Price upside: 13% till year-end

Opening date: 13.09.2019

GDR opening price: $3.9

Target GDR price: $4.4

We suggest Sistema’s shares as an investment idea in the medium and long term. We believe the key driver of the company's value is the positive revaluation of the group's non-market assets.

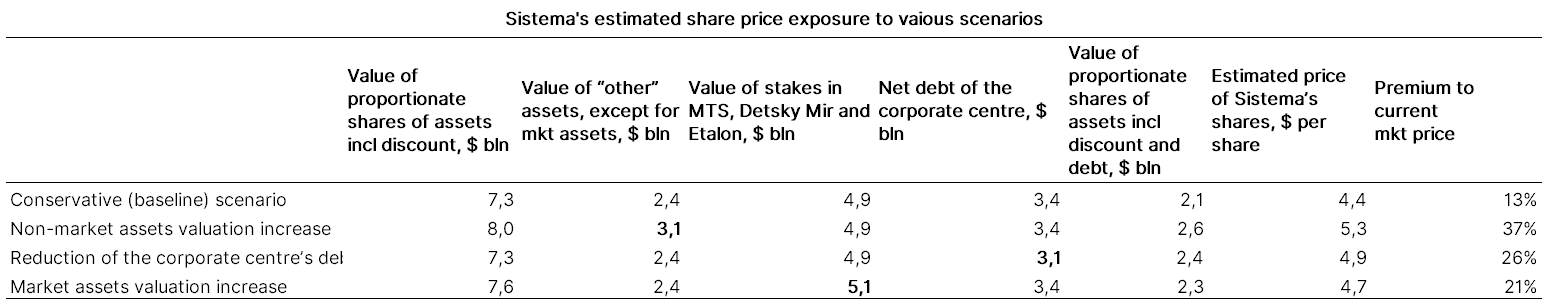

Sistema's share price upside assumes a 13% premium to the current market price, up to $4.4/GDR, by the end of 2019, according to our conservative estimate. Share price may grow by 23–39% ($4.7-5.3/GDR), according to a more upbeat assessment.

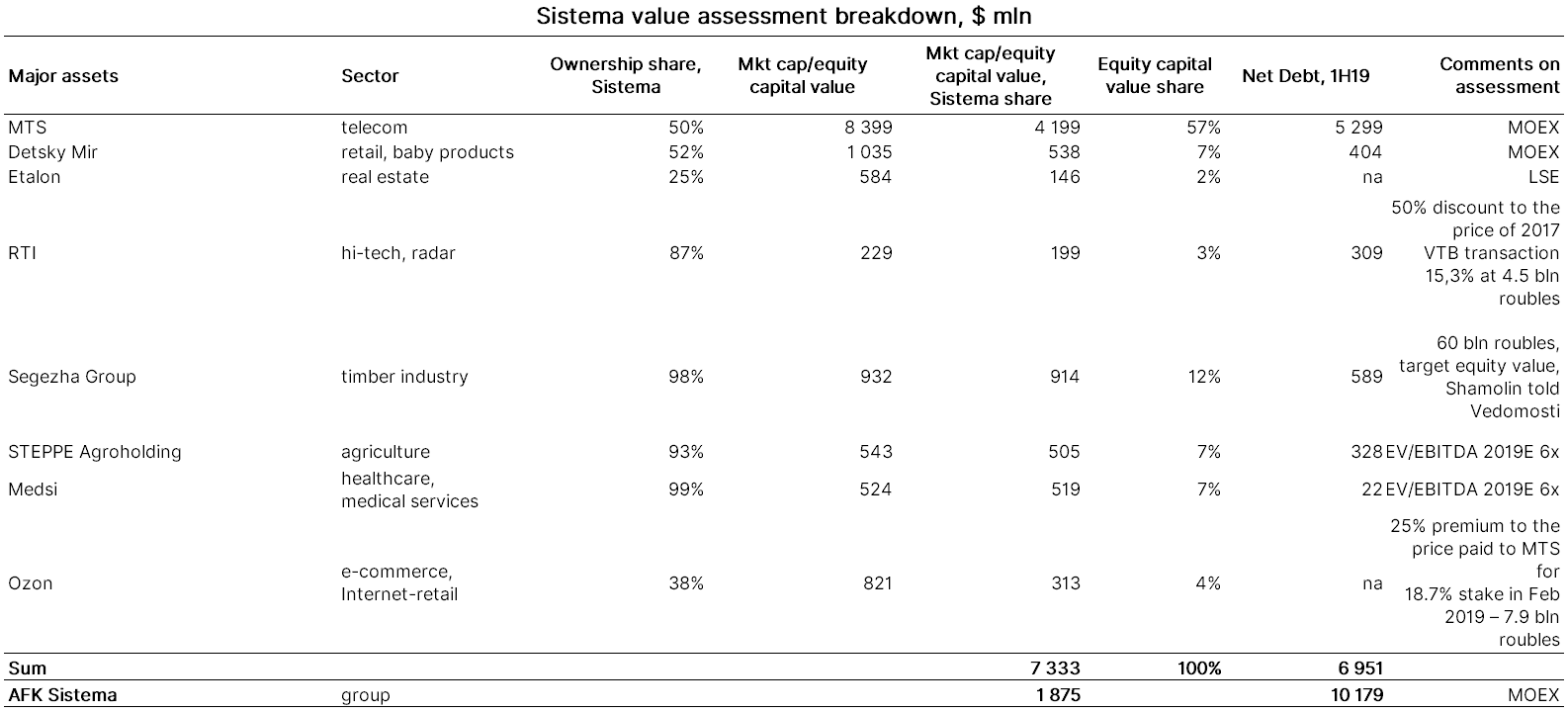

Sistema's non-public assets’ value assessment

Sistema's non-public assets are seen hidden in a "black box" out of which the company, as a skilled magician, pulls new assets out. With nearly no market value given for the latter ones by investors until recently (mainly due to lack of information), any news about potential IPO or sale of non-public subsidiaries, including Ozon, Segezha Group, STEP Agroholding, to a strategic investor sends Sistema's shares market value up.

We have compared Sistema's shares price against aggregate value of its proportionate shareholdings in its two major market assets, MTS and Detsky Mir, since the beginning of 2018. (We have also made a similar assessment of the group's three market assets, including Etalon, that dates back to February 2019; however, since Etalon inclusion did not affect the outcomes, this study ignores it).

Since June 2019, the group's share price has been outpacing the "market asset portfolio" stocks price, our analysis suggests. For details see the graph below.

The trend reflects a gradual disclosure of value and a positive revaluation of the company's other businesses by market players. We expect this trend to continue.

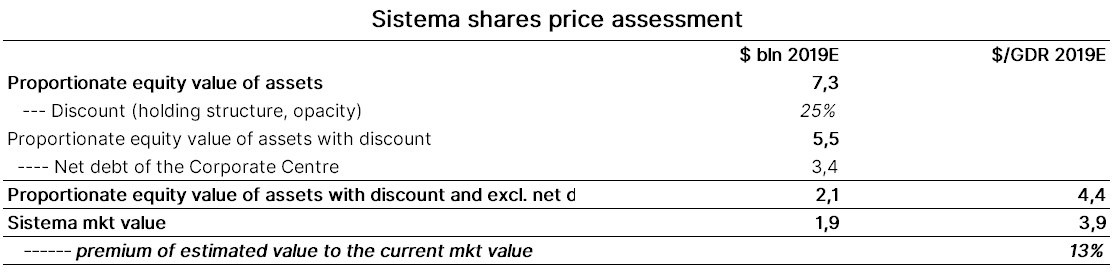

Sistema shares price assessment

We calculated the value of Sistema's shares using the value of proportionate shares in its assets, adjusted for the negative effect of consolidation and holding structure, and taking into account the debt at the level of the holding's corporate centre.

Sources: ITI Capital, Bloomberg, Company data

It should be noted that we used a conservative approach to valuation. Thus, (1) we used the market value of the group's public assets (MTS, Detsky Mir and Etalon) instead of their potential value (taking into account their share price upside); (2) we used the EV/EBITDA 2019E multiple for STEP Holding at 6x, while the same gauge for other companies in the industry exceeds 9x; finally, (3) our valuation of Ozon's shareholding implies a 25% premium to a purchase price paid recently to MTS, which does not reflect the double-digit annual growth rate of Russia’s e-commerce sector. Moreover, we applied a 25% discount due to holding structure and lack of transparency of the group's operations and took into account the corporate centre's debt of $3,4 bn. Sistema’s estimated share price we arrived at, even with our conservative approach, is $4.4/GDR, which implies a 13% premium to their current market price.

Sources: ITI Capital, Bloomberg, Company data

It should be noted that under a more optimistic valuation of the group's non-public assets, at 200 bln roubles against 160 bln roubles under our conservative scenario, Sistema's share price may advance $5.3/GDR, assuming a 39% premium to the current market price.

Similarly, the corporate centre’s debt reduction from $3,4 bn to $3,1 bn (Sistema announces a target price of $2,2-2,3 bn) raises our estimated value of Sistema's shares from $4.4/GDR to $4,9/GDR (premium to the current market price – from 13% to 28%).

Finally, adding a 5% premium to the market price to the market assets (MTS, Detsky Mir and Etalon) valuation adds 11% to the Sistema's shares upside, from $4.4/GDR to $4.7/GDR (premium to the current market price – from 13% to 23%).

Sources: ITI Capital, Bloomberg, Company data

Investments into Russia’s economy fast-growing segments

Summing up, we believe that investments into Sistema's shares are investments into fast-growing segments of the Russian economy. Therefore positive surprises are possible going forward.

And here's why. We believe mobile communications (MTS), baby products (Detsky Mir), healthcare services (Medsi) and e-commerce (Ozon) are among the most fast-growing sectors in the Russian economy. Moreover, the group-owned companies are leaders in their segments. Therefore, their growth may bring positive surprises, which should enhance Sistema’s financial indicators and value.

Let’s take a closer look at Ozon. According to our estimates, the company's equity capital stands at $821 mn, based on the value of Ozon’s stake bought by Sistema from MTS with a 25% premium. Russia’s e-commerce market is set to double in the next three years, according to Data Insight estimates (penetration of e-commerce in the country stands at 5% against 10%+ in more developed countries). Assuming doubling of the Russian e-commerce market and reduction of its fragmentation (accompanied by Ozon's market share growth from the current 6%), and considering that Ozon is the top-3 in this segment, benefiting from its own logistics network and a strong management team, we expect the company's value to at least double, resulting in additional 11% upside of Sistema's shares.