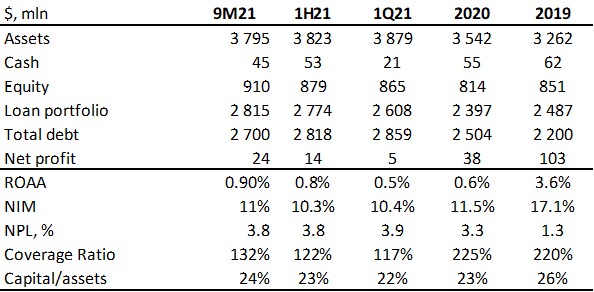

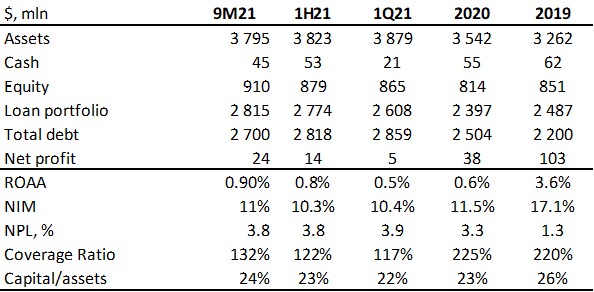

Credito Real, Mexico's largest payroll lender, released its financial results for January-September 2021 on October 27. The total loan portfolio increased by 1.5% quarter-on-quarter and 8.5% year-on-year to $2.8 bln.

Payroll deductible loans (PDL) remained the key growth driver, up 11% year-on-year. This business segment now accounts for approximately 57% of the total loan portfolio. A positive factor is a gradual reduction in the share of the most high-risk small and medium-sized enterprise (SME) segment - 22.8% of the total portfolio versus 24.8% a year earlier. Relief loans programme almost terminated, in line with expectations, with their share not exceeding 0.6% of the total portfolio at the end of 9M21. This programme is expected to be terminated by the end of the year.

The overdue debt remained at the same level as in 2Q21 - the share of NPLs stands at 3.8%. Asset quality in the SME segment remains low, with the NPL ratio estimated at 11.5% (vs. 0.6% a year earlier). Excluding this segment, the NPL ratio would have been 2.5%.

After the earning report, Credito Real reached an agreement to receive compensation for a non-performing loan in the SME segment of almost $35 mln (representing over 6% of the SME loan portfolio). The reclassification of this overdue debt is expected to result in a marked overall improvement in asset quality. The company estimates its current NPL ratio at 2.6% (to be disclosed in 4Q21). Asset quality in the PDL segment remains unchanged over the past year, NPL ratio stands at 1.7%.

Total profit in 3Q21 rose 23% quarter-on-quarter (to around $170 mln) driven by an overall business recovery (especially in the payroll lending segment) and a decline in the share of loans issued under relief programmes and higher products’ yields.

The total yield on loans amounted to 24.5% in 3Q21 versus 21.6% in 3Q20. The company's net profit also increased both q-o-q and y-o-y to $24 mln (for 9M21). Net interest margin (NIM) is also improving (11% for 9M21 vs. 10.3% in 1H21) thanks to a bet on higher-margin business segments.

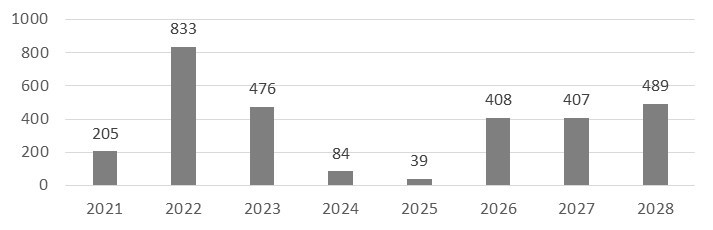

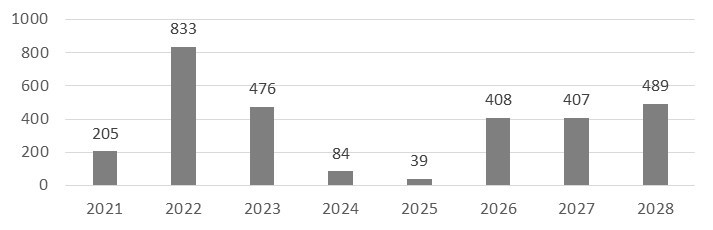

During 3Q21, Credito Real successfully refinanced approximately $107 mln of short-term debt. The remaining debt maturing by the end of the year is estimated at $205 mln, of which nearly 71% is revolving credit facilities.

Total debt fell by 4.2% (QoQ) to $2.7 bln in 3Q21. Approximately 80% of total liabilities are denominated in hard currencies (mostly U.S. dollars).

According to the debt repayment schedule, the peak is expected to be reached in 2022, when about a third of the total debt ($833 mln) needs to be repaid, including the Swiss franc-denominated Eurobonds. With free liquidity on the balance sheet for 9M21 estimated as low as $45 mln, refinancing risks will be very sensitive for the company next year.

To address this problem, Credito Real announced a sale of some assets in the autumn in order to raise additional financial resources. At the end of October 2021, the company reported its first successful deals. Thus, the company sold the SME loan portfolio (at a premium to book value), raising around $75m and reducing the volume of the high-risk SME portfolio by 14%.

Credito Real's debt repayment schedule, $ mln

Source: Company data

The equity share in liabilities is stable and not yet a cause for concern (equity/assets ratio of 24% for 9M21). The capitalization ratio (equity/total portfolio) is estimated at 32.3% (31.4% in 2Q21).

Credito Real selected IFRS financials

Source: Company data

Key risks to Credito Real's credit profile:

- Large amount of debt to be repaid before the end of 2022.

- Difficulties in refinancing in case of capital market closures and slower asset sales at low prices

- Deterioration of asset quality amid declining customer payment discipline in case of a new wave of Covid-19 and potential lockdown in Mexico

- Technically negative factor for the company's bonds in case of a closure/reduction of limits by the risk arms of major institutions on the back of negative news about Credito Real

- Pressure on NIM due to higher funding costs, possible intensification of competition, inflation of operating costs

Strengths

- Leading position in the Mexican payroll deductible loans (PDL) market

- Geographical diversification of business

- Gradual increase in lower risk and higher margin PDL lending

- Raising additional funding through sale of loan portfolio

- Gradually restoring profitability through cost control and betting on more profitable business segments

- Adequate capital adequacy