Late last week, Unifin, Mexico's largest leasing company, published its 3Q21 and 9M21 IFRS results. The earnings can be broadly characterised as rather positive.

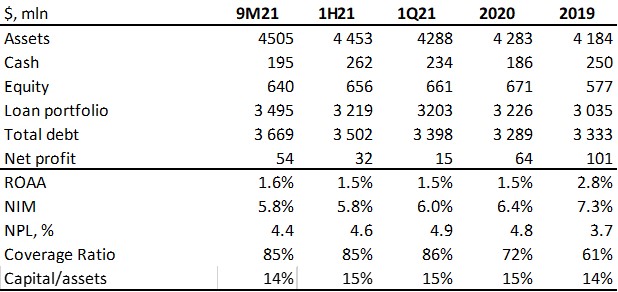

The total loan portfolio continued to grow, reaching $3.5 bln (+8% YoY). Leasing still accounts for the largest part (69%) of the portfolio. Structured finance and working capital loans are the second-largest (26%) and most actively growing segment.

In terms of maturity, approximately half of all loans are repaid within the next 12 months, a reflection of the company's strong liquidity profile. Borrower payment discipline is not deteriorating. On the contrary, the NPL ratio in the overall portfolio is improving, having declined to 4.4% at the end of 9M21. The provision coverage ratio remains stable throughout 2021 at 85%. An additional benefit is that Unifin owns all leasing objects until the end of the contract term.

The overall yield on the company's loan portfolio stands at 17.9%, compared to 17.6% in 2Q21. The portfolio yield increase is explained by higher interest income across all our business lines. At the same time, the NIM remained under pressure due to rising costs and a conservative policy of maintaining liquidity (involving a substantial amount of free cash on the balance sheet).

The company's funding base reached $3.7 bln (+12% YTD). The share of short-term borrowings amounts to 28%. Unifin's outstanding Eurobonds account for almost 60% of the total liabilities (FХ-risks are hedged). The average cost of funding stands at 10.3%.

Despite the turbulence in the Mexican non-banking financial institutions sector, Unifin continues to use debt financing, with four deals totalling $165 mln closed in 3Q21. The share of capital in liabilities is stable at 14%.

Unifin's long-dated Eurobond issues have come under pressure over the past few days, with the price declining by roughly 3%. In our view, the drop seems unjustified, especially given the positive results for 3Q21. In August, both rating agencies, S&P and Fitch, confirmed the company's ratings.

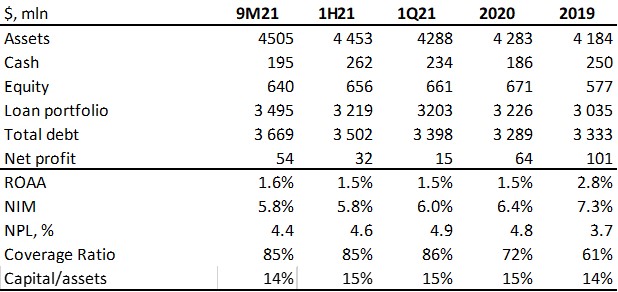

Unifin IFRS selected financials

Source: Company data