Our baseline forecast

On Friday, March 19, the Bank of Russia plans to hold the second in this year monetary policy meeting. A growing number of market participants are pricing in a faster policy tightening and even do not rule out that the first rate hike will be made as early as this Friday. Investors focus on OFZ yields spike on the short segment of the curve (with up to three years maturity), implying a rate hike of up to 5%, or by 75 bps from the current level. The rhetoric of the policymakers has become more “hawkish” in recent weeks. It cannot be ruled out that the monetary environment will normalize (i.e., the rate will move to a 5-6% range) as early as this year, although at the beginning of the year the regulator pledged to keep stimulus in place until 2022. Global central banks are getting themselves ready for the era of elevated rates. Brazil may follow Turkey in tightening monetary policy as early as Wednesday, March 17. Brazil has a similar inflation rate (5.2% yoy, as has Russia), but is facing a rising number of COVID cases. Ahead of the Bank of Russia's policy decision this week, the rates will be announced by the central banks of England, Japan, Norway, Brazil, Indonesia, Taiwan and most importantly the Fed (March 16-17, 2021).The US FED meeting will be in the spotlight given the recent growth of the long-term US Treasury yields.

Our baseline forecast assumes at least two hikes going forward, which implies a 4.75% year-end rate. As for the next meeting, we estimate the odds of tightening as 50/50. The CBR is likely to raise the rate at its core meeting scheduled for April 23. See below our arguments in favour of such a decision.

What may lead the CBR to raise the rate in the coming days, and what will almost certainly make it do so on April 23?

- The lingering impact of pro-inflation risks. Annual inflation has been growing in Russia, driven both by continued costs pressure and stronger consumer demand, according to the regulator. Weekly inflation has not been falling below 0.2% for quite some time now. Therefore, the annual CPI reached 5.8% as of March 9. If there is no change in the environment, the peak of inflation will approach 5.9-6%, by the end of March, going far beyond the CBR's target range for the current year (3.7-4.2%). The CBR does not rule out that it may not return to a 4% target until early 2022. Russia is one of the laggers in terms of CPI growth in the emerging markets (EM). Therefore, even though the rouble key rate is one of the highest in the EM universe, the real rate has long been in the negative zone, running counter to the current CBR’s strategy.

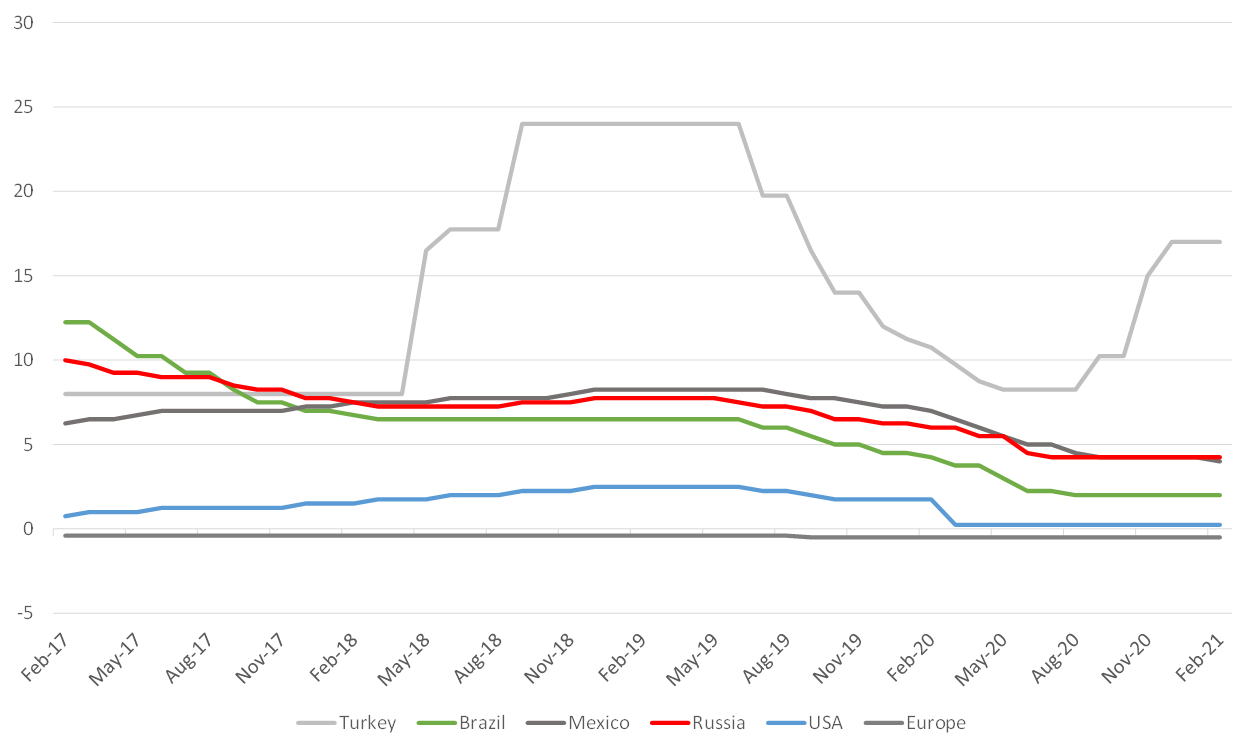

Global key rates, %

Source: Bloomberg, ITI Capital

- The economy’ recovery beat the baseline forecast. The rebound reduces the need for long-term monetary stimulus. Elvira Nabiullina has recently confirmed the assumption, suggesting that the watchdog may shift to a neutral rate of 5-6% in 2021-2023.

- Global rates growth. The U.S treasuries yields growth since early 2021 driven by fears of a significant deviation of inflation from the target, increases the likelihood of an earlier withdrawal of pandemic-driven economic stimulus efforts by the Fed, which will certainly affect the monetary policy in developing countries, including Russia. One should therefore take note of the widening spread between the UST and the TIPS (Treasury Inflation-Protected Bonds), which reflects price growth expectations.

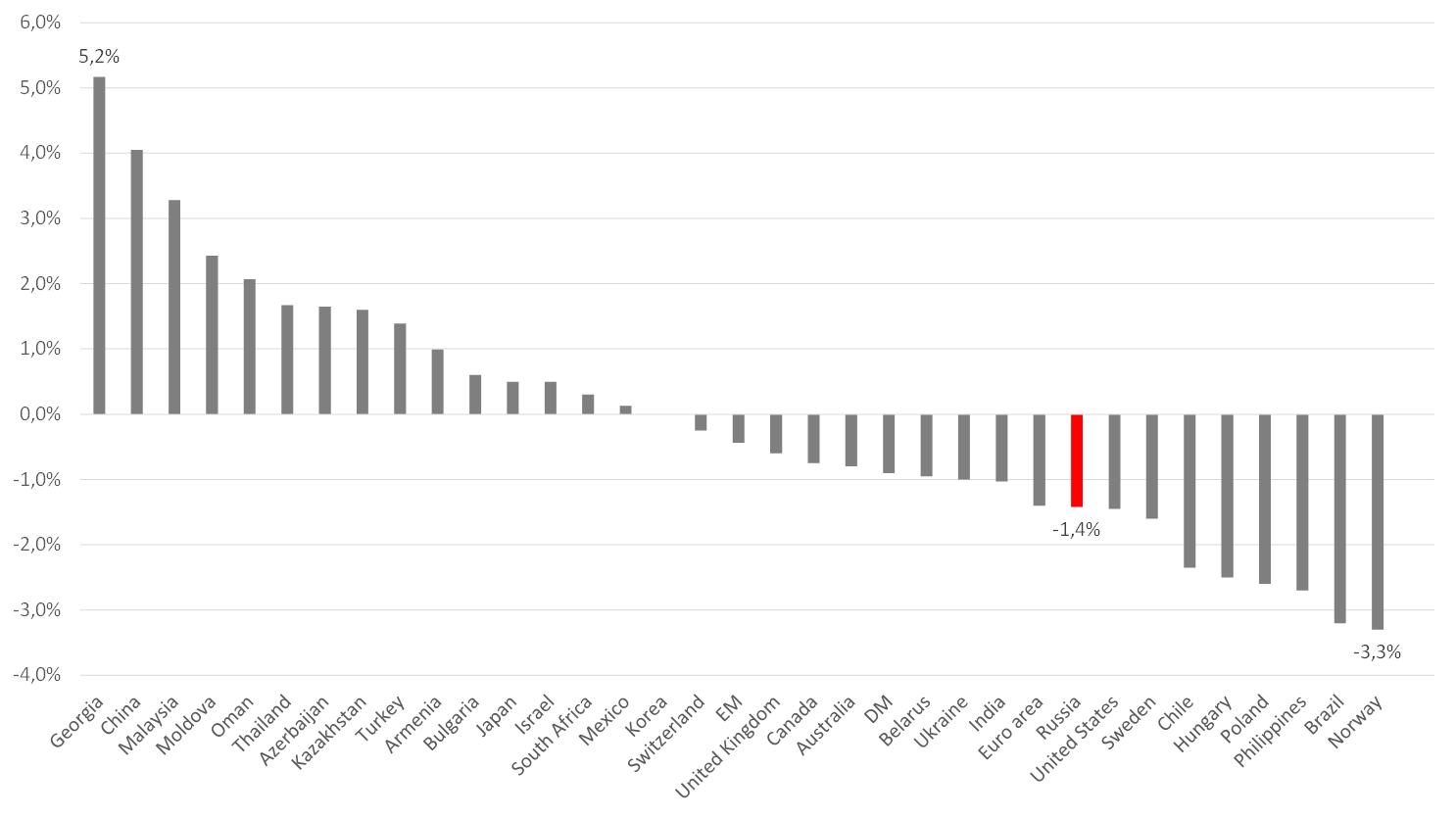

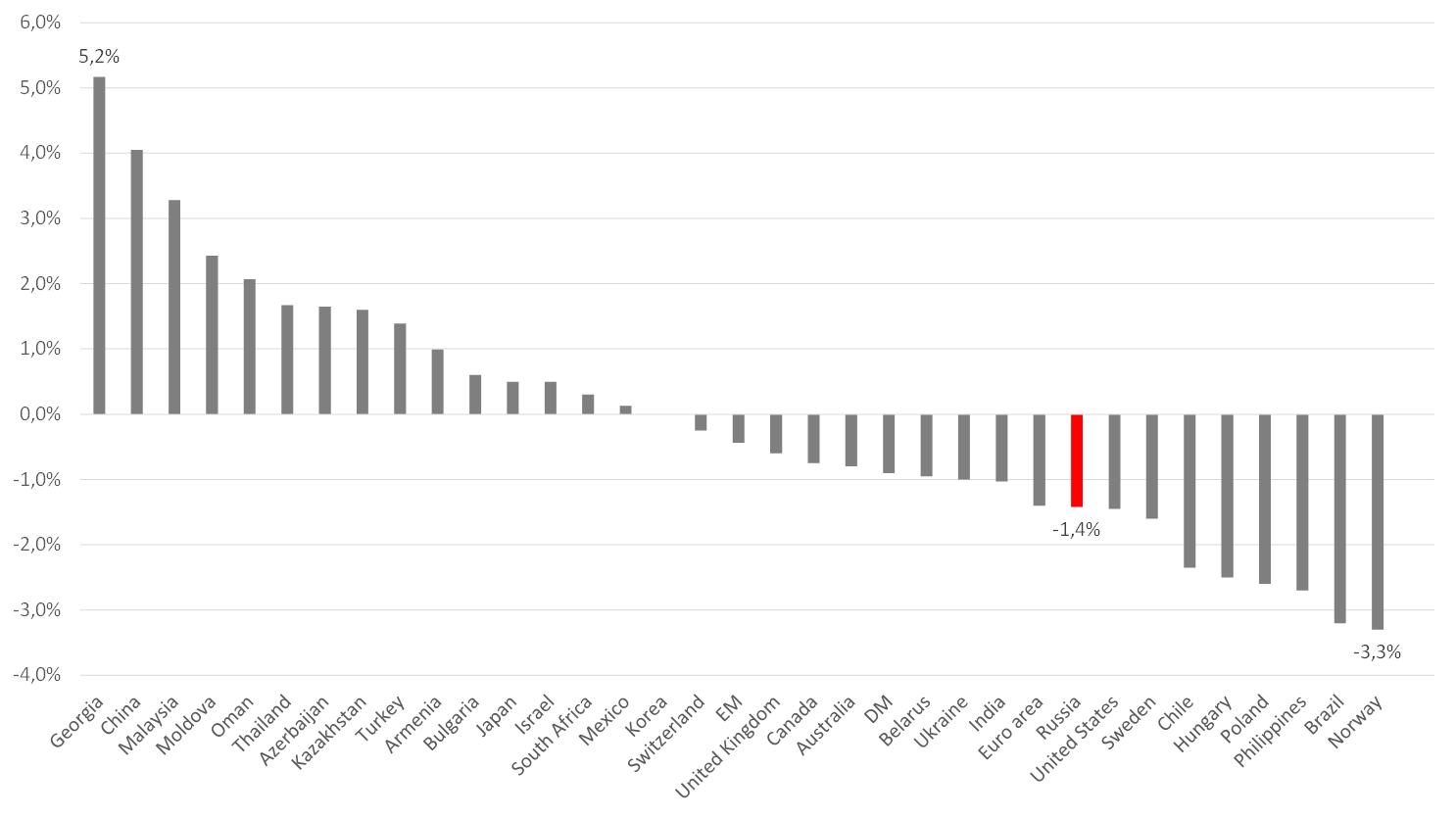

Inflation rate by country, %*

-923.png)

Source: Bloomberg, ITI Capital

* Surge in inflation since early November, driven by higher prices in energy and commodities, both hard and soft

- Growth in short-term OFZ yields since early February, since the sovereign bonds are an important benchmark for all economic agents and one of the leading indicators of changes in the cycle. For instance, the 3Y benchmark yield has surged by 70 bps to 5.9% since early February. The yield spread between the benchmark and the longest OFZ 26230 stands at its lowest point for the past year, 118 bps, vs. the median 150 bps.

- Sanctions risks have been growing. The recent round of U.S. sanctions turned out to be lighter than many investors expected, triggering a spike in demand for the Russian risk assets. However, this does not mean that no restrictive measures will follow. If Russia fails to eliminate violations relating to storage and use of chemical weapons (as part of Alexei Navalny poisoning) within 90 days, the U.S. may adopt a tougher line and impose a ban on holding Russian sovereign debt. The geopolitical premium for the rouble, which still reflects the sanctions risks, despite oil prices growth, supports this assumption.

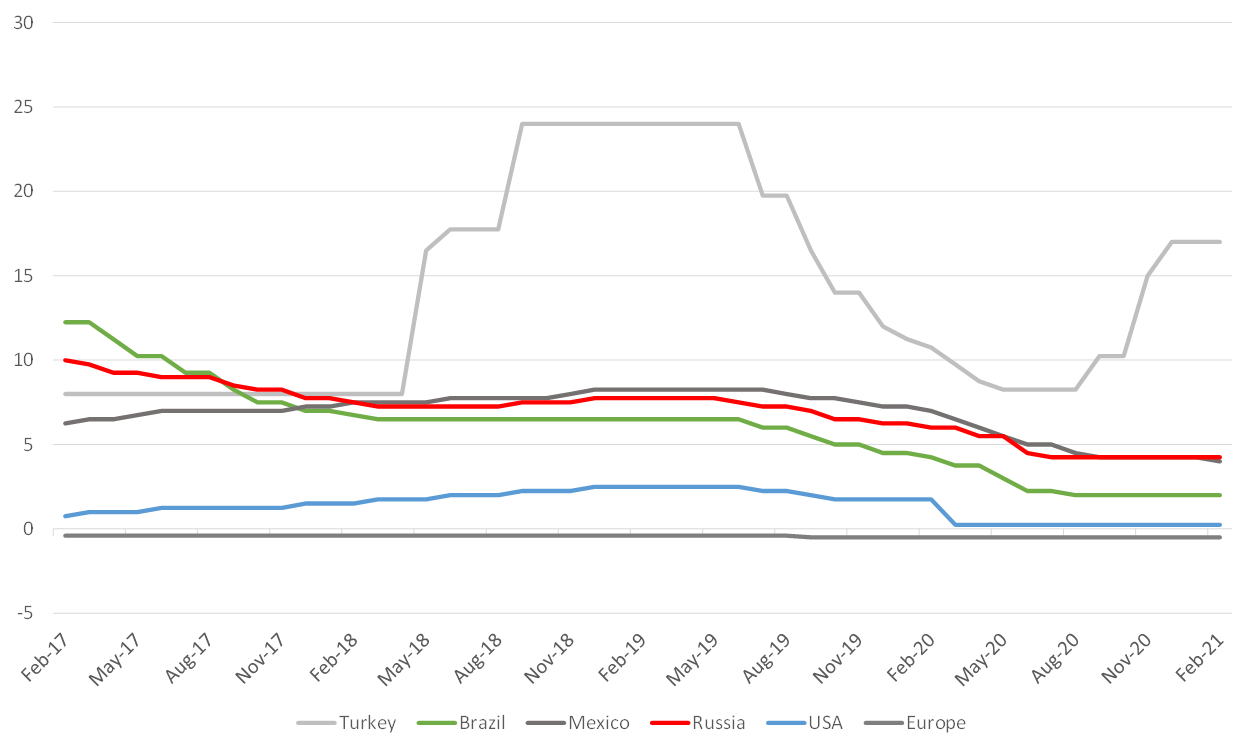

Real rate based on the current headline inflation, %*

Source: Bloomberg, ITI Capital

*There are fewer countries with a positive real rate, the number has halved to 25-30% over the past year, there are now as few as seven in the G-20.

-923.png)