Bank (23%), and the rest 17% is free-float.

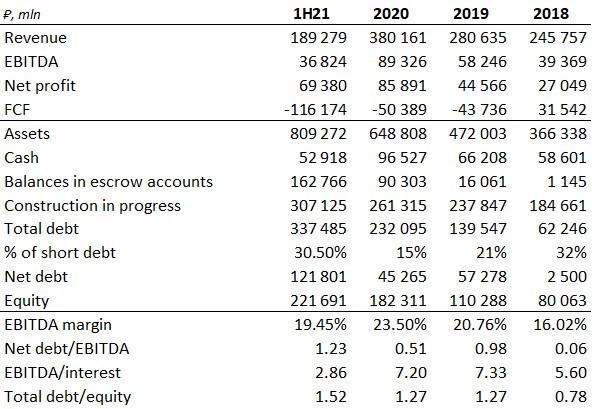

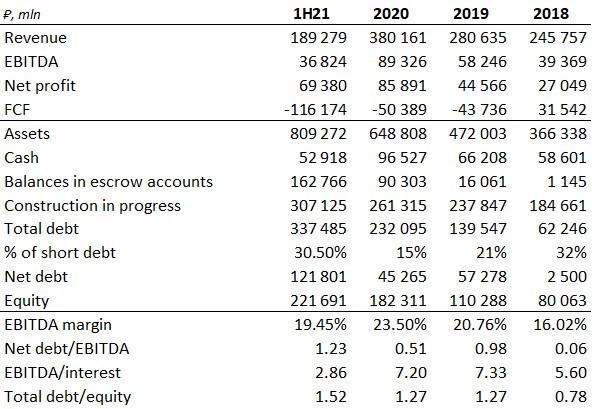

PIK’s revenue reached ₽189 bln (+37% year-on-year), according to the recent 1H21 IFRS report. The robust growth was mostly driven by a favourable pricing environment (+29% YoY) and higher sales. EBITDA (adjusted for one-off items) was around ₽37 bln (+38% year-on-year).

Total debt was ₽337 bln at the end of 1H21. Project financing accounts for over 81% of total debt. The group's (the holding company) net corporate debt was negative at the end of 2020. It turned positive in January-June following a drop in free cash. PIK benefits from a low total net leverage (including escrow account balances and project financing) which is estimated at 1.2x as of 1H21. Internal policy caps total net leverage at 2x.

We believe the strengths of the company's credit profile include:

- strong market position and brand recognition

- favourable pricing environment in the homebuilding market, strong demand growth

- stable financial metrics: consistently high revenue growth rate, high margin, low debt

- increasingly diversified business model

- high standards of corporate governance and transparency

We assume the risks include unfavourable changes in legislation, increasing competition, more expensive mortgages due to the Russian Central Bank's policy tightening, and higher costs amid global commodity inflation.

PIK’s key financials, IFRS

Source: Company data