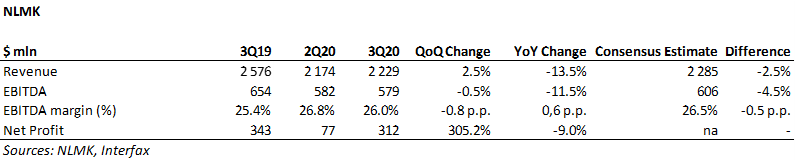

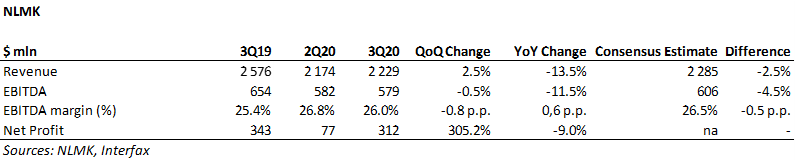

- Revenue down by 13.5% y/y (+2.5% q/q) to $2229 mln (-2.5% vs consensus estimate);

- EBITDA decreased by 11.5% y/y (-0.5% q/q) to $579 mln (-4.5% vs consensus estimate);

- Net profit decreased by 9.0% y/y (+305.2% q/q due to low Q2 result) to $312 mln;

- FCF totaled $239 mln against $249 mln in Q319 and $304 mln in Q220.

Quarterly dividends + one-off payments

The BoD recommended shareholders to approve Q320 dividend in the amount of ₽6.43 per share (vs ₽4.75 per share in Q220). The dividend yield will be around 3.7%. The BoD decided to pay out dividends in the amount of $500 mln, including a $250 mln one-off dividend on top of their dividend policy aimed at compensating the reduction in Q419 dividends die to the first wave of the pandemic.

Stoilensky incident’s negative impact on profitability (EBITDA down -$60 mln)

Revenue in Q320 totaled $2229 mln (+2.5% q/q, -13.5% y/y) due growth in steel product sales by 2% q/q to 4.4 mln t. A decrease of 13% y/y (vs -22% y/y in Q220) was a result of a drop in prices for steel products and an increase in the share of semifinished products in the sales mix. EBITDA totaled $579 mln (-0.5% q/q, -11.5% y/y), an increase in sales, an improvement in the product portfolio structure, and the devaluation of the rouble offset the negative effect from production losses during the restoration of the conveyor gallery at Stoilensky. The negative impact of the incident totaled $60 mln. EBITDA was weaker than the Interfax consensus estimate by 4.5%. Excluding this one-off effect, the Q320 EBITDA would have been $639 mln. A reminder, on the 7th of September operations on Stoilensky Mining and Beneficiation Plant were discontinued following the collapse of an ore transportation conveyor gallery. During the forced shutdown planned repairs at other plants were rescheduled to reduce concentrate production losses. The incident had a negative impact on the company’s profitability due to covering iron ore needs by the company’s own stock and external supplies during the repair period. In this context NLMK’s results should differ from Severstal’s, in our opinion. Net profit increased 4-fold q/q to $312 mln (+305.2% q/q, -9.0% y/y) due to the low base in the previous quarter when investments in NBH were impaired.

Efficiency growth

FCF in Q320 totalled $239 partially due to effective working capital management: the negative impact of an increase in receivables (-$37 mln) was offset by inventory reductions (+$49 mln) and an increase in payables (+$93 mln). Structural gain from Strategy 2022 projects in Q320 $55 mln relative to the 2019 cost base ($170 mln in 9M20), including the impact of operational efficiency programmes ($25 mln) and investment projects ($30 mln).

Positive outlook for Q420 and 2021 confirmed

NLMK expects an increase in steel output at NLMK Lipetsk in Q4 2020 following the completion of major capital repairs will support the achievement of the NLMK Lipetsk steel output estimate of 12.2-12.3 mln t in 2020 communicated earlier. Corresponding projects form part of the modernization programme which will enable an increase in NLMK Lipetsk’s steel output to 14.2 mln t per year starting 2021.

The company announced operating results earlier on

According to NLMK Group’s Q320 trading update steel output grew by 3% y/y to 3.9 mln t (flat q/q). Sales totaled 4.4 mln t (+2% q/q, +11% y/y) due mainly to higher pig iron sales to the US, Chinese, and Turkish markets. Quarter-on-quarter, sales were up by 2%, while the share of finished products in the sales portfolio grew from 56% to 62%. An all-time high steel output in China was driven by state support for infrastructure projects. Domestic sales totaled 52.5%. Sales on export markets totaled 1.8 mln t (-10% q/q, +42% y/y). The positive y/y dynamic is due to an increase in semis shipments. The q/q reduction reflects the recovery of business activity in Russia and a normalized share of export sales by the Group’s Russian companies.