ITI Capital FX and Rates overview: Why it’s the right time to BUY Rouble vs USD and EUR

The rouble has been underperforming year-to-date. We will try to explain why is that so and what are the currency’s prospects going forward. The rouble looked incredibly sustainable in the end of April, when Brent and Urals fell below $20/bbl and $12/bbl respectively. Russia’s debt-GDP ratio is the world’s lowest backed by world’s largest reserve adequacy ratio and one of the highest BOP metrics as % of GDP in the world, which is one of the rouble’s traditional strong points.

The local currency has been lagging behind, although oil has been steadily trading above $40/bbl, and we believe that rouble is undervalued vs USD by fundamental metrics at least by 8% and is on track to recover though over longer term upside is more limited than downside given potential sanction risks and overall global volatility.

With respect of RUB/EUR, additional pressure comes from the euro’s rally that brought it 5% higher in July amid lockdown-driven problems in the US economy and higher new cases rate, while Europe’s prospects look better. The rouble’s performance against the dollar and the euro will largely depend on the decease rate in the US, which dropped to the level of July 6, but we expect the situation to improve by the end of August. The current levels seem attractive for selling the dollar and the euro against the rouble.

The rouble outlook

The is expected to remain volatile through the first week of August, it drop to ₽75/$, since there is high demand for dollars on the local market for 2019 dividend payments, which will be made till August 10. Exporters made small dollar sales despite traditionally strong tax payments in July. The usually high demand is also driven by seasonally low current account, which may turn negative for the first time since 1998 in the third quarter of 2020.

The market is also under pressure from global volatility due to a worsening pandemic and rising sanctions risks amid higher chances of Joseph Biden’s victory in the US. We believe the situation will improve closer to mid-August by the end of Phase 3 of the coronavirus vaccine trial. It is more likely that by the end of August the rouble will advance to ₽68–69/$ even if oil prices remain unchanged.

In this case, the Euro will drop to $1.16 and fall below ₽80 in line with our USDRUB forecast.

The Russian assets honeymoon is expected to last from the end of August to the end of September, while in October a negative period is projected to start ahead of the U.S. elections amid higher chances of Biden’s victory.

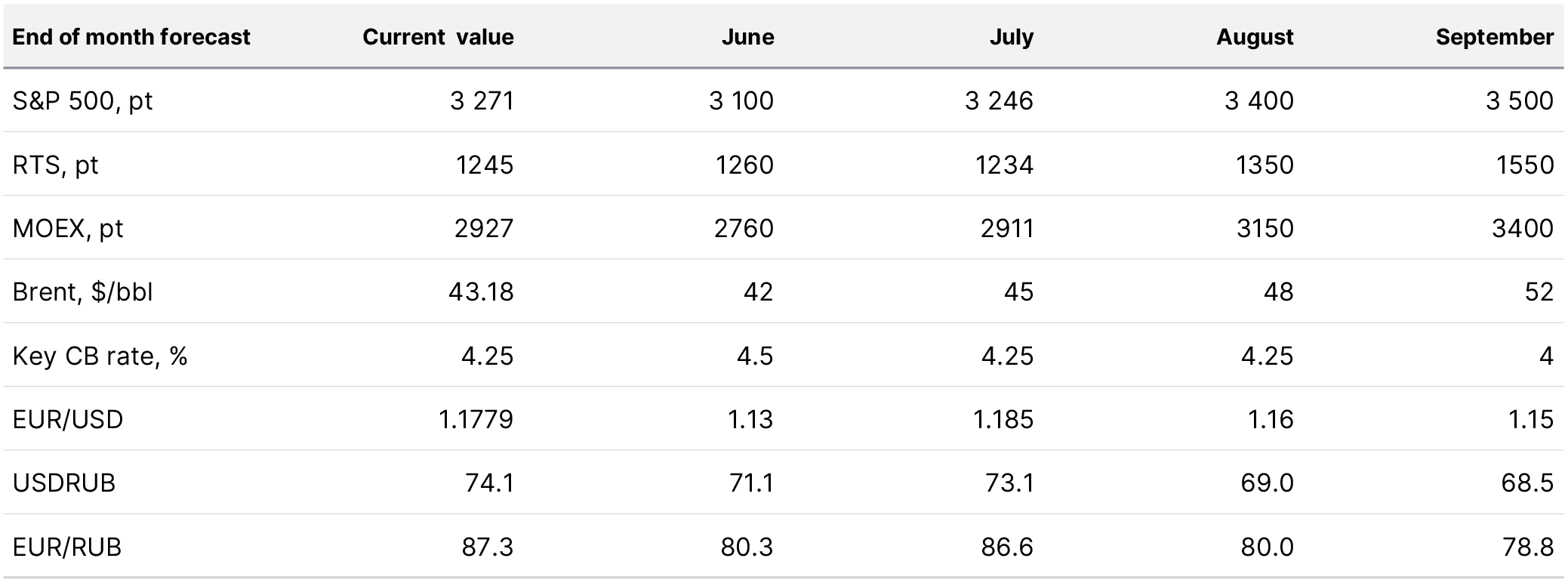

Key assets forecast

Source: Bloomberg, ITI Capital

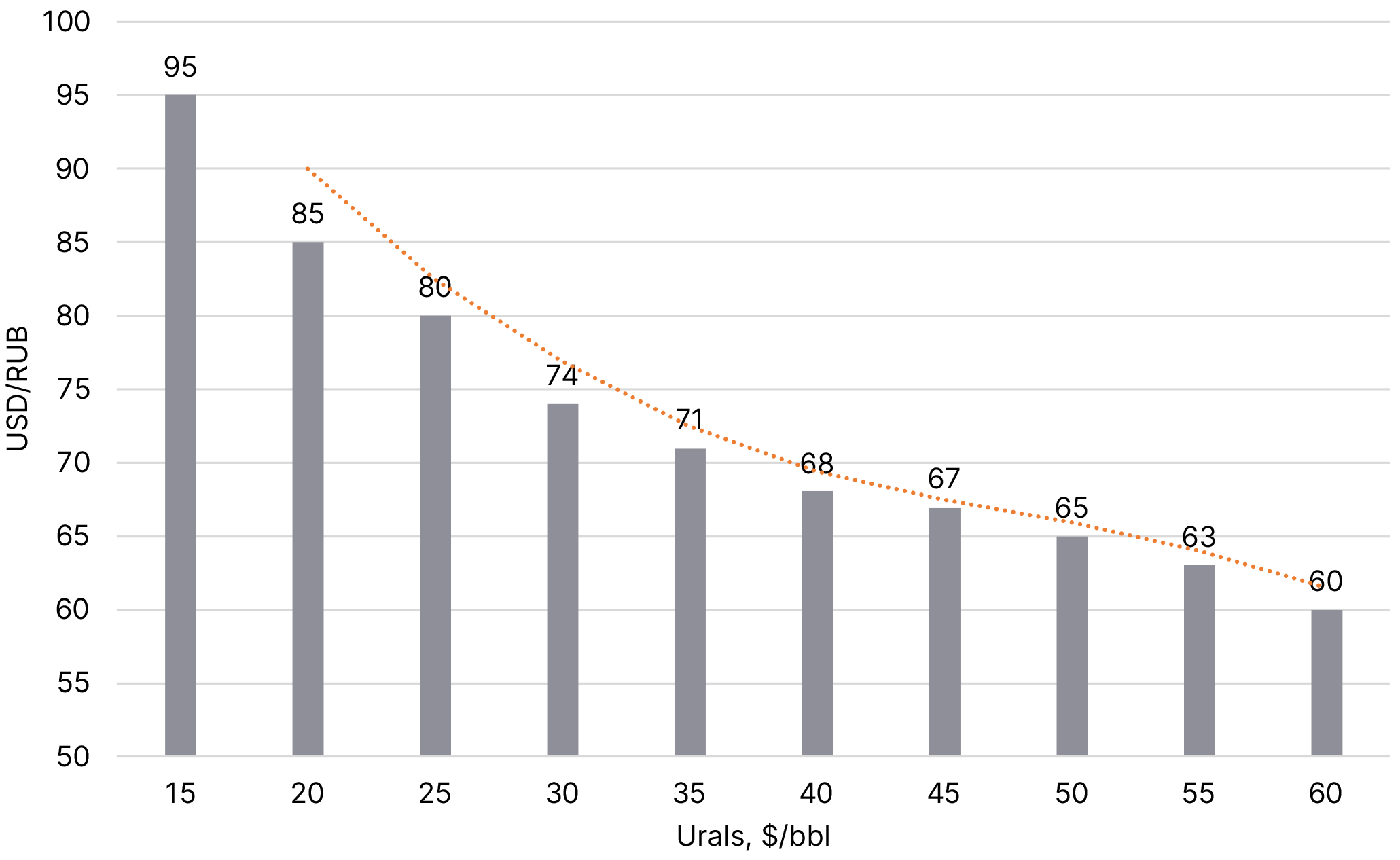

What is the fair rouble price?

With the current oil prices the dollar should not be higher than ₽69. Given our oil forecast for the end of September ($52/bbl), the rouble is likely to strengthen to ₽68/$, with no adjustment for sanctions risks over the US election. Therefore, the biggest driver of the rouble’s growth is the pandemic decline, primarily in the US, which will increase the chances of Trump's winning, which have dropped to new low of 40%. If the new cases rate does not change before the election, the rouble will remain in the ₽73-80 range, and after Biden's victory the dollar will strengthen even further.

Rouble vs oil regression

Source: Bloomberg, ITI Capital

The history in making

Rouble: From low beta to high beta

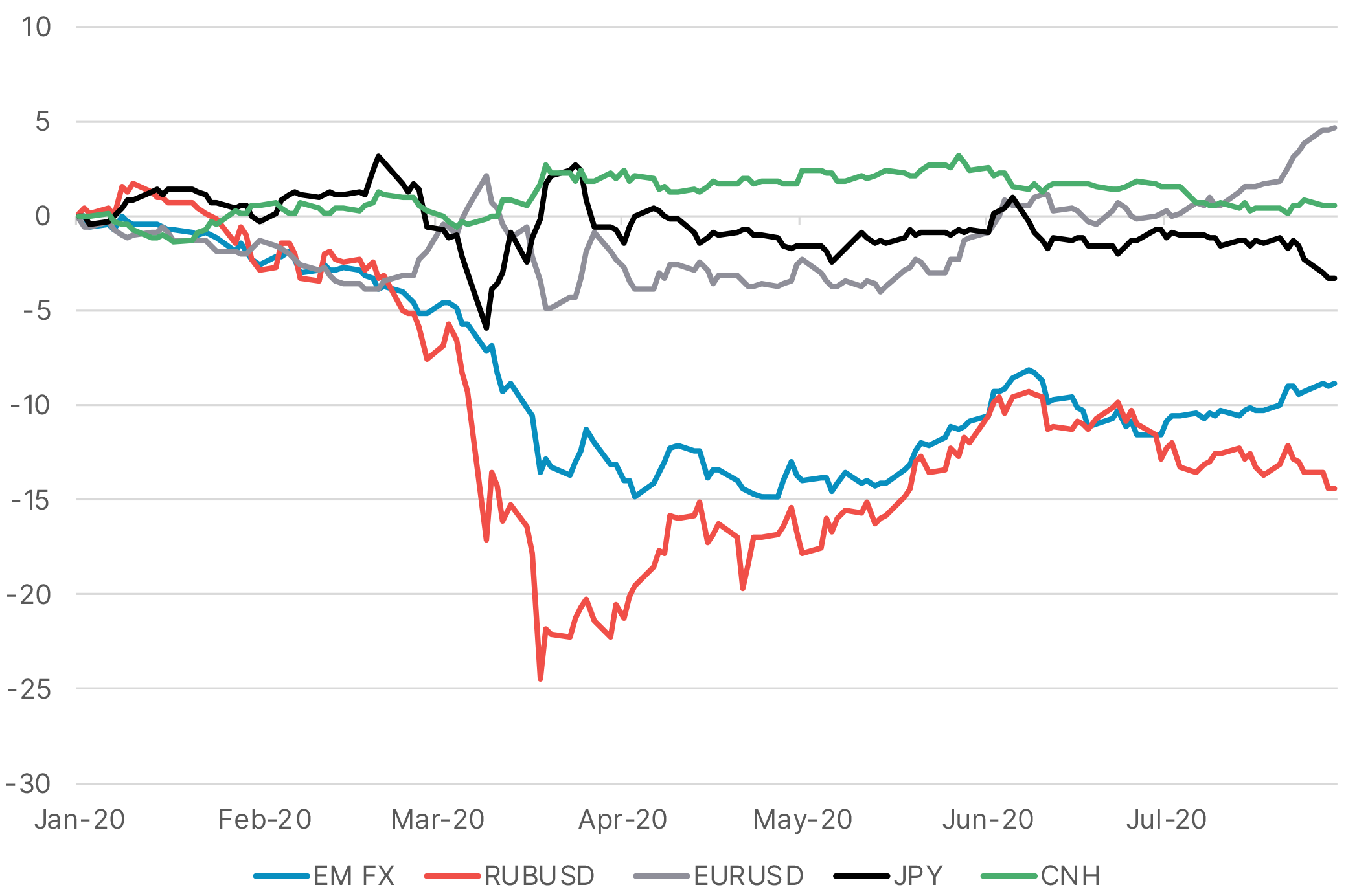

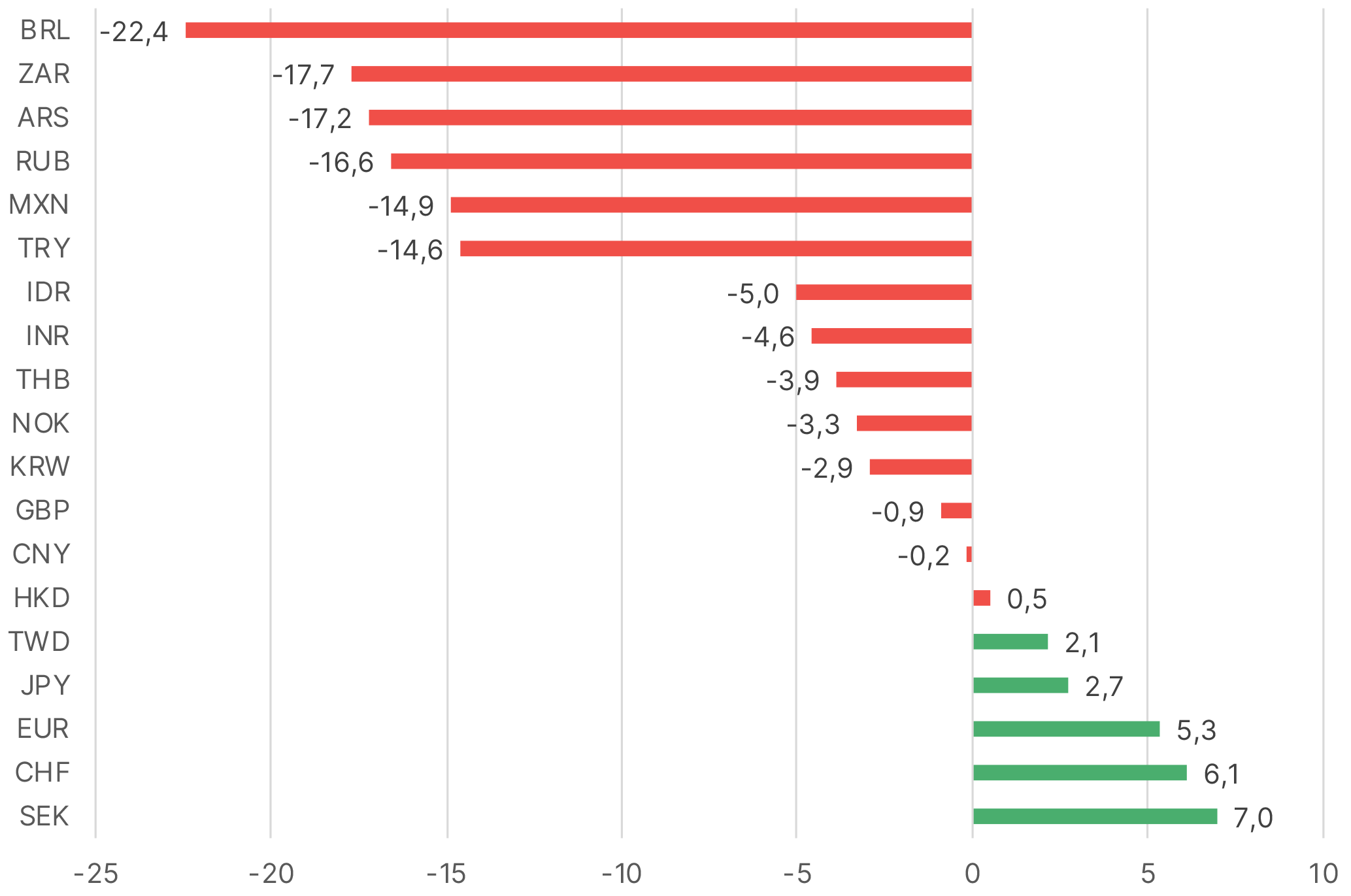

After many global assets faced a U-turn on March 18–23, the rouble became the top gainer in the emerging markets (EM) and was second best amongst G-20 after the Norwegian krone. From March 18 to June 6, the rouble was the best performer among global currencies and climbing more than 18% against the dollar after oil soared 80% in the period. The rouble has been closely tracking global cyclical stocks and commodity assets, but entered a bearish zone where it remained up to now.

On June 8, USDRUB reached its low of ₽68.04/$, while Brent stood at $42–43/bbl and since than Russian currency weakened by 8.5% to the peak of ₽74.4/$ which is the highest since May 14, 2020. From June 8 to the end of July, the rouble has been underperforming among global currencies against the dollar, retreating by 7.5%, while the Brazilian real dropped 7%, the Indonesian rupee – 5% and the Mexican peso – 4.3%. The top gainers against USD were the Swedish krona (+5%), the Swiss franc and euro (>4%).

Rouble weakness after June 08 looks particularly odd comparing to Brent oil rise by 7%, Nasdaq + 6%, S&P 500 + 1%, but the Dow Jones fell by 4%, as the value of some cyclical U.S. stocks in consumer discretionary reached its second bottom amid bullish environment due to regular monetary and fiscal stimulus and rates cuts..

As a result of the sanctions rhetoric and devaluation, the rouble has found itself among the currencies facing increased risks, such as the Turkish lira, Mexican peso and Brazilian real.

Rouble and other currencies YTD, %

Source: Bloomberg, ITI Capital

Why the rouble lost momentum?

I Global factors:

Grounds for further sanctions. At the end of June, the media reported citing American intelligence officials that that a Russian military intelligence unit secretly offered bounties to Taliban-linked militants for killing coalition forces in Afghanistan — including targeting American troops. Following the news the rouble weakened by 2%. Since many non-residents didn’t like the story, they closed some positions in the rouble and sold medium and long OFZs. The OFZs 10Y retreated more than 3%.

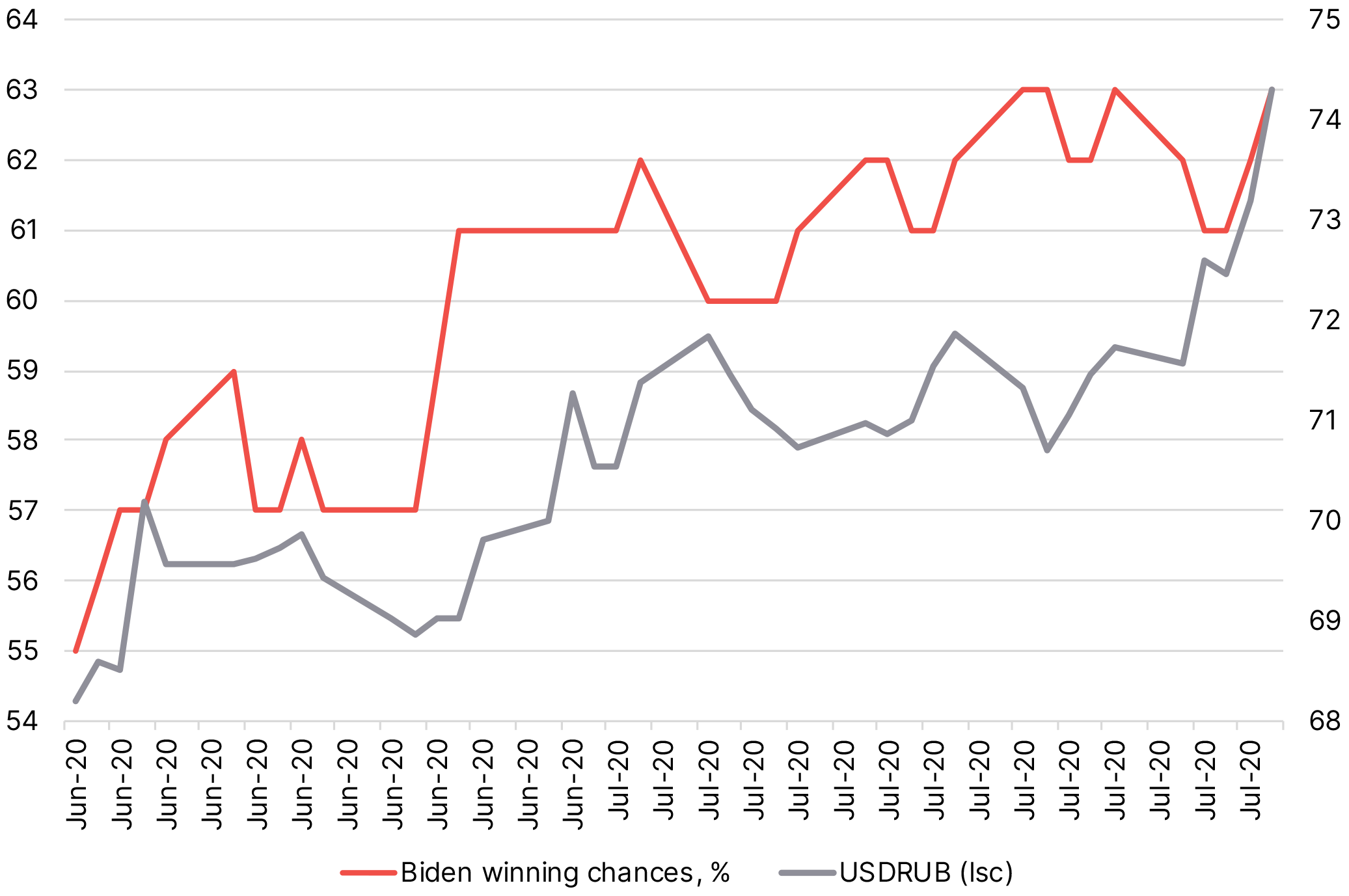

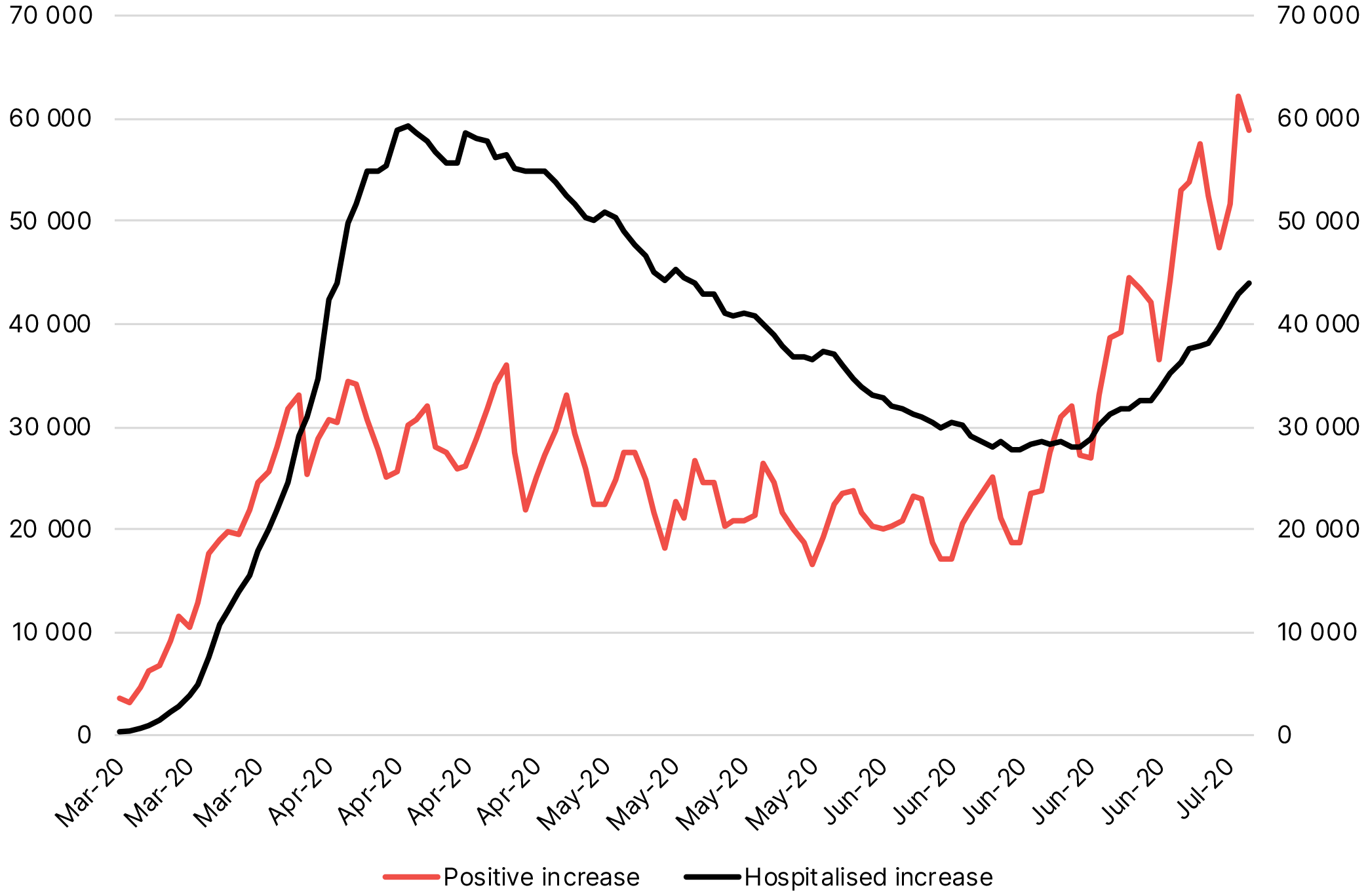

Polls put Biden ahead. Biden's approval rating has been growing since June, it surged after a pike in COVID-19 cases in the US. Transmission rate fell to 17,000 on June 16, the lowest since late March, then quadrupled in the space of a month, while hospitalizations rate doubled.

The current probabilities equal 61% for Biden, according to Bloomberg poll, while before the pandemic and mass protests they were below 20%.

Democrats' victory and delayed sanctions. The Democrats' victory automatically means new sanctions against Russia that have been delayed since the poisoning of the Skripals in March 2018. Instead of moderate sanctions, such as ban on all primary sovereign borrowings for non-residents, insignificant sanctions were put in place to cut off foreign aid to Russia though Russia was net creditor, arms sales, and export licenses for controlled goods, services, and technology. If Biden wins, moderate sanctions could be imposed and the rouble will first weaken to +₽90/$, and then will likely stabilize.

Biden, sanctions and the rouble

Source: Bloomberg, ITI Capital

A bull in a bear’s lair. Despite the fact that the market looks bullish, which is reflected in the low number of shorts and declining VIX volatility, some 50% of the U.S. and global predominantly cyclical stocks 30–40% below the pre-COVID levels. Cyclical companies and commodity currencies are under massive pressure due to risks to the global economy and lower demand for commodity assets. The assets may remain under pressure, and even be accompanied by IT-stocks correction, given the 19% growth this year compared to a 9% drop in Dow Jones.

US covid stats

Source: Bloomberg, ITI Capital

Uneven dollar growth. The dollar has been strengthening only against the EM currencies, which fell by 10% against since this year, in particular, the rouble was down 17%, while Latin America currencies retreated 18-20% on average. The drop results from high economic risks over the pandemic and capital outflows. At the same time, the dollar is lagging behind the DM currencies, in particular the Swedish krone and the Swiss franc, which advanced more than 6% against the dollar. Euro increased by 5% due to slower U.S. recovery as compared to Europe one and return to lockdown, which is already reflected in the jobless claims growth and the composite PMI decline.

Local currencies against dollar YTD, %

Source: Bloomberg, ITI Capital

II Local factors:

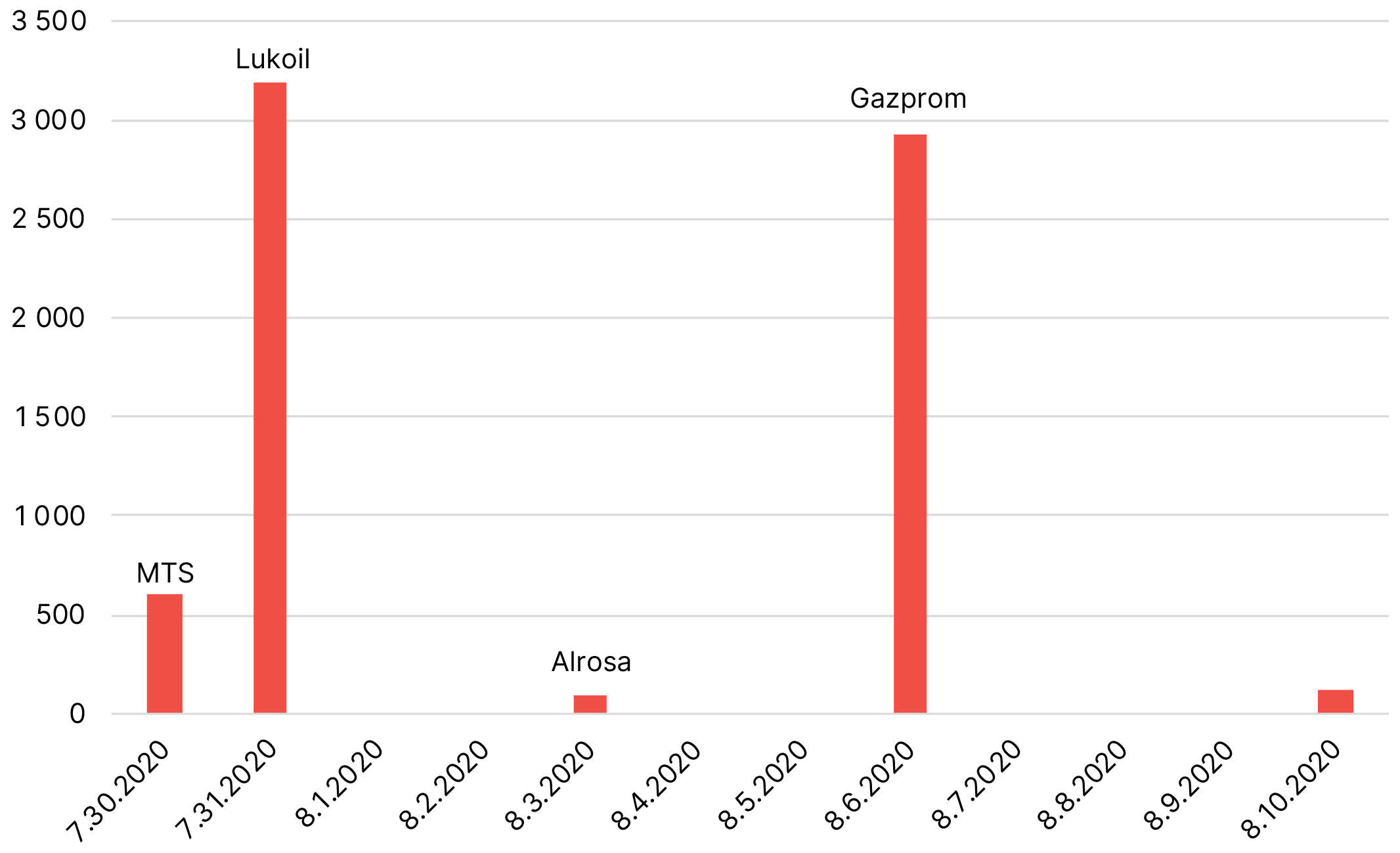

Negative effect from dividends payouts Earlier we pointed out that dividends payments traditionally have a negative impact on the rouble, and this year it will come under considerable pressure. The last 2019 dividend cut-off date was July 20, and most shareholders received their dividends in the roubles by the end of July. The largest payments were made in the end of July and now, in particular ₽243 bln by Lukoil and ₽360 bln by Gazprom that was paid yesterday, roughly 40% of all payments made since March 2020. In total, ₽1 489 bln in interim dividends were paid, out of which $10.5 bln equivalent were converted into dollars ($6 bln were due to the DR holders and $4.5 bln to international funds).

Some $4.5 bln can be purchased by individuals/local minority holders, who will get dividend payments as free-float stocks holders. Hence, total amount of FX-buying (by issuers for conversion and individuals after receiving dividend payments) may reach $15 bln. Currently, the companies have about $8 bln left to convert, or 53% of the total $15 bln.

Total FX-conversions, including payouts to receipts holders and to international funds, excluding local minority shareholders who may have bought currency earlier.

Source: ITI Capital:

Decrease in FX-sales by exporters. In July, tax payments could have reached ₽1.8 trln, out of which 40% could have been made on July 25, that is at least $4-5 bln under conservative FX-sales estimates, but this did not happen, the buying was low.

Seasonal low current account and BOP. Traditionally, the rouble has been weakening due to the current account decline starting from April. This year, the rouble has come under increased pressure due to cheaper oil and lower export revenues amid lower demand for energy resources amid the pandemic. According to the Central Bank of Russia latest data, the current account surplus fell by 49% year-on-year in 1H, from $43 bln to $23.4 bln. The current account surplus was just $0.6 bln in the second quarter. Since the price of oil remained flat after rising in June and demand has kept falling due to seasonality, the current account balance is expected to turn negative in the third quarter, the way it did back in 1998.

Rate cut and lower FX-sales

A rate cut usually trigger demand for long bonds if there is room for positive real rates. The Central Bank has cut the key rate by 2% year-to-date, and since our year-end forecast stands at 3.75%, the real rate will reach 1.25%, so the key rate and OFZ downside is limited. FX-sales have recorded a twofold decrease, to ₽5 bln per day, or to ₽100 bln per month, down from ₽200 bln the previous month, which is fully in line with the budget rule.