MSCI semi-annual global indices review takes place after markets close on May 12 (following calculation period in April 20-30). The effective date is June 1, 2020. Major changes are expected in May, which will affect certain stocks and the entire MSCI Russia. The standard data cut off dates for the prices used for calculating minimum requirements including minimum full market cap and minimum free float market capitalization as well as liquidity requirements (that is candidates for inclusion and exclusion) are any one of the last business days of April (April 20 – 30) for the May Semi‐Annual Index Review (SAIR).

Key takeaway: Unless MSCI makes an exception and lowers the minimum market capitalization required for inclusion into for MSCI Russia from previous $3,300 mln and free float capitalization - from $1,600 mln, candidates for admission, in particular Tinkoff, Rostelecom and Rusal, will not make it to the index. Only Yandex retains chances of joining the index in November as planned.

There is a high probability that Transneft and possibly MMK will leave the index and the total outflow from MSCI Russia could exceed $200 mln including active funds. In addition, numerous exclusions from other indices will trigger additional outflow from MSCI Russia.

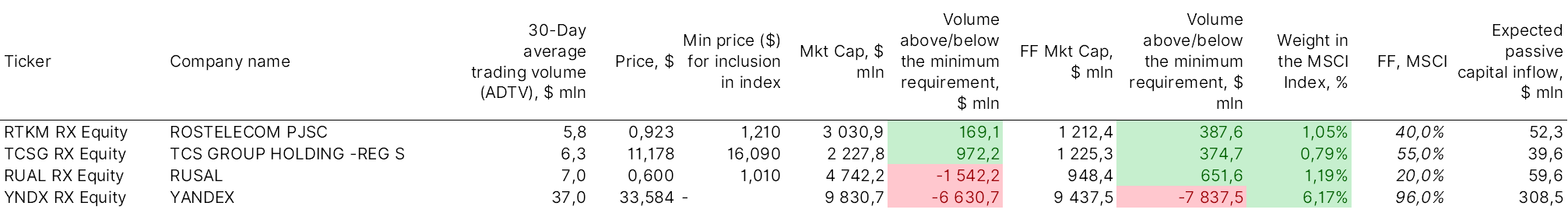

New candidates: The current volatility and risk selloff rule out the possibility of new companies joining the index during the May review

- In our March reports we noted that the number of candidates for inclusion dropped to two, but now there are no candidates at all! If Rostelecom left out of favourites to be listed on MSCI Russia in March, now Tinkoff and Rusal followed suit. Tinkoff's shares fell sharply, and now for the company to join the index the full market capitalization has to grow by more than 44%, while the free float-adjusted capitalization - by 31%

- Rusal’s free float capitalization has to advance 69%, while Rostelecom’s free float capitalization - by 32%

- The chances for inclusion are slim, given expected performance ahead of the calculation period

- Only Yandex retains chances of joining the index in November as planned

Candidates for inclusion in MSCI Russia

Source: ITI Capital, MSCI inc

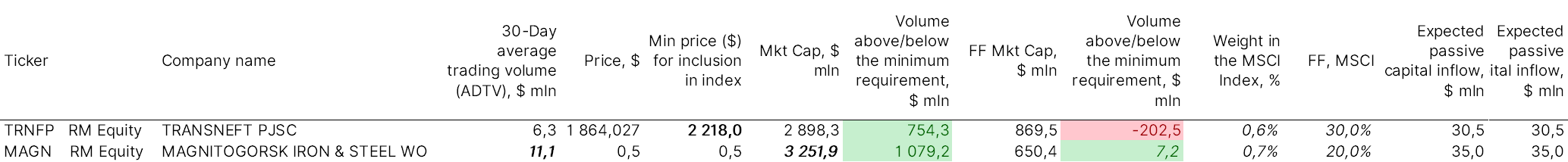

MSCI constituents: Transneft is the first candidate to leave index and MMK is the next most likely

- Transneft’s major problem as always has been free-float capitalization, which fell to $870 mln, 19% below the minimum capitalization required for exclusion ($1072 mln)

- If the company fails to increase its capitalization by 19% before the calculation period, it will drop out. If Transneft is removed from the index, the outflow from the company's stocks may reach $100 mln, which is 20 times the average daily trading volume

- MMK is another candidate for exclusion, its free-float capitalization is now only $7 mln above the minimum threshold. If the company leaves the index, the outflow will exceed $100 mln, 10 times the average daily trading volume of $10 mln

Candidates for exclusion from MSCI Russia

Source: ITI Capital, MSCI

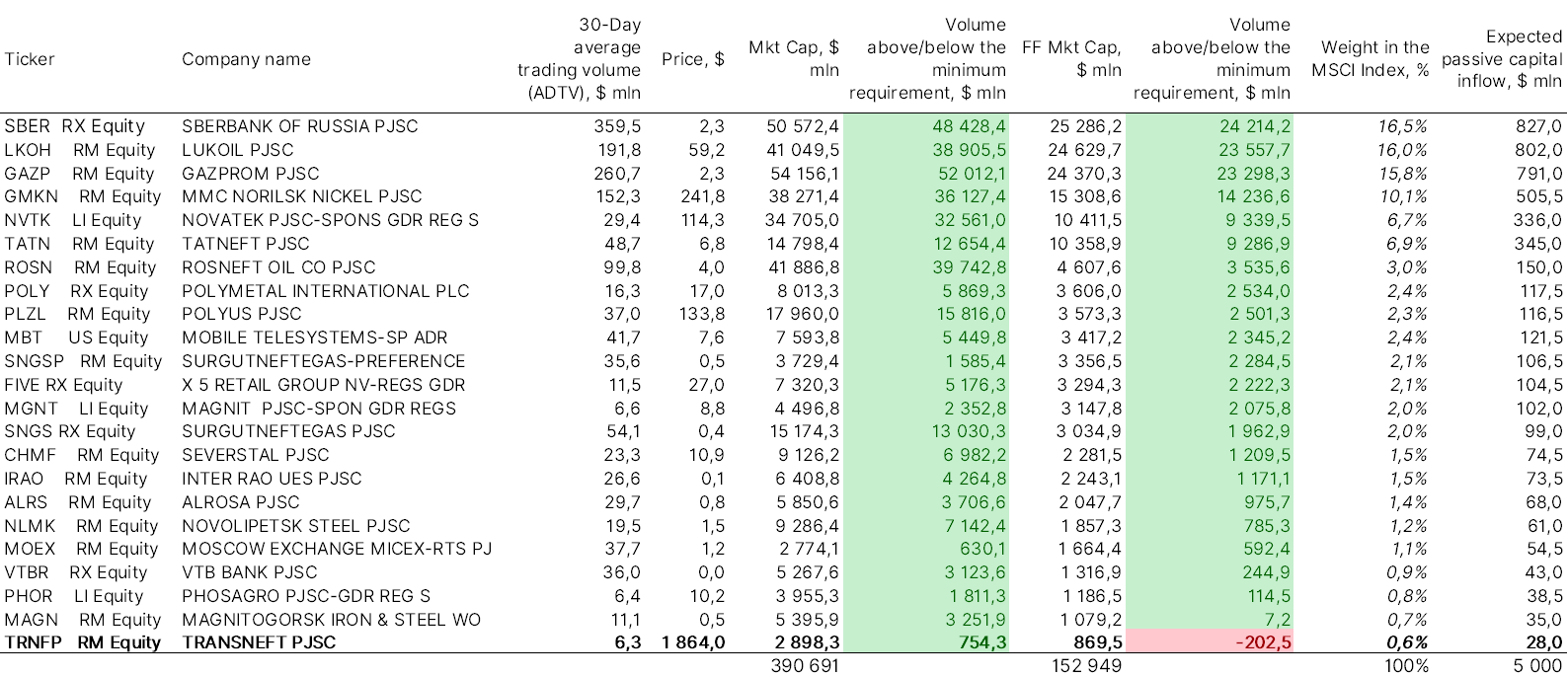

MSCI Russia constituents

Source: ITI Capital, MSCI