What happened?

The end of last week saw yet another slide in the Mexican non-banking financial institutions Eurobonds. Credito Real, Mexico's largest payroll lender (PDL), experienced the hardest hit, as its bonds sank by around 10%. Unifin leasing company, a well-known player, also faced a sell-off, as its bonds dropped by more than 3%.

Such emotional trading was driven by a global investment bank’s note that highlighted an accounting adjustment in Credito Real’s third-quarter results may have boosted profits.

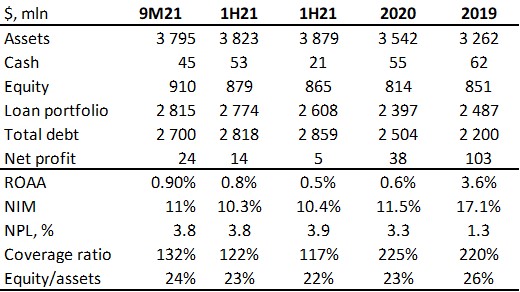

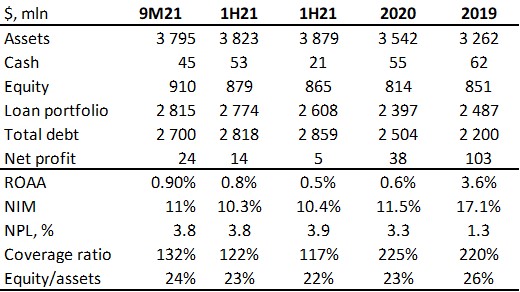

The company recently released its financials for January-September 2021, which we believe are neutral in terms of its credit profile (see note). An analyst suggested the company would have likely reported a net loss for the quarter if it hadn’t adjusted the value of a loan portfolio it bought from retailer Famsa’s failed bank. The assumption triggered negative news.

The note did not provide any final figures, other than an assumption that the July-September 2021 book interest income could have been $20 mln. According to the official audited IFRS results, Credito Real's net profit for the period was $10 mln and the company has earned a total of $24 mln since the beginning of the year.

Thus, even if we adopt an overly conservative approach and adjust profits by the above figure, cumulatively, since the beginning of the year, the gauge would still be positive. It is important to note that the company rather quickly issued a follow-up report in response to investors’ questions and feedback.

Credito Real said that the higher yields at its payroll business (the largest segment, accounting for 57% of the total loan portfolio) followed a shift away from loans to pensioners to higher-income customers. Part of the improvement in yields during the third quarter was due to an upward FX revaluation.

As for income from the acquired Famsa bank's portfolio, it is also reflected in the financial statement. However, the company’s quarter-on-quarter results saw a material downward trend. As additional interest income received from this portfolio, Credito Real takes into account only the interest paid on the loans (principal loan repayment has no impact on the net profit). Accordingly, as the portfolio "matures", the amount of interest paid naturally decreases in favour of final repayments and the contribution to the final financial result decreases.

Our take:

We still assume that investors overreact to any negative news about Credito Real. Following the Alpha Credit bankruptcy case that has unfolded over the past six months, the market is very wary of the Mexican non-banking financial institutions sector, fearing further accounting errors.

At the same time, given all the risks inherent in Credito Real's business model, we remain bullish on the company's operational recovery from the pandemic-driven slump. The recently released 3Q21 financials and comments from the top management suggest some positive trends in both asset growth and quality.

We also give the issuer's credit for its willingness to engage in a dialogue with investors and to reassure the market with regular comments. Thus, the recent drop in Credito Real’ Eurobonds (denominated both in USD and EUR) seems unjustified. We expect that in the near future the emotion-driven sell-off will be offset by buying, as overall global risk appetite improves after the FED’s meeting.

Credito Real selected IFRS financials

Source: Company data