Trans-oil group (Aragvi), the largest agro-industrial holding in Moldova, is now marketing new Eurobond senior secured notes with a 5-year maturity. The proceeds will be used for repurchasing existing Aragvi 24 issue in the amount up to $300 mln. Tender offer for any and all of old bonds was announced on 31 March 2021. The Early Participation Deadline has been set on April 13, 2021 with an early bird premium of 4.0 ppts, and the Expiration Deadline has been set on April 27, 2021. The solicitation suggests inserting in the ’old’ bond an exit call at 110.125 ppts on 4 May 2021. Book building for the new bonds is expected on April 14,2021. No yield guidance has been provided yet. We estimate fair yield for 5-year notes should be in the high-7% (i.e.7.75-8%) and recommend participation on these terms. We believe Aragvi is likely to outperform (due to further credit profile improvement) in the mid-term thus providing extra profit to the bondholders.

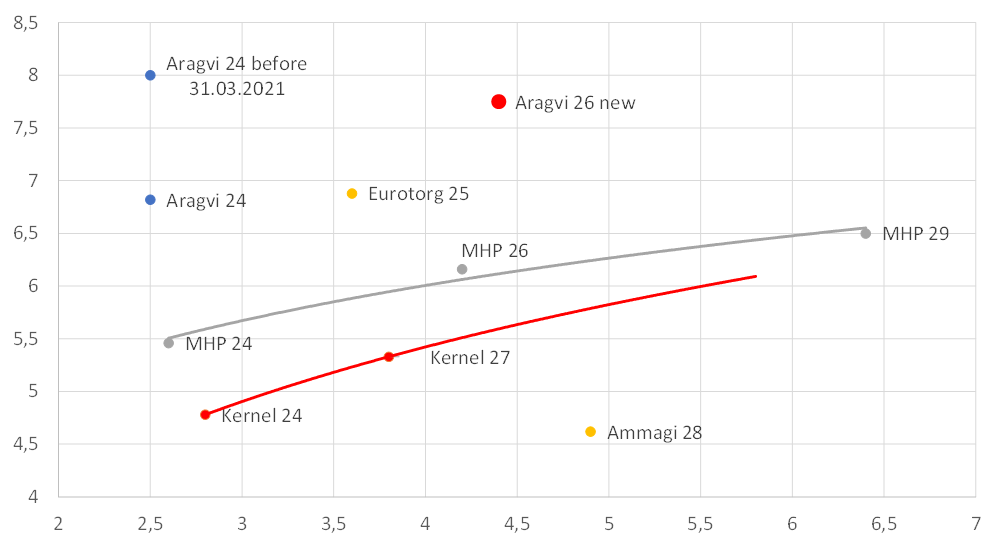

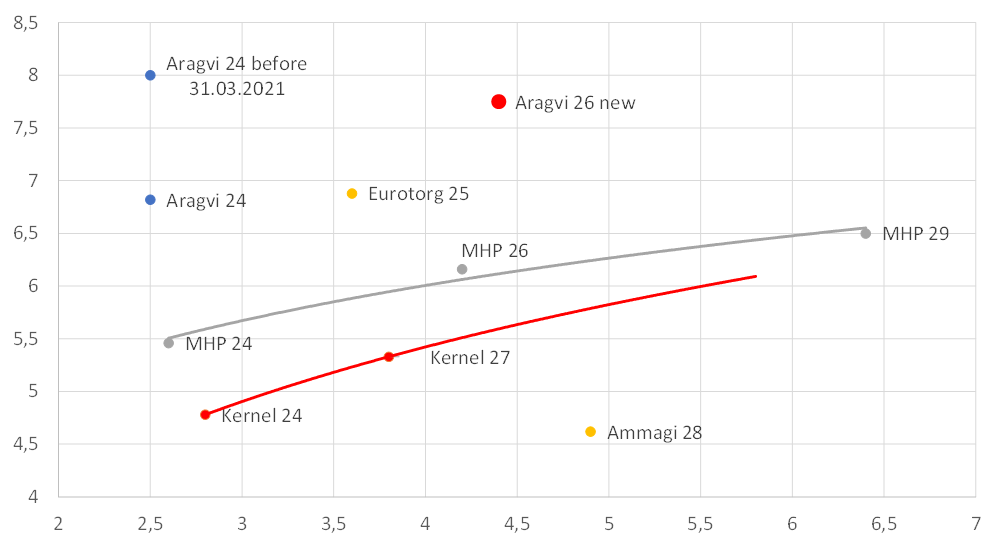

Bond map of corporate Eurobonds (Aragvi vs peers)

Source: Bloomberg

Short company overview:

Trans-oil is a vertically integrated group with a wide range of activities including oilseeds crushing, grain handling and storage, international commodities trading, vegetable oil in bulk, bottled oil, farming and production of flour. The group has been the No.1 exporter of grains produced in Moldova over the past ten years, selling up to 62% of the country's grain export. It operates a large network of 13 silos, controlling 85% of Moldova's total storage capacity; and two seed-crushing facilities, representing 95% of the country's vegetable oil production. It has its own fleet of railcars as well two port terminals: Giurgiulesti in Moldova and Reni in Ukraine. During 1H21 (ended on 31.12.2020) Trans-oil sold approximately 1,8 mn metric tons of commodities of all types (+4% y-o-y). It is a private company controlled by it’s CEO Vaja Jhashi.

At the end of 2020 Trans-Oil acquired Serbia-based Victoria Oil, the country’s leading producer of SFS oil. The asset was purchased through a bank loan (€50 mln) as well as subordinated shareholder loan ($13 mln). Trans-Oil is expected to consolidate Victoria Oil in 2021.

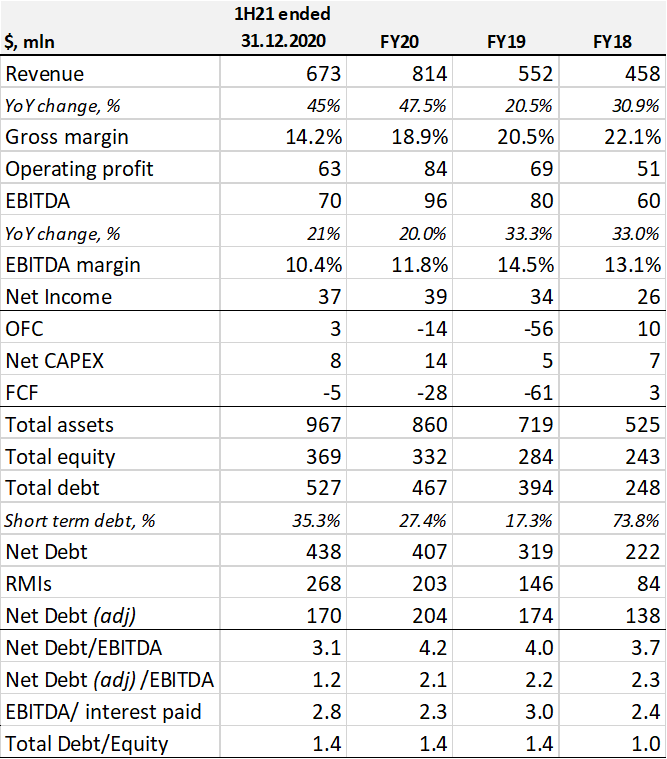

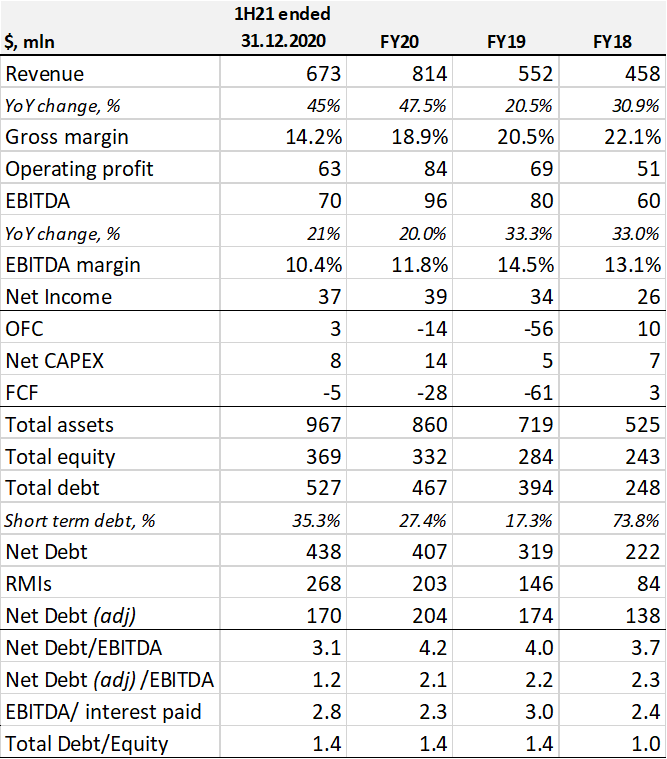

1H2021 Financial highlights:

- The top line for 1H21 came out almost 45% higher y-o-y, reaching $673 mln despite the challenging conditions due to the drought in the Black Sea region in 2020 and the outbreak of Covid-19. This was achieved thanks to the origination and marketing programme outside Moldova. The bulk of revenue (98%) came from export operations and was denominated in hard currency. The increase of 46.9% in Origination and Marketing segment revenues is largely due to rebound in commodity prices on the international markets. Crushing and refining production volumes have decreased by 24,5% in 1H21 because of drought and shortage in sunflower seeds crop production. However, the segment's turnover still has increased by 36% y-o-y, due to a spike in sunflower seeds and sunflower seed oil prices.

- As of 1H21 consolidated EBITDA margin stood at 10.4% vs 12.5% in 1H20. The decline was attributed to costs inflation in Origination and Marketing segment, that accounts for almost 71% of consolidated EBITDA. Rapidly growing volume of international operations has lower margins (although requires less investments in working capital). Crushing segment’s EBITDA margin advanced (18% vs 17% in 1H20) thanks to a favourable price environment. Trans oil aims to increase the share of crushing segment EBITDA up to 40-50% (currently 25%).

- Net income for 1H21 was $37 mln, a 54% increase YoY

- Free cash flow (FCF) again returned to negative zone (-$5 mln) as a result of higher seasonal demand for working capital

- Company’s total debt mostly consists of Eurobond issue Aragvi 24 ($300 mln) and PXF line ($180 mln) syndicated by a number of international financial institutions that matures in July 2021. Debt profile has seen further improvements since last reported for FY2020. The Group is demonstrating further deleveraging even despite the operating margin decline. Namely Adjusted Net Debt to EBITDA ratio decreased to 1.2 x in 1H21 compared to 2.1x for FY20.

- The upcoming placement of new 5-year notes will evidently provide extra support to the debt profile. Thus, it will reduce refinancing risks as well as optimize funding costs. Nevertheless, liquidity profile still remains vulnerable due to high demand for funding of working capital.

Key financial data, IFRS

Source: Company data, ITI Capital estimates