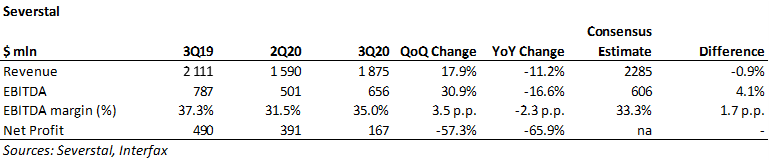

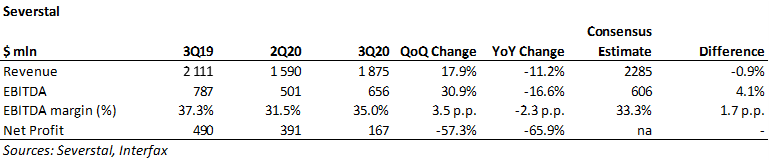

IFRS Q3’20 Results — EBITDA stronger than Interfax Consensus Estimate

- Revenue: +17.9% q/q (-11.2% y/y) to $1875 mln (-0.9% vs consensus estimate);

- EBITDA: +30.9 % q/q (- 16.6 % y/y) to $656 mln (+4.1% vs consensus estimate);

- Net Profit: −57.3% q/q (-65.9% y/y) to $167 mln;

- Strong FCF: +101.1% q/q ( +10.4% y/y) to $382 mln;

- Q3’20 Dividends: RUB37.34 per share; dividend yield: 3.7%.

Benefits of vertical integrations — highest EBITDA margin in the industry, EBITDA stronger than Interfax Consensus Estimate

The revenue increase by 17.9% q/q (-11.2% y/y) to $1590 mln was driven by steel price recovery q/q and steel sales volumes growth. EBITDA increased by 30.9% q/q to $656 mln, 4% higher than the Interfax consensus estimate on account of an increase of the weighted average steel selling prices by 2% due to positive steel pricing dynamics and a higher share of HVA products in the sales mix q/q (HVA share in Q3 — 49% vs 43% in Q4). The share of domestic steel shipments increased to 63% against 56% in Q2. The integrated cash cost of slab in Q3 2020 declined to $173/t vs $184/t in Q2’20. The EBITDA margin increased to 55% in Q3 vs 45% in Q2, which highlights the advantages of vertical integration during current high prices for iron ore raw materials due to high demand in China and shipment restrictions for producers (Brazil). Consequently Severstal’s 35% EBITDA Margin is the highest in the Russian steel industry. Net profit decreased by 57.3% q/q (-65.9% y/y) to $167 mln due to a $262 mln Forex loss which mainly reflects an accounting loss on the translation of USD debt balances.

Strong FCF...

FCF increased by 101.1% q/q (+10.4% y/y) to$382 mln reflecting EBITDA growth and positive changes in working capital. According to our evaluation, the release of working capital totaled $259 mln in Q3’20, the ratio of working capital to revenue decreased by 6.7% from 10.0% in Q2. There was a slight increase in Capex: $341 mln vs $331 mln in Q2. Capex in 2021 will stay at the 2020 level, around $1,45 bln, assuming a 0.77x net debt to EBITDA ratio vs $2006 mln, 0.82x in Q2. The net debt/EBITDA ratio should not exceed 1x by the end of this year, nevertheless, the company does not rule out the fact that it may next year, which theoretically could affect the dividend amount.

...and quarterly dividends double against Q2’20

As a result of significant FCF growth, as well as a comfortable a comfortable level of debt for the company with a net debt/EBITDA ratio of 0.77x the BoD recommended a quarterly dividend payout of RUB37.34 for Q3 vs RUB15.44/share in Q2. At the time of the announcement the dividend yield amounted to 3.7%. The dividend record date — December 8th.

Positive outlook

Earlier on Severstal announced operating results for Q3’20, which demonstrated recovering demand in Russia and a decrease in inventories. Production volumes continued to grow, which could attest to what the company considers a stable recovery trend.

The company expects that in Q4 steel product prices will remain at a comfortable level after the recovery of demand in Q3. Sales volumes in Q4 will reflect production volumes — at a 2.4-2.8 mln t level. In Q3 the company sold most of their warehouse inventories, which could mean lower cash flow in Q4. According to Severstal’s data the demand for steel in China increased by 6% y/y in Q3 vs −14% y/y globally. China's positive impact will continue in Q4. Consumption in Russia should not decrease by more than 6%y/y, according to the company.