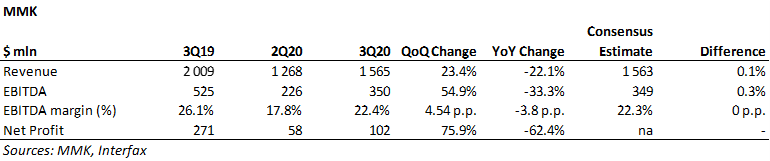

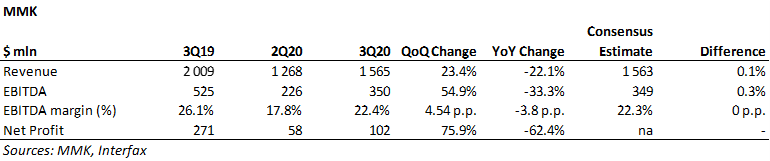

3Q20 IFRS Results — in line with Interfax consensus estimates, high dividends

- Revenue up 23.4% q/q (-22.1 y/y) to $1565 mln (+0,1% vs consensus estimate);

- EBITDA up 54.9% q/q (-33.3% y/y) to $350 mln (+0.3% vs consensus estimate);

- Net profit increased by 75.9% q/q (-62.4% y/y) to $102 mln;

- FCF: $335 mln against -$18 mln in Q220 and $289 mln in Q319;

- BoD recommends a Q320 dividend of ₽2.4 per share (vs ₽0.6/share in H120).

Revenue growth due to domestic market

Q/q revenue growth reflects a growth in sales volumes and a rise in steel prices thanks to a recovery in business activity. The demand for steel on the Russian market was down 8% y/y in Q320 vs −19% in Q2. In Q320 the share of sales on the domestics market was 84% vs 74% in Q220. Export was redirected to the Near East (52% export vs 23% in Q220). MMK’s share of HVA products is one of the highest 49% in Q320 vs 52% в Q220 и 49% в Q319.

Slab cash cost per ton was up to $263 inQ320 due to an absence of vertical integration (the company does not produce its own materials) vs $255 inQ220 which reflects the continuing growth of iron ore raw material prices. «Evolution» operational optimization programmes added $16 mln to the Q320 EBITDA. As a result, the EBITDA margin was 22.3% in Q320 (+4.6 pp q/q, −3.8 pp y/y) which is comparable to the Severstal’s steel segment EBITDA margin (22.0%) and NLMK’s Russian steel segment (23.1%).

High Q320 quarterly dividends... in the amount of ₽2.4/share (vs ₽0.6/share in H120). At the time of the announcement the dividend yield amounted to 7%. The dividend record date — January 14th, 2021.

...due to high FCF in Q320... which totaled $335 mln vs -$18 mln in Q220 and $289 mln in Q319. The release of working capital amounted to $190 mon in Q219, while the ratio of working capital to revenue was down to 11% from 19% in Q220. FCF was positively impacted by a Capex decrease of $17 mln q/q to $159 mln (vs $191 mln in Q319).

...allowing for pressure on FCF in the future Capex for Q420 is expected to grow q/q to $260 mln and total $700-730 at the yearend against the previously announced $750-800 mln primarily caused by postponing the coke-oven battery construction period and rouble devaluation, as most of the company’s Capex is rouble-denominated. Capex in 2021 will amount around $1 bln. The average Capex level in 2021-2023 wil total $950 (vs the $900 mln target announced last year) and will decrease to $700 mln in 2024-2025. In Q330 the company sold most of its warehouse inventories, which may result in lower CF support Q420.

Negative Net debt

The company’s total debt was up to $946 in Q320 vs $870 in Q220. Net debt was negative: -$34 vs $235 in Q220.

Positive outlook for Q420

Recovering demand in Russia and the stabilization of prices in Q3 on a precrisis level will benefit MMK, as MMK’s share of sales on the domestic markets is higher than their peers (Severstal and NLMK). MMK plans to increase steel product sales by 11% q/q to 3 mln t in Q420 vs 2.7 mln t in Q320. The start-up of Hot-Rolling Mill 2500 in July will additionally support sales with an increase in utilization by 1.5 mln t to 5.2 mln. Further growth, in our opinion, could be stunted by 100% utilization of blast-furnace production in Q320. Amid economic recovery MMK expects an increase in Russian steel consumption by 3-4% y/y in 2021, conservatively. Major infrastructure projects in China will support the iron and steel industry in H121.

MSCI index revision in November — main risk for MMK quotes

A positive outlook for Q420 and high dividends in Q320 could increase market cap and lower the risk of exclusion from the index. An important driver for MMK could be a potential decrease in feverish iron ore demand from China. Post-pandemic growth of iron supplies from Brazil should positively impact MMK’s profits.