Our take: we expect at least two more hikes this year

On Friday 11 June Bank of Russia raised its key interest rate by 50 bps for the second time in a row – the first such occurrence on record. The level of the policy rate was brought to 5.5% reaching the middle of the CBR’s long-term neutral range (previously outlined as 5.0-6.0%) last seen in April-May 2020.

The decision had been widely anticipated following the publication of disappointing inflation data earlier in the week. Headline inflation for May reached 6.0% and further accelerated to 6.15% in the first week of June. Increased inflationary pressures which are becoming entrenched on the back of the rapid demand growth have clearly contributed to the CBR’s decision-making process.

The CBR clearly guided towards more tightening in its press release. The regulator pointed to “the necessity of further increases in the key rate at the upcoming meetings”. Moreover, during her post-decision statement Mrs Nabiullina noted the growing likelihood of transition to a moderately tight monetary policy, depending on performance of inflation and inflation expectations.

Thus, unless consumer prices growth slows down soon, an increase in the key rate to 6% at the July policy meeting (scheduled for 23.07) is effectively a done deal. Going forward, our baseline forecast suggests that the cost of lending could be well pushed to 6.25% before year-end, as a central scenario. We assume that 10-year OFZ yields will be around 6.8-7.0% per annum by the end of December 2021.

Market reaction: decision and guidance largely priced in already

Since the regulator's decision was fully in line with traders’ forecasts, once again, market reaction was expectedly limited. OFZ prices advanced ahead of the announcement, recovering from the sell-off in the first half of the week. Following the announcement, moderate price increases continued. The increasingly hawkish stance of the CBR did not spook OFZ holders, instead they welcomed the regulator’s pledge to act decisively in order to curb inflation. The local foreign exchange market was little changed post-decision. Going forward, we still do not foresee serious risks to longer-dated OFZs, despite the increased expectations for peak levels of policy rates. The OFZ market had been pricing in further rate increases for quite some time - the short end of the sovereign yield curve is pointing to policy rate increases of up to 6.5%.

The Chair’s briefing highlights

- Inflation, running well above the target, is a growing concern. Households inflation expectations have also been near recent highs over the past several months. At the end of 2021, inflation is expected to run below the current level, but it will exceed the forecast range from April (4.7-5.2%). The peak of headline inflation is likely to be at the current level, or slightly higher. Year-on-year inflation is likely to get back to the 4% target in the second half of next year (the CBR’s April forecast expected this to happen in the first half). There are increasing risks that higher inflation globally may be sustained, amid stimulating monetary policy of major central banks.

- The Bank of Russia is ready to act decisively to meet its inflation target. Therefore, there is a growing probability of a transition to a moderately tight policy. Everything will depend on actual inflation, pace of economic recovery and inflation expectations. During the latest meeting, the board had considered an even bigger increase, of 100 bps. However, the Board opted to review the effectiveness of the measures taken already and wait for more data, and made a more cautious decision. The Board is “highly likely” to raise the key rate again in July, even though a hold cannot be completely ruled out.

- As part of the next policy meeting in July, the Bank of Russia will present an updated macro forecast, which will likely reflect expectations for a higher average policy rate level in 2021 (currently 4.8-5.4%). The regulator will also release the latest annual inflation and GDP projections.

- The Central Bank takes into account the updated FX structure of the National Wealth Fund while managing Russia’s foreign exchange reserves, but this is not the only factor behind the bank’s reserves policy.

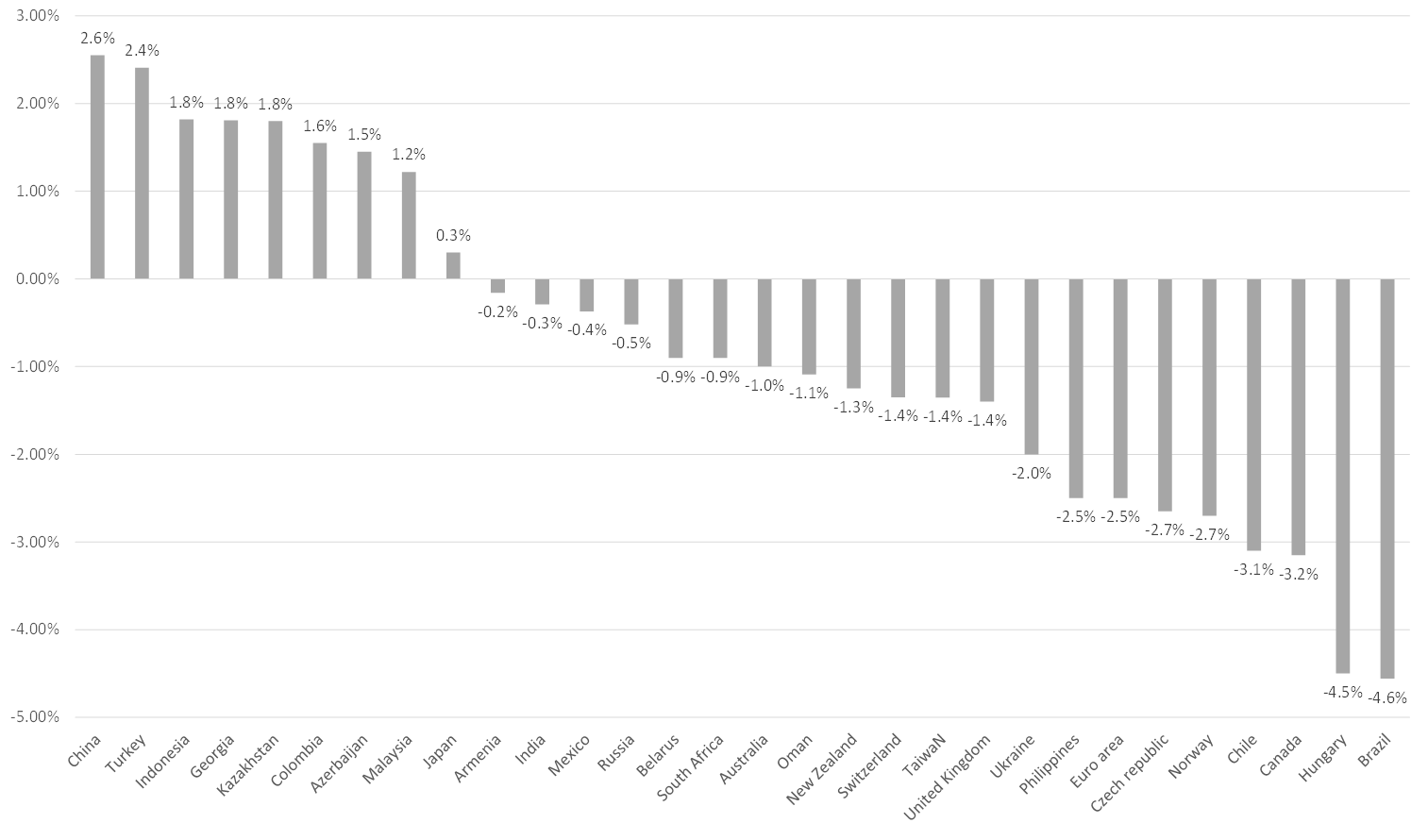

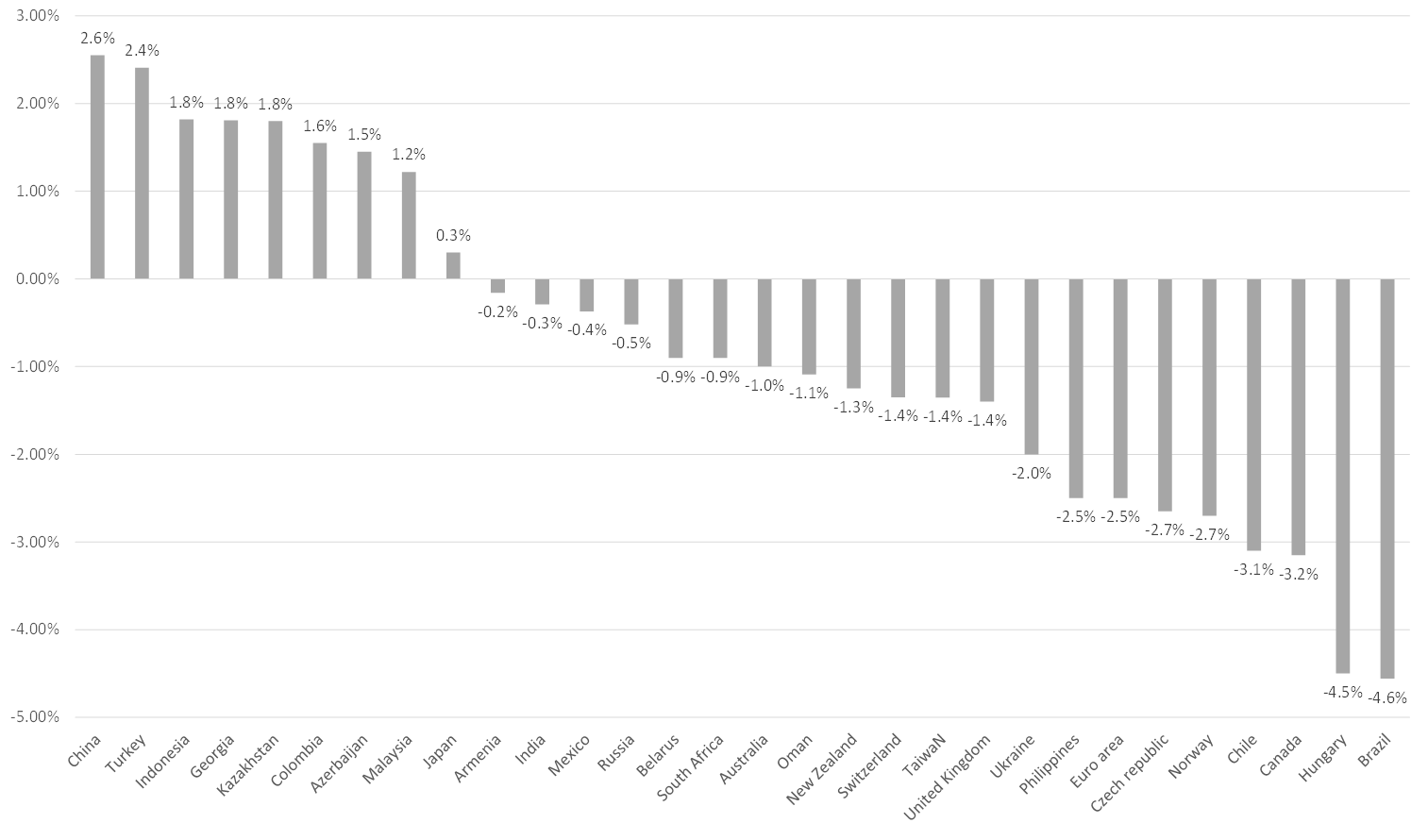

Real interest rates

(policy rates adjusted by headline inflation, p.a.)

Source: central banks, Bloomberg

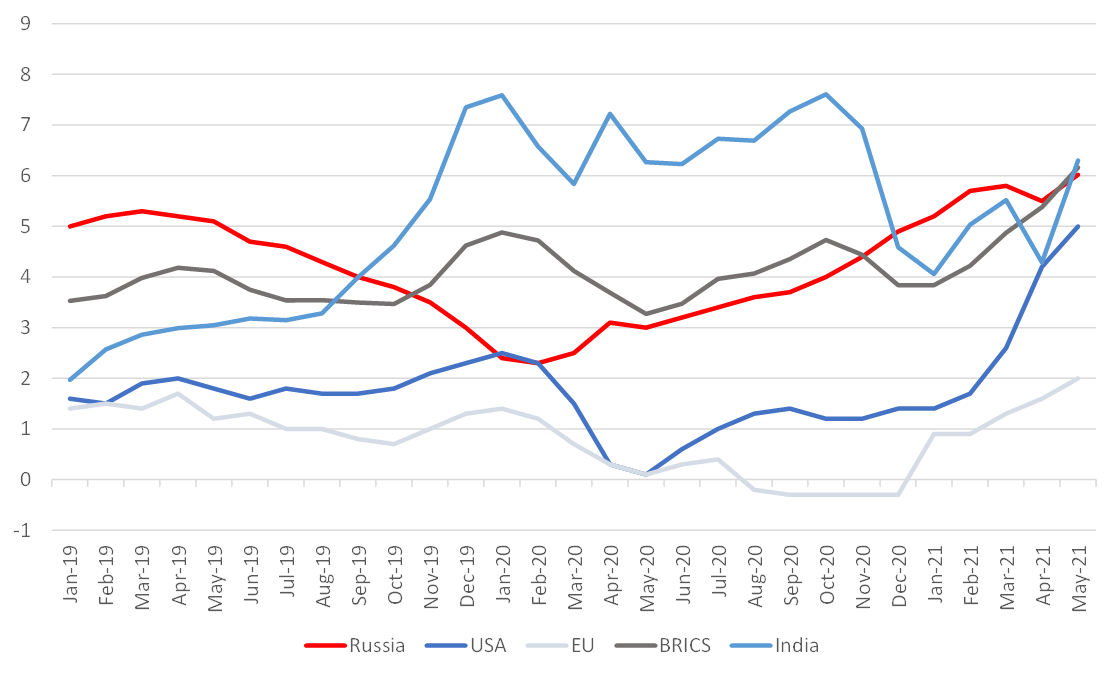

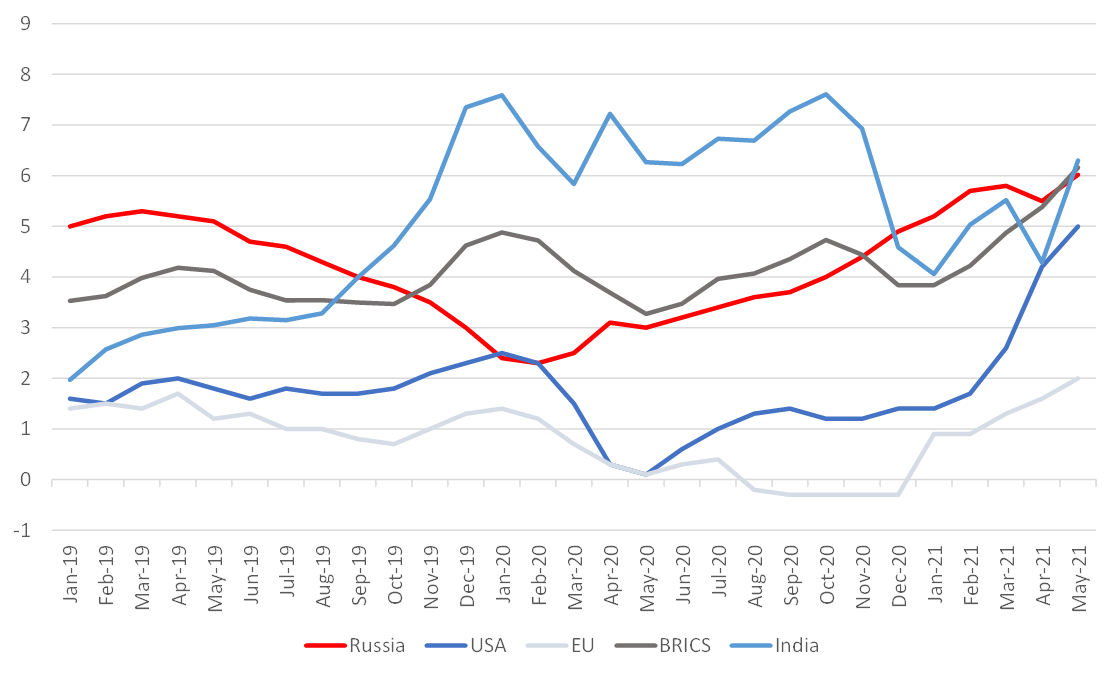

Headline inflation, yoy, %

Sources: Bloomberg, ITI Capital