Our key forecasts and trends

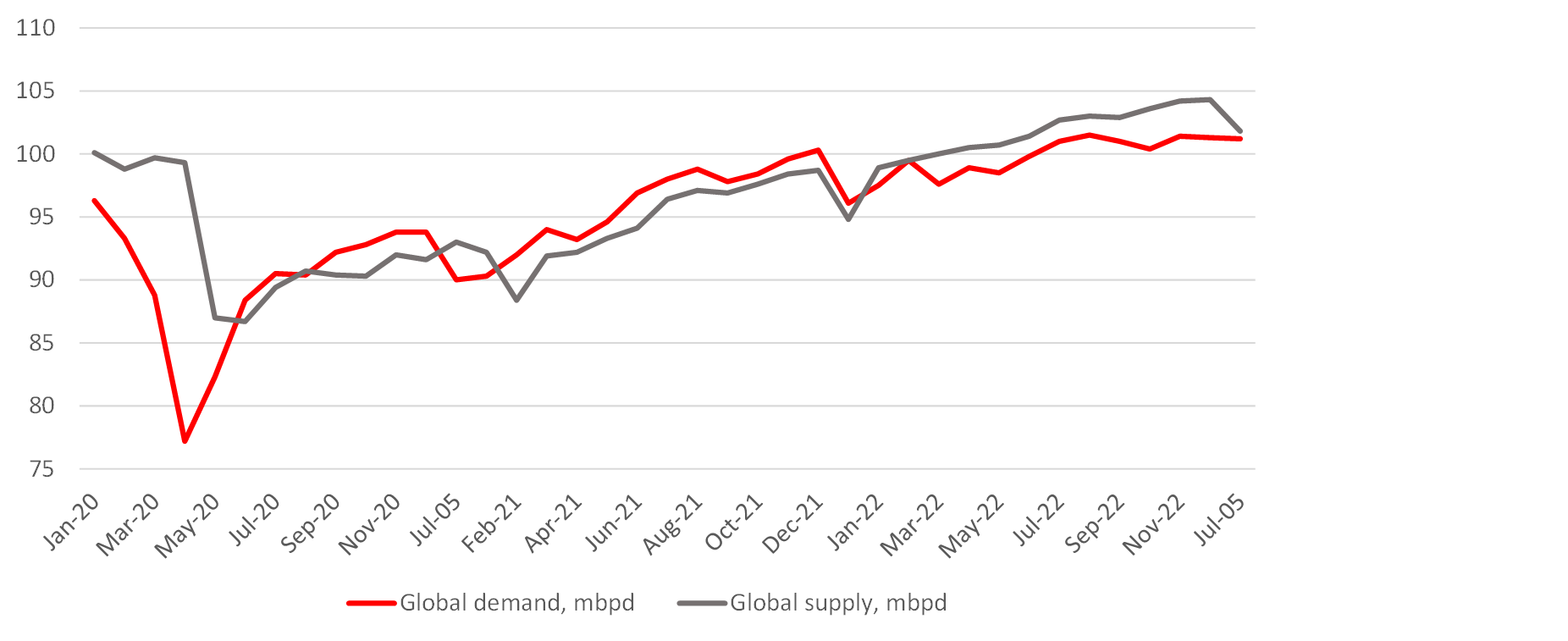

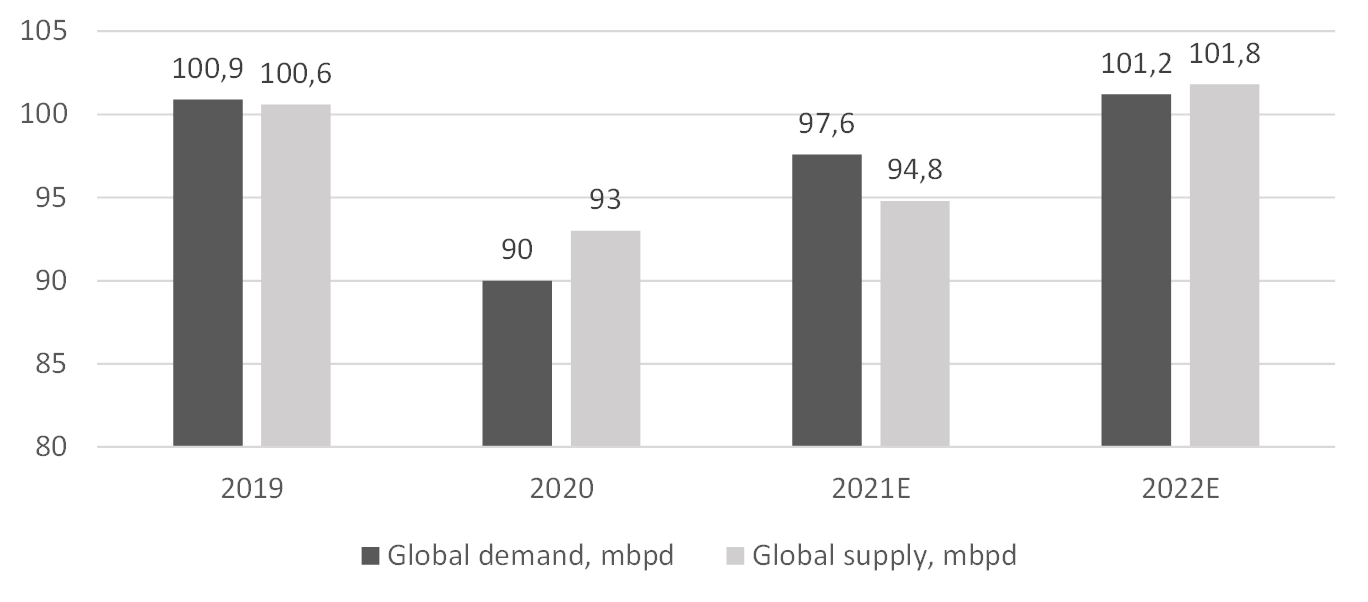

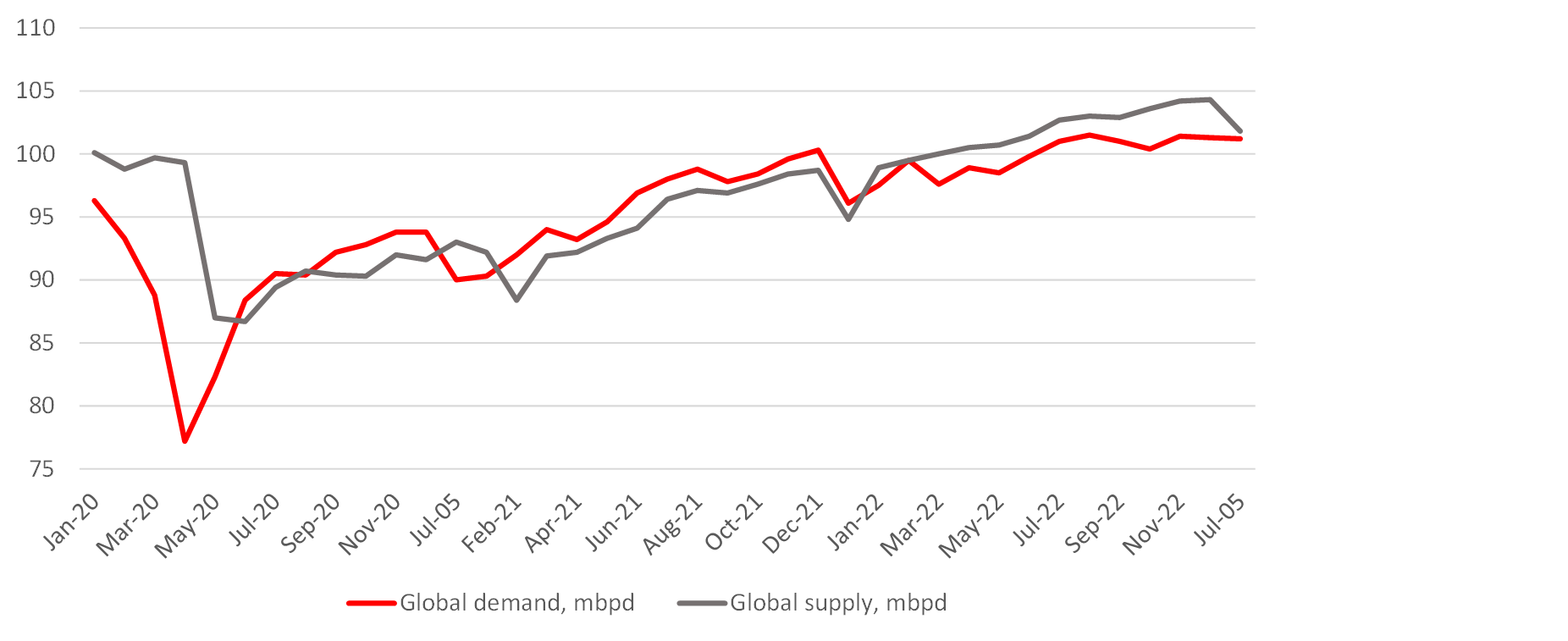

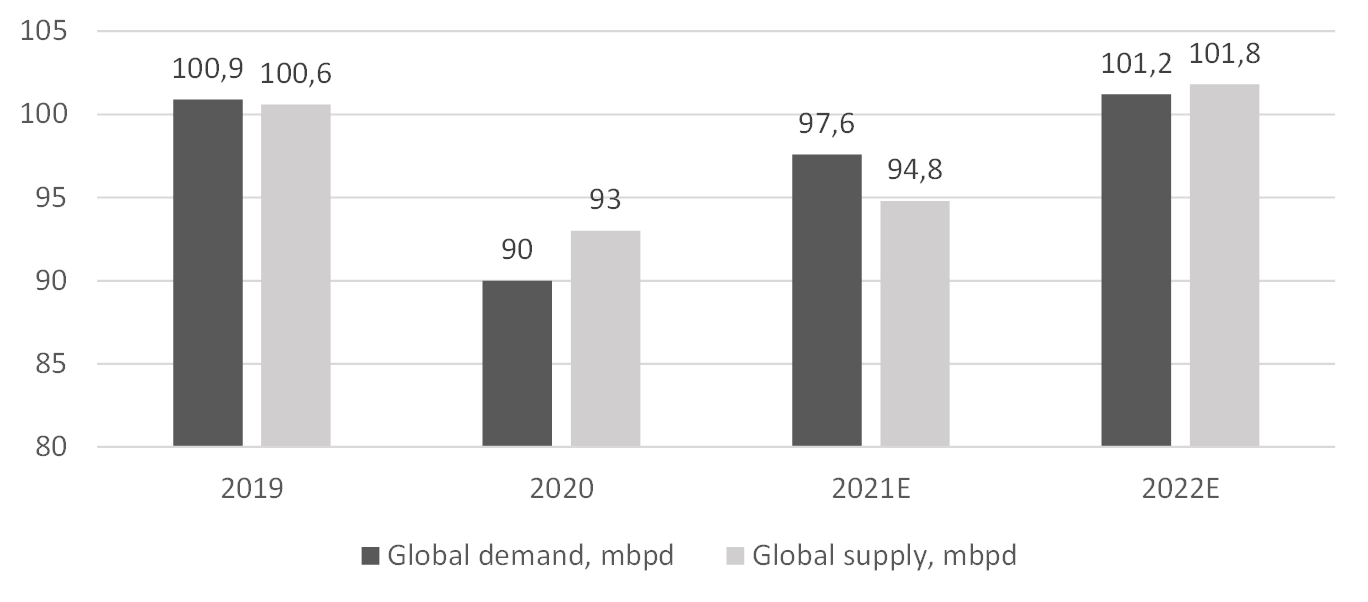

By the end of 2021, we expect a record global oil products and liquid fuels deficit of 2.8 MMbpd based on the demand of 97.6 MMbpd and supply of 94.8 MMbpd. In 2020, the supply surplus was 3 MMbpd based on the supply of 93 MMbpd and the demand of 90 MMbpd. At the end of 2022, we expect a small surplus, with supply at 101.8 MMbpd and demand at 101.2 MMbpd. Our expectations are also reflected in the latest forecasts of OPEC+ according to the group’s projections 55% of the remaining idle oil supply will be released to the market through September 2022. The OPEC+ agreed on September 1 to continue a policy of phasing out production reductions by adding 400,000 bpd to the market from September to the year-end.

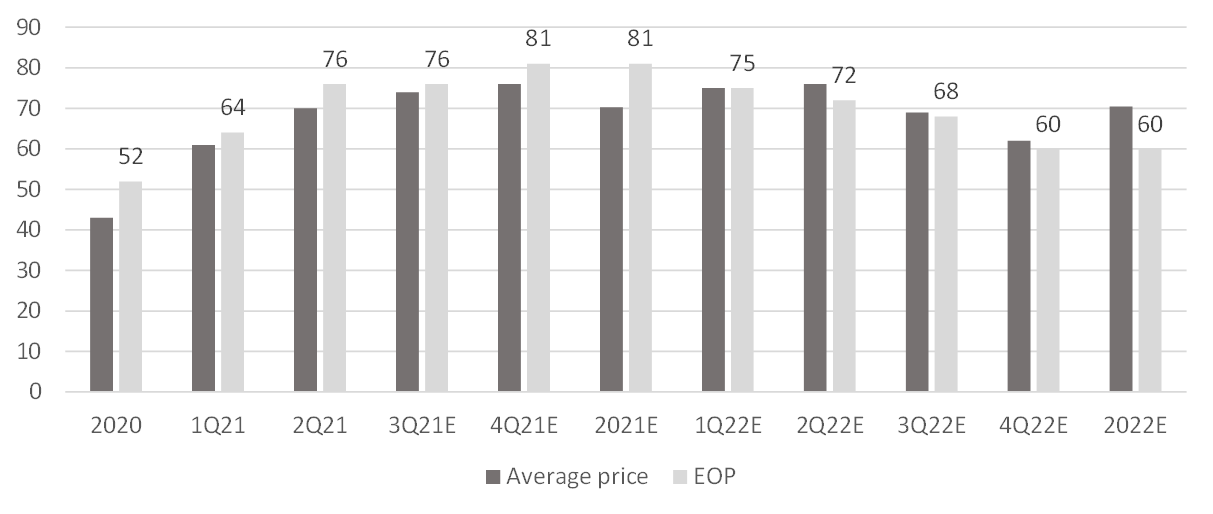

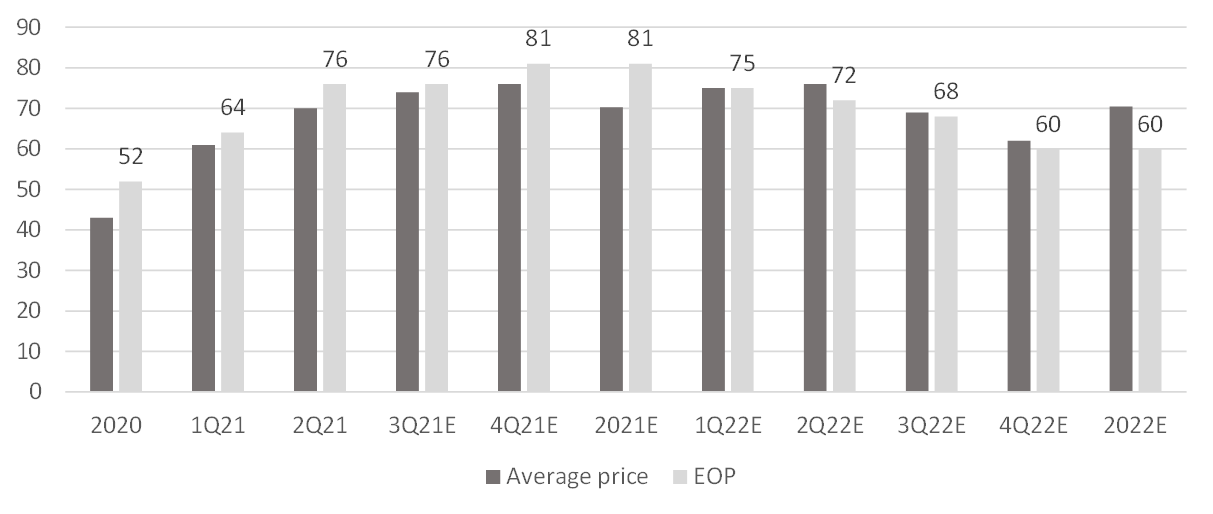

We expect the oil price to pick up on average by 65% y-o-y in 2021 and remain flat in 2022.

The end of 1H21 and the beginning of July 2021 saw the peak of the demand growth (as of July 6, 2021, the price was $77.53/bbl), with a new high ($80+/bbl) expected in 4Q21.

Therefore, we expect a global liquid hydrocarbons deficit of more than 1.2 MMbpd next quarter and a global inventory drawdown of 37 MMbbl, a drop in Iranian exports to 1 MMbpd instead of 2 MMbpd and even lower in the event of tougher sanctions against Teheran. Further restrictions would drive oil prices higher.

At the end of 2022, the global market is seen to balance, leading to higher supply. We expect a small supply surplus of 0.6 MMbpd. However, the average oil price in 2021 and 2022 won’t change materially and will stand at $70-71/bbl, according to our projections.

What will happen to oil prices?

The peak of the price growth is expected in the fourth quarter of 2021 and the first half of 2022, followed by a drop to $62/bbl closer to the fourth quarter of 2022. The highest price, around $80-81/bbl, is expected in the fourth quarter of 2021. Thereafter, the high prices would remain in the first half of 2022, around $75-76/bbl.

Our Brent prices projections, $/bbl

Source: ITI Capital, JPMorgan, IEA

Global oil supply and demand, MMbpd

Source: ITI Capital, JPMorgan, IEA

Oil market deficit (-) and oversupply, MMbpd

and oversupply-723.png)

Source: ITI Capital, JPM, JPMorgan, IEA

Global supply and demand trends, MMbpd

Source: ITI Capital, IEA

Key risks

Global rise in pandemic and slowdown in economic growth, though we think the risk is transitory and is likely to fade in the first half of 2022, as vaccination will accelerate.

Production of the largest exporters running above OPEC+ quotas.

In the second half of 2022, we expect that continuing growth in production from OPEC+ and accelerating growth in U.S. tight oil production which is currently rising by 0.1MM barrels per month—along with other supply growth—will outpace decelerating growth in global oil consumption and contribute to Brent prices declining to $60/bbl by end of Q422.

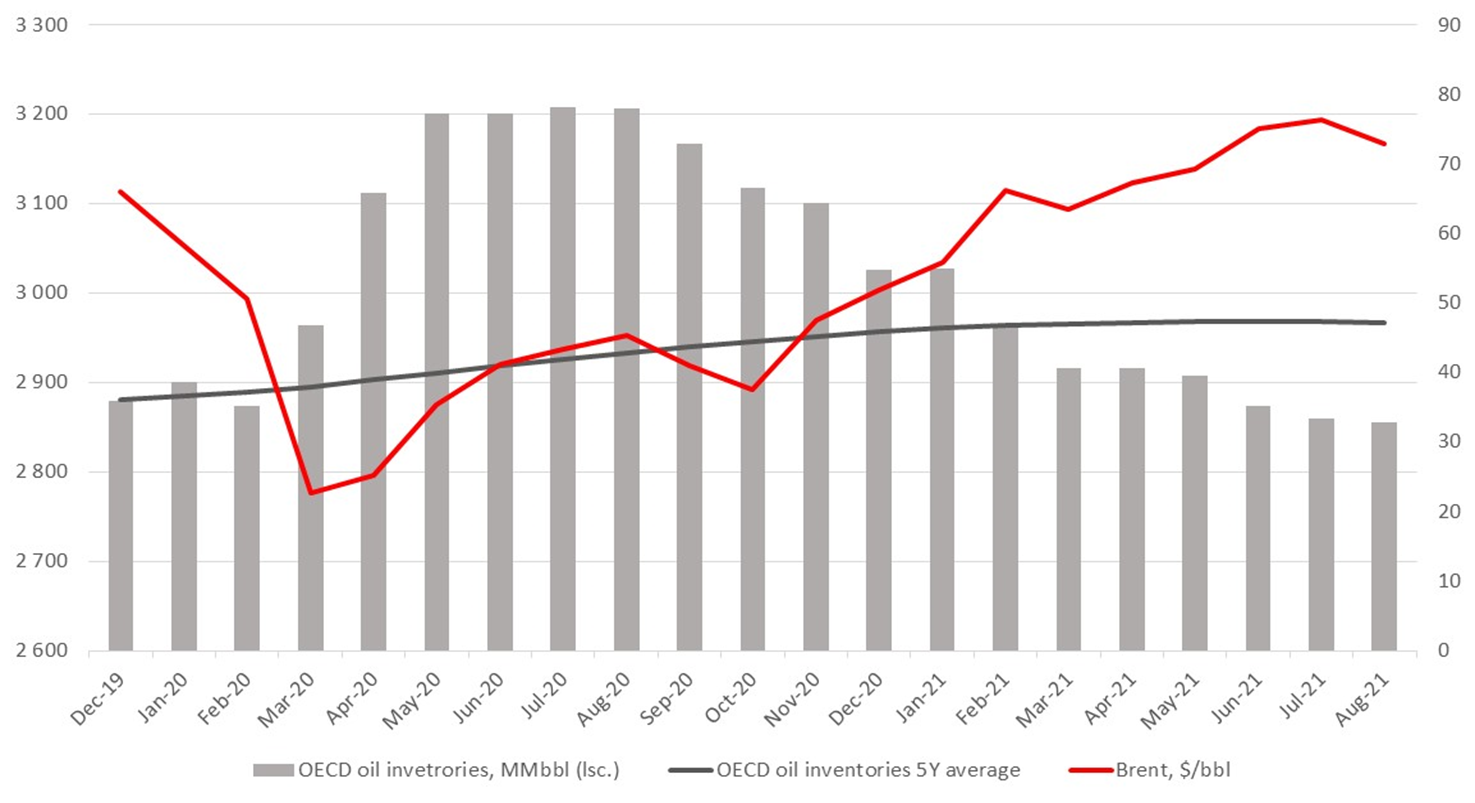

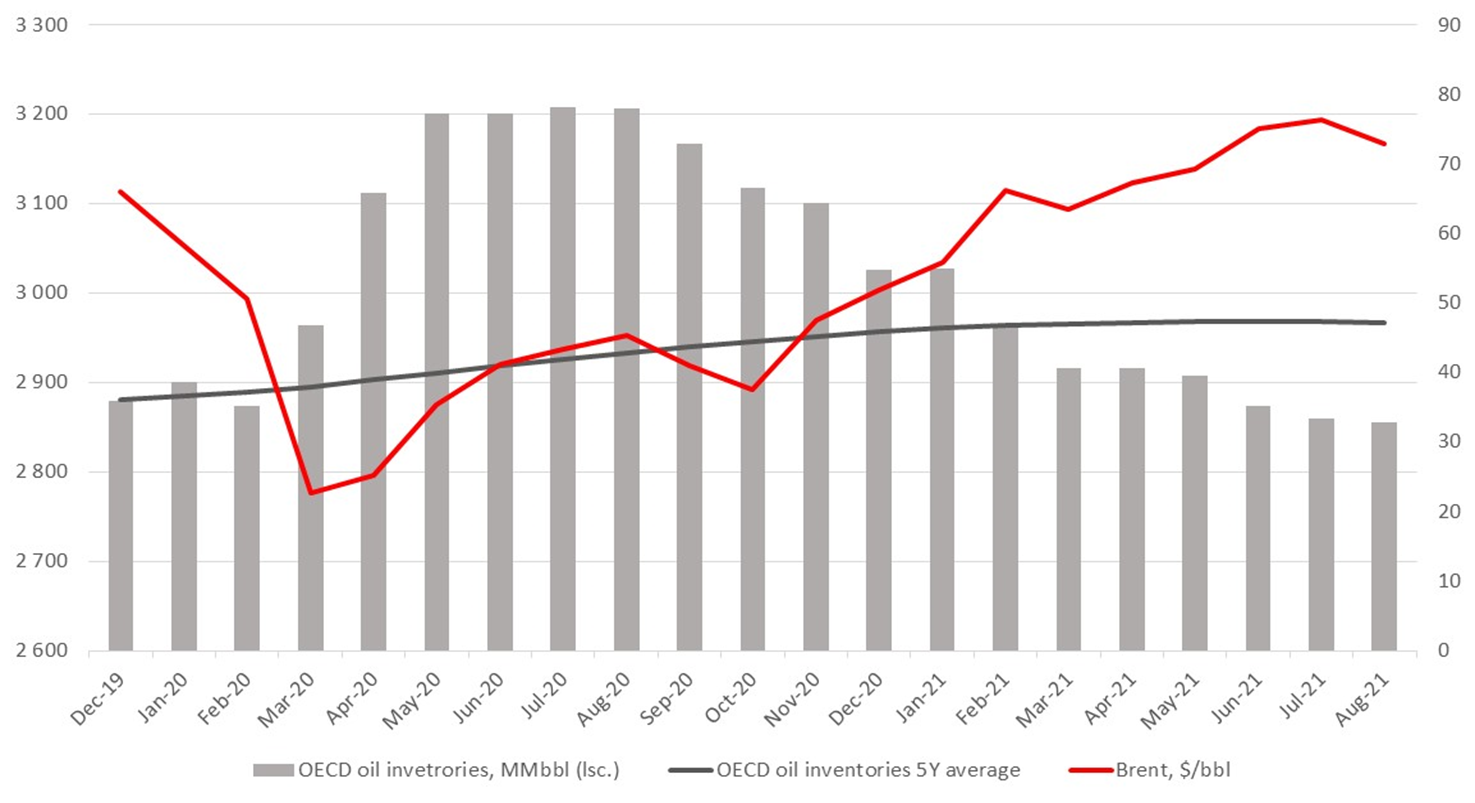

Global oil inventories return to pre-pandemic levels

Over the last six months, we have seen a significant reduction in global oil stocks, which have reached pre-pandemic levels (early spring 2020). Over the last five weeks, the decline has only accelerated, averaging around 18-20 MMbbl per week, according to research company Kayross.

Current stocks of OECD, which include the US but exclude Russia and the UAE, have fallen to the March 2020 levels, i.e. by 344 MMbbl from the July 2020 peak.

Current stocks are 110 MMbbl below the five-year average of OECD oil stocks. Overall the market looks balanced, but deficits have been rising since February 2021 and are largely dependent on pandemic developments.

OECD oil inventories below five-year average, MMbbl

Source: Bloomberg, ITI Capital, IEA

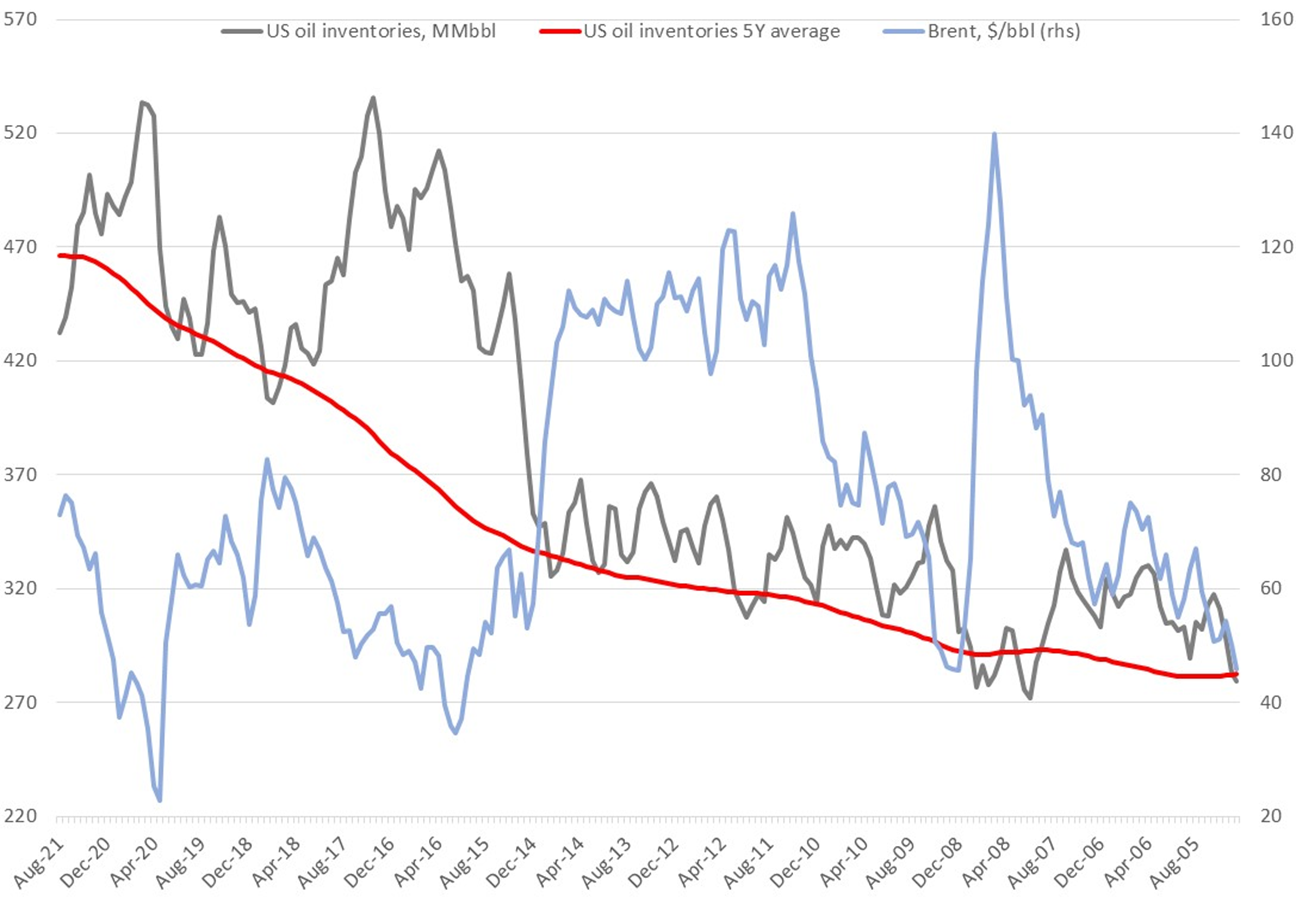

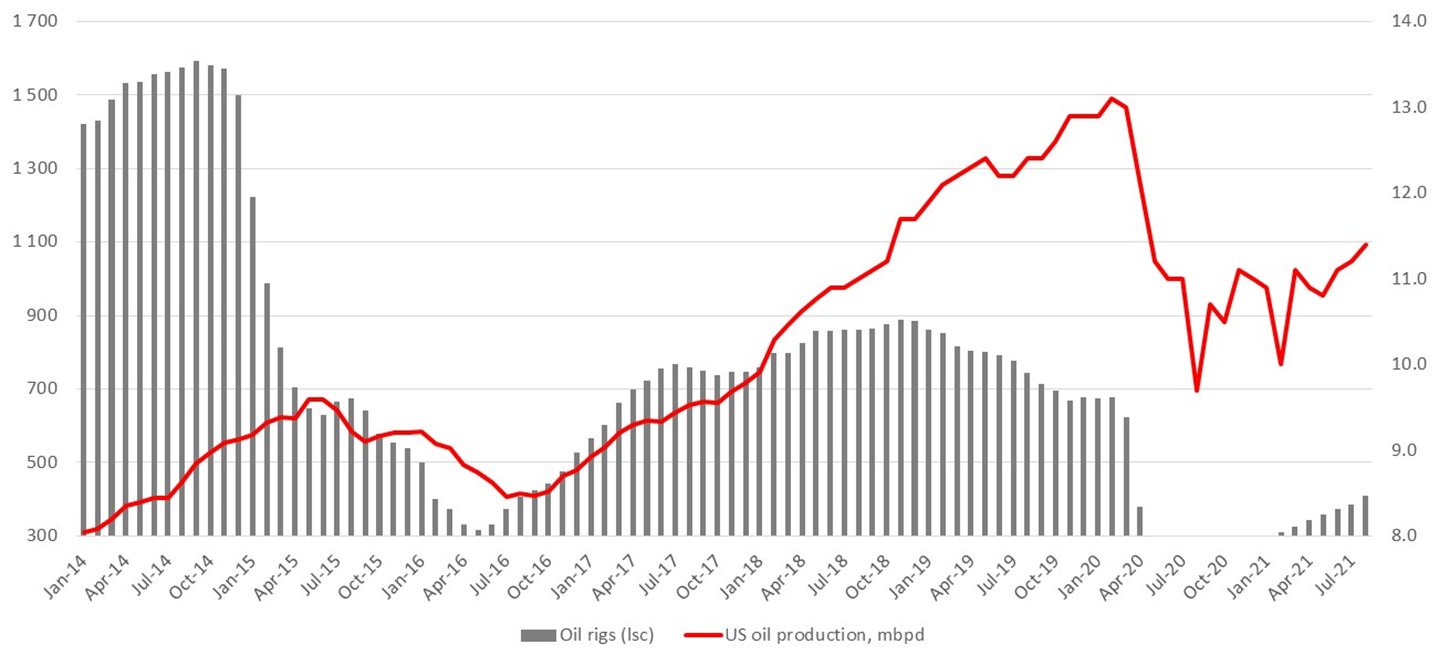

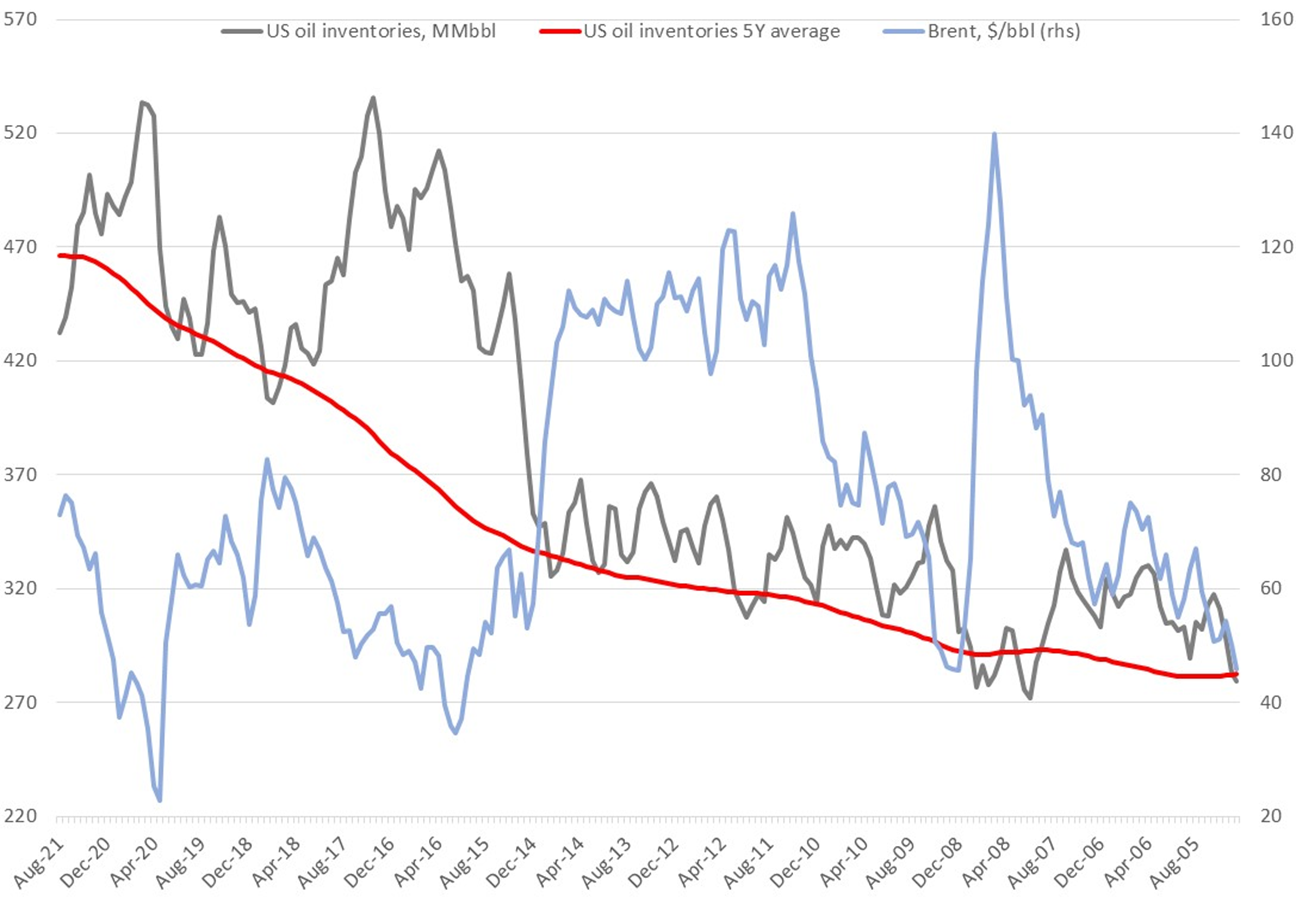

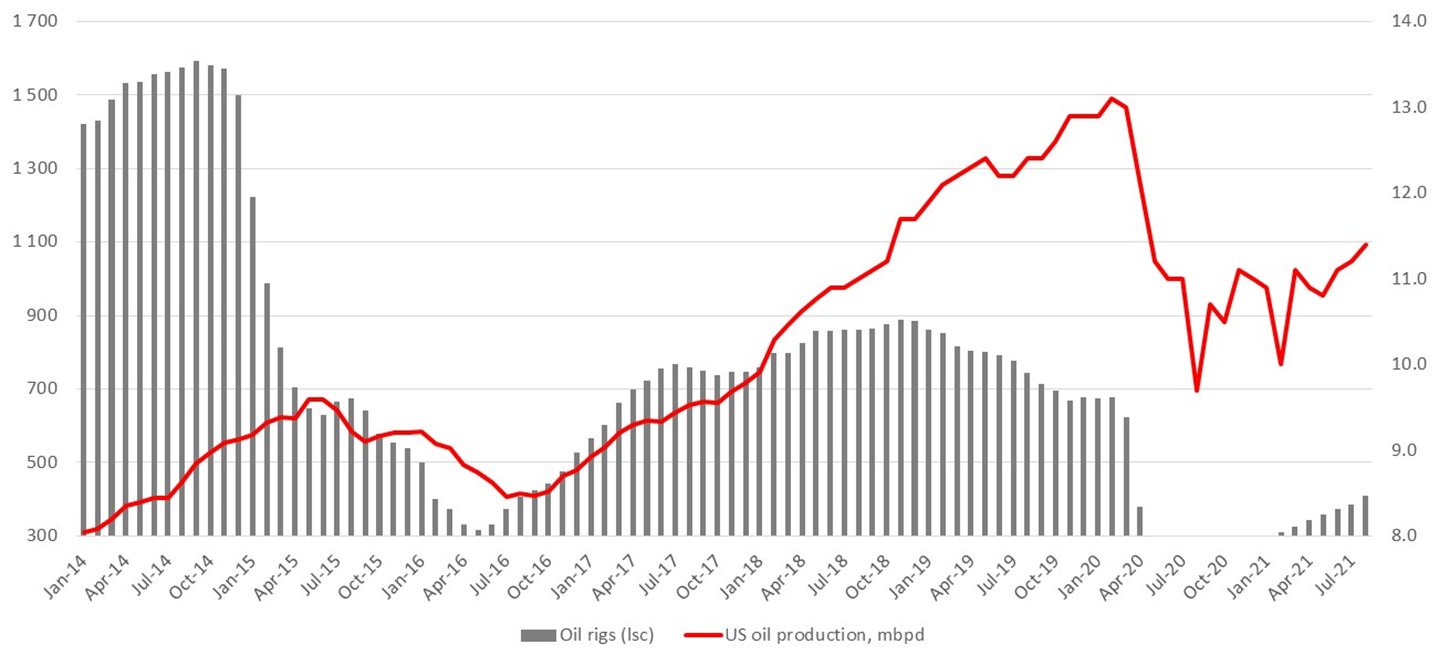

Falling US production has partly stabilised the global market

US oil and petroleum product inventories, excluding kerosene, are already approaching the lower end of the five-year average range and are 13 MMbbl below the average. Yet, surprisingly, US producers are in no hurry to ramp up production.

Drilling activity is accelerating, with the number of rigs increasing by five each week and the number of inactive wells is declining. However, this is not yet translating into a significant increase in production - the figure recovered to as little as 11.4 MMbpd after falling earlier in August. Refinery demand for oil remains relatively high at 91.9% of capacity (increasing in recent weeks).

US oil production trends, MMbbl

Source: Bloomberg, ITI Capital, IEA

US oil rigs and production

Source: Bloomberg, ITI Capital, IEA

It is worth noting that US inventories have been shrinking at the expense of an active export build-up. Therefore, if this trend continues, the local market could face a deficit at some point. Moreover, it could happen when refineries switch to winter fuel production (which usually drive up demand for oil - petrol and diesel stocks start to rise at the time, as oil stocks decline). It is not unreasonable to add that Libya is struggling to maintain high levels of production amid a lack of financing. Summing up, the fundamentals have improved considerably. On the negative side, Venezuela’s and Iran’s oil stored in ships has been stacking up off key Chinese ports, the Chinese economic growth is slowing, and the Indian government is selling off oil stocks to keep the price down.

OPEC+ to do its utmost to support the market

The oil market deficit is projected to shrink by 1 MMbpd and even more if Delta impacts peak.

However, it’s unlikely to happen as the vaccines prove effective and result in lower hospitalisations numbers in developed countries, which account for most of the increase in demand over the summer.

In the worst-case scenario, the slowdown in OPEC+ production growth is set to more than offset the anticipated 1 MMbpd decline in demand over two months as Delta variant cases surge.

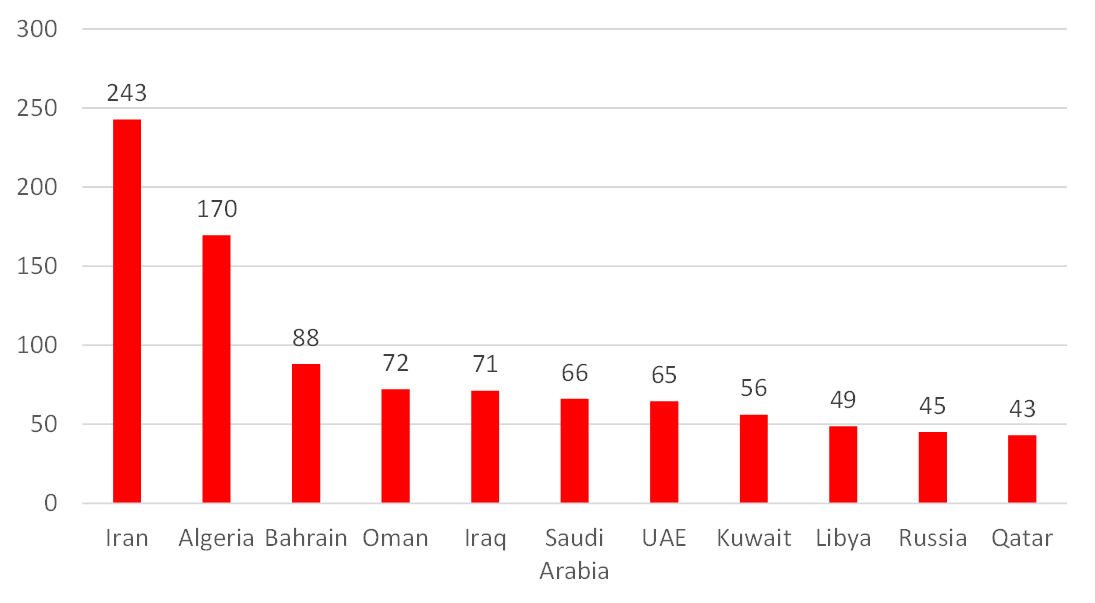

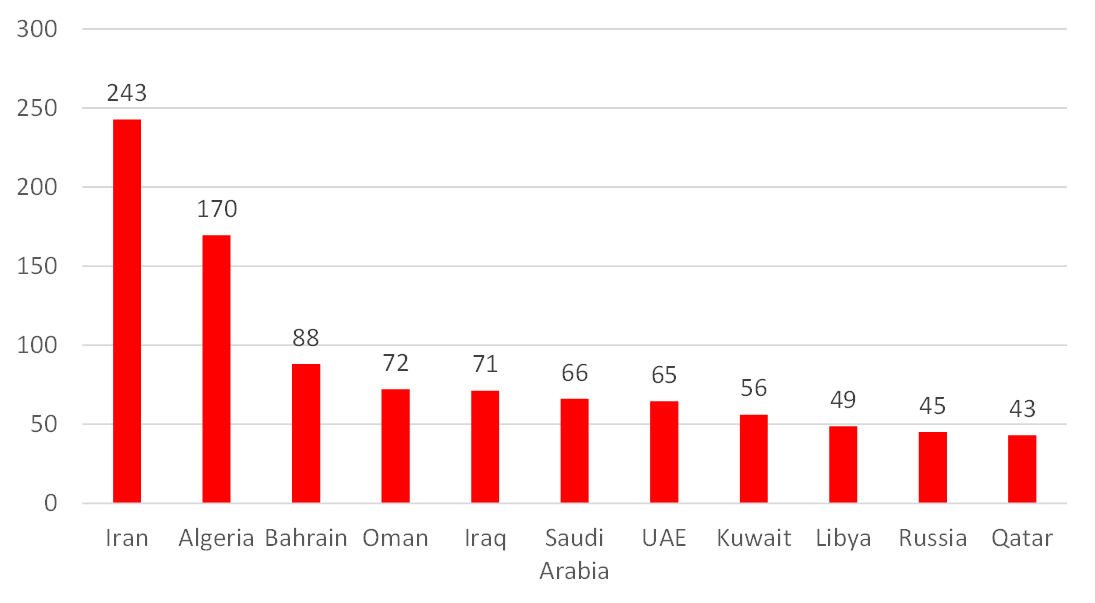

Another important point is that the average breakeven price needed to balance Gulf budgets is $80+/bbl, so local producers are clearly interested in keeping global oil prices stable and fine-tune any potential spike in oil price volatility in advance.

Breakeven price needed to balance budgets of major OPEC exporters

Source: IMF, Bloomberg, ITI Capital

What to buy?

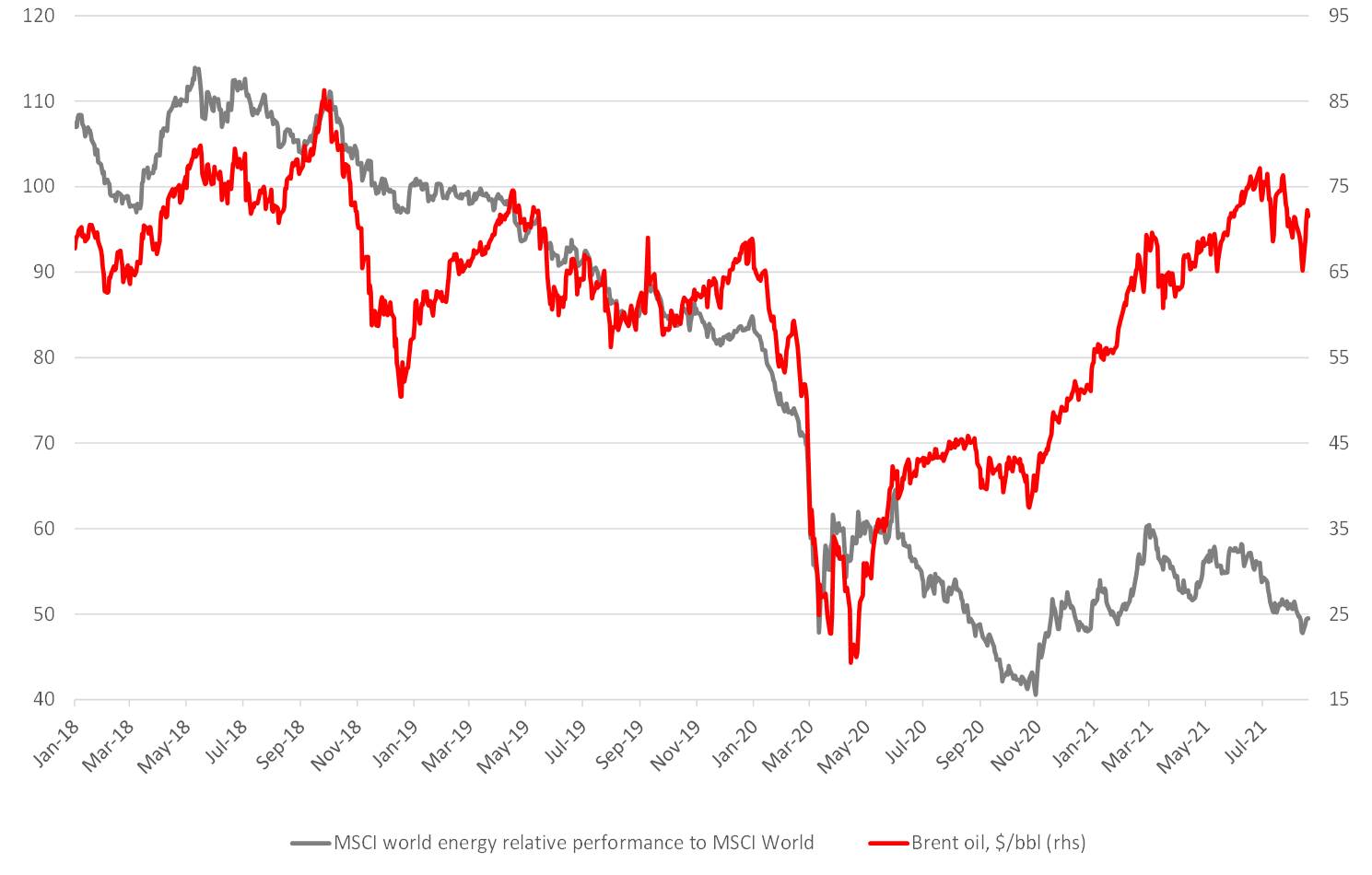

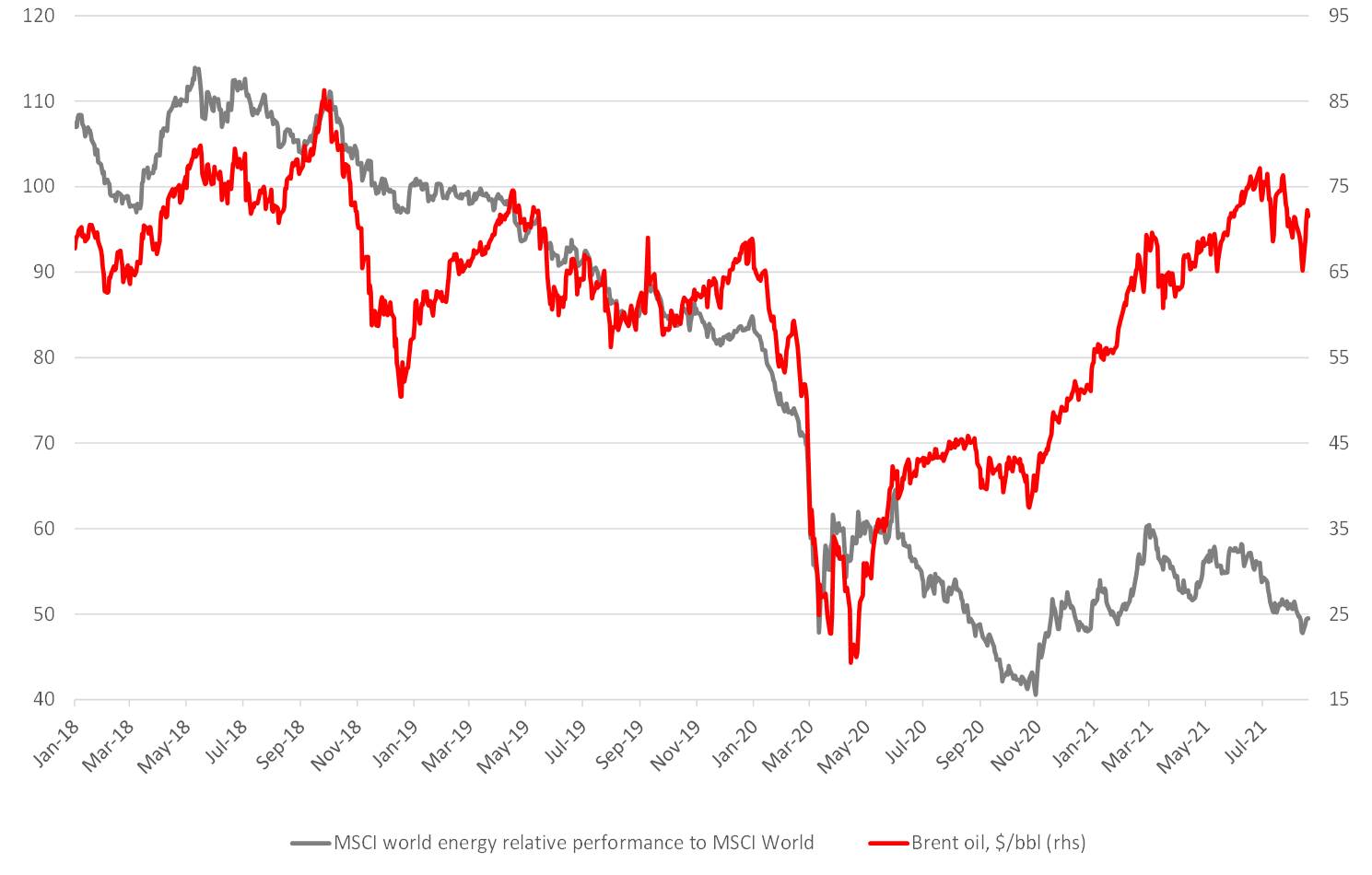

US oil and gas stocks are currently trading at levels when Brent crude was $52/bbl compared to $73/bbl today, implying a spread of at least 35-40%. The current gap between the gauges is at its widest – though the oil and gas stocks advanced more than 30% year-to-date, they have been lagging well behind the base assets, which is not the case for other commodities, such as metals.

Out top picks among global oil and gas companies include TechnipFMC, BP, PetroChina, Schlumberger, Occidental Petroleum and Apache, with their upside exceeding 30% over the next six months.

Relative price of US oil and gas companies and oil

Source: Bloomberg, ITI Capital, IEA

and oversupply-723.png)