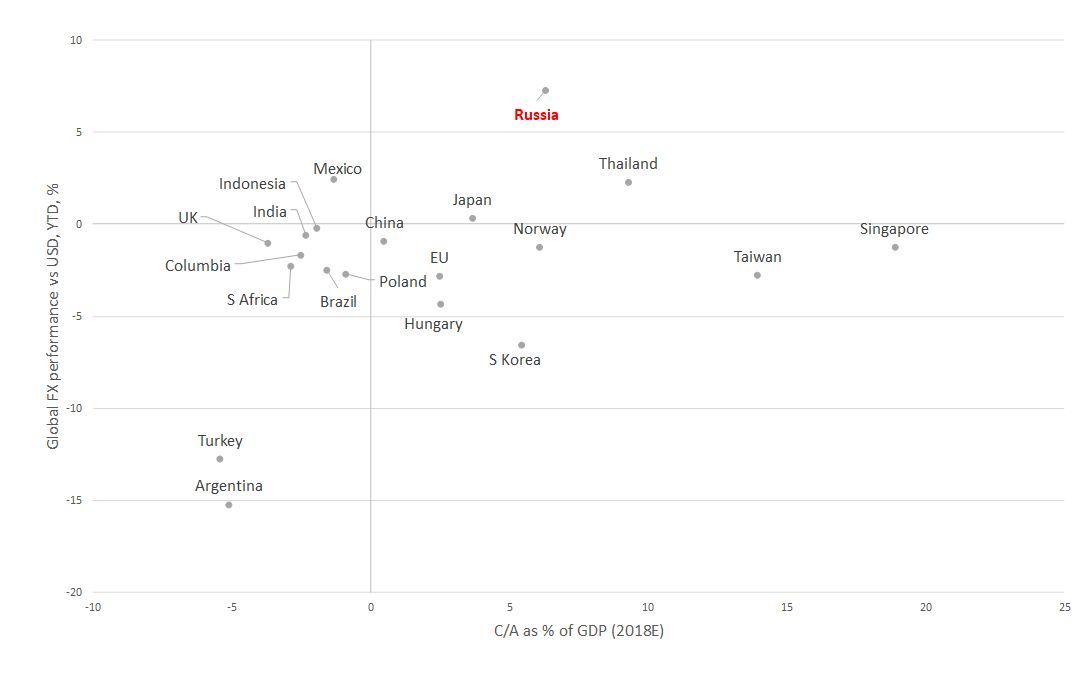

Russia has enjoyed the most profitable stock market (+22% in dollar terms) and the most stable and yielding currency (+7%) against the dollar among EM countries year-to-date. Weekly implied volatility stands at 7.1% in line with the Japanese yen. The twin surplus (budget and current account) and high real interest rates (4.3%) make OFZs one of the most attractive investment targets among peers, which clearly impacts key and local interbank rates.

Since March, global media coverage of Russia has shifted away from the negative, as the focus turned to trade wars and geopolitics. Russia is back as a safe haven for international investors. Its appeal stems from low multiples and high credit reliability of the Russian corporations, which outstrips that of peers and the current low investment rating. Market players shrugging off sanctions and other risks supports the overbought rouble and FX-debt that is now close to pre-Rusal-sanctions levels of earlier April 2018. However, the upside potential of the rouble-denominated sovereign securities and high-yielding corporate issues remains strong as it lags dollar denominated debt.

Given the positive environment, the Bank of Russia is likely to cut the key rate on June 14 meeting by 25 bps to 7.5% in line with consensus-forecast, market expectations and the latest CBR’s governor’s comments. With no new sanctions coming this year, CBR is likely to make two consecutive 25 bps cuts in September and December and leave the rate at 7% by the year’s end. OFZs’ yields will reach 6.5% on the short curve and 7% on the long one by that time.

Key local factors signalling rate cut

- Inflation expectations retreated in May to 9.3% down from 9.4% in April 2019

- Disinflation. Inflation in May dropped to 5.1%, from 5.2% in April, since weekly inflation for May 28 — June 3 was 0% following seven consecutive weeks of 0.1% growth

- Governor Elvira Nabiullina said it’s possible that Russia’s central bank will cut interest rates for the first time in a year at its next meeting on June 14

- Short-term OIS Swap Curve rates suggest a 25-bps key rate cut on June 14

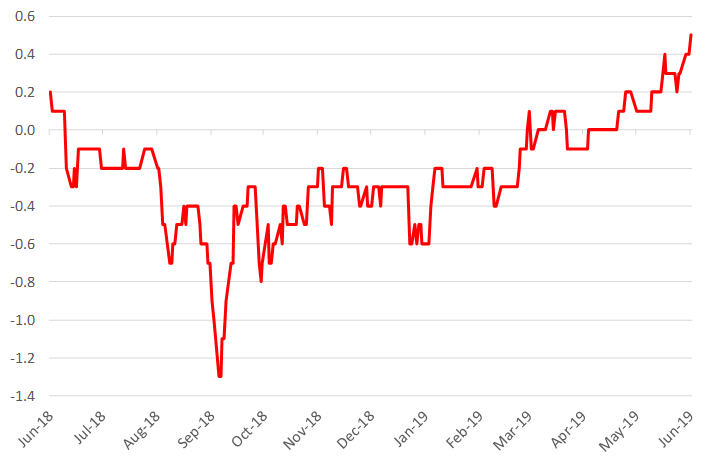

- The spread between the three months MOSPRIME rate and the roubles forwards rates signal a 50-bps rate cut before 6 September meeting.

- Short OFZ yields edged below the key rate, to 7.4%, signalling an even bigger cut

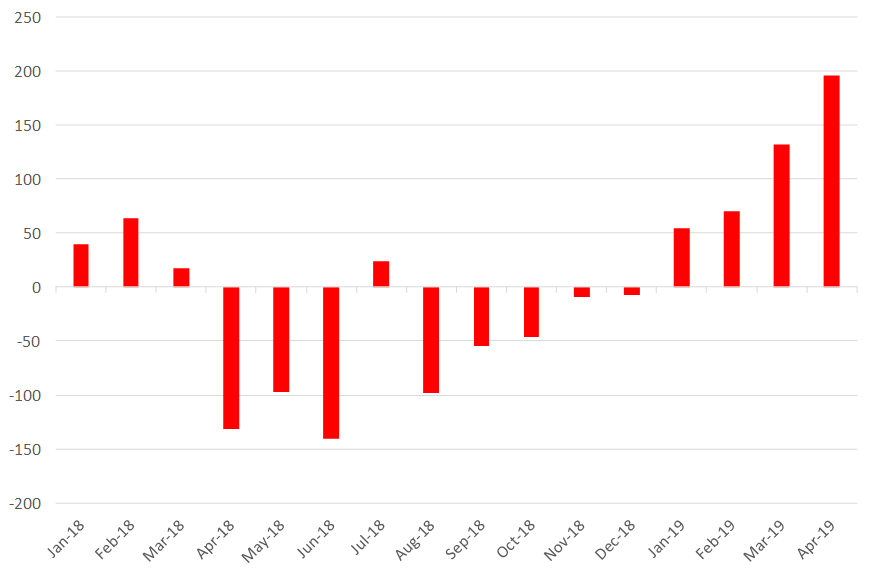

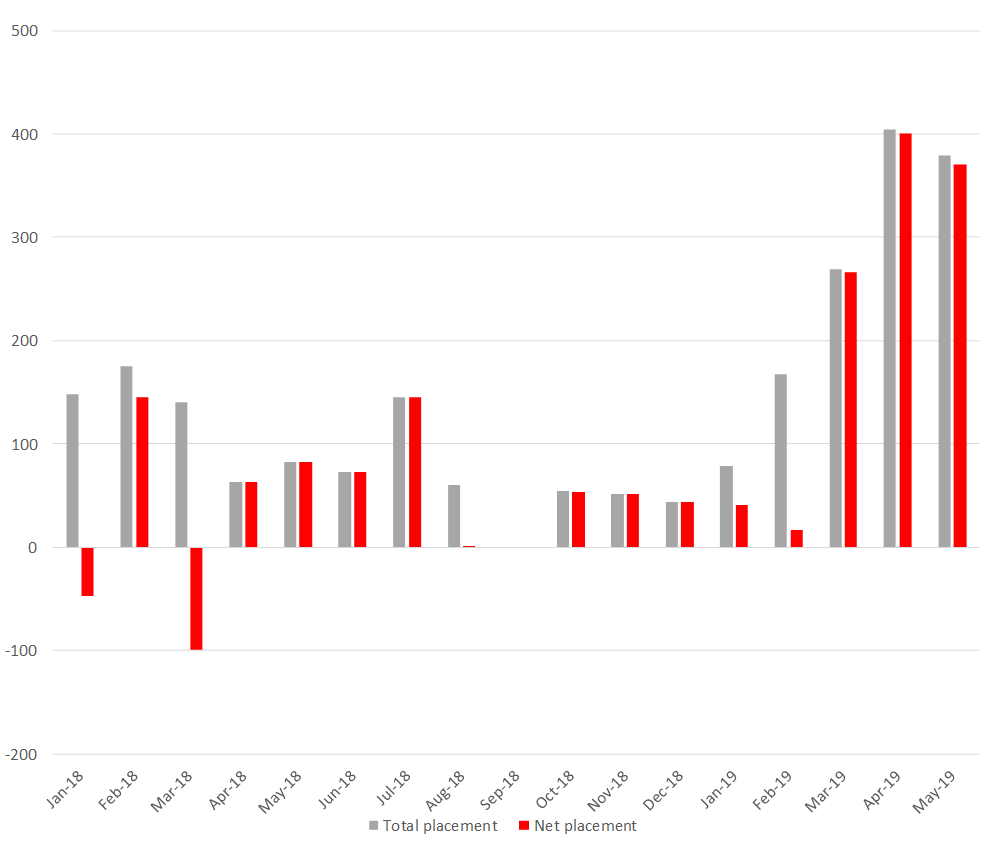

- The inflow of non-resident funds amounted to 452 bln roubles year-to-date. ($7 bln), roughly 80% of the capital flowed out of Russia in April — December 2018.

- Short-term liquidity has come back to the levels seen in April and May 2018 due to an increase of funds on the correspondent accounts and an inflow of funds from exporters and non-residents for OFZ-buying

Key global factors signalling rate cut

- Stronger appeal of carry trade due to high real rates and the fundamental appeal of the Russian issuers due to relatively high credit profile

- The rouble has outpaced its peers as the best-performing currency (+7%) against the dollar year-to-date despite high volatility. The local currency has stabilized, volatility has retreated

- The threat of fresh sanctions has abated after the release of the hopeless Mueller report, and there is hope for an improvement in the US-Russian ties as soon as the G-20 summit in Japan

- Russia is back as a safe haven and a safeguard against trade wars-fuelled external volatility

Key risks

- New spike in inflation due to seasonality-driven higher fuel prices

- EM sell-offs amid possible sanctions against Turkey over S-400 deal, a political crisis in Argentina that is unlikely to be resolved until the presidential elections in October, etc.

- The threat of fresh sanctions in case of escalation in Venezuela and Syria, etc.

Top picks

1. Short-term OFZs

- The short curve looks more attractive (OFZ 2020, OFZ 2021 and OFZ 2022). The yields could drop further by 40 bps, if they return to early August 2018 levels (before sanctions against Russia and Turkey), and by 100 bps, comparing to the early April 2018 (sanctions against Rusal)

- The long OFZ yields (OFZ 2027, OFZ 2029 and OFZ 2033) slipped by 45 bps year-to-date, they may drop further by 10 bps if they return to the August 2018 level, and by 70 bps if yields will drop further to April 201

- As a result, prices may rise by 1–1.5% on average, if they come back to the early August 2018 level, and over 4% if they come back to early April 2018 level.

2. Local bonds

- Quasi-sovereign corporate investment-grade securities enjoyed the strongest upside potential until May. The spread between them and OFZ is triple where it was before

- The upside potential for yields of high-yielding and riskier issuers is largely limited. The spread between the rouble-denominated Rosneft 23 bonds and OFZ 23 was 100 bps, but narrowed to the 12-months average of 35 bps

- But given the strong downside potential for the short/medium OFZ curve yields, the price of high credit rating securities will rise further, while their yields will decline.

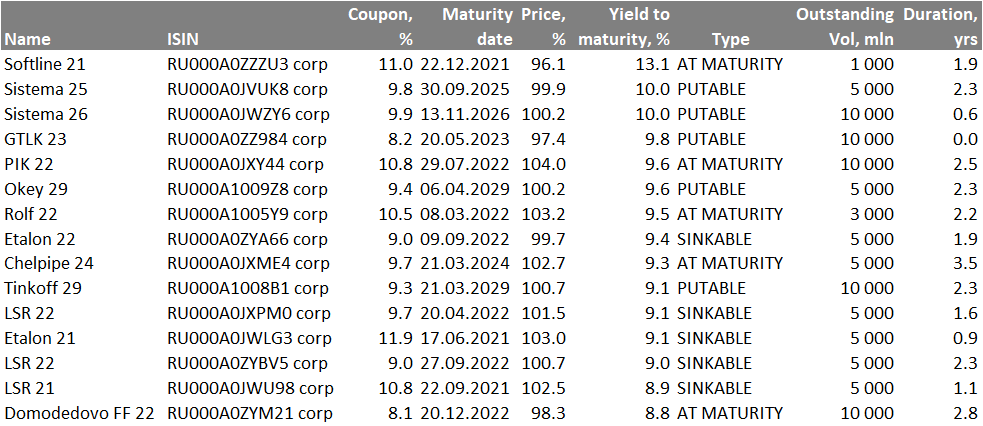

- We believe that the high-yield issuers offering a high premium are the top picks now. Therefore, we recommend the following issues:

MOSPRIME 3-month rate minus forward rate, bps

Source: Bloomberg, ITI Capital

Inflow of foreigners into OFZs since 2018, bln roubles

Source: CBR, ITI Capital

Russia has raised over 1 trln roubles, a record on a year-to-date basis, due to strong demand from local and foreign investors.

Source: Russia’s MinFin, ITI Capital

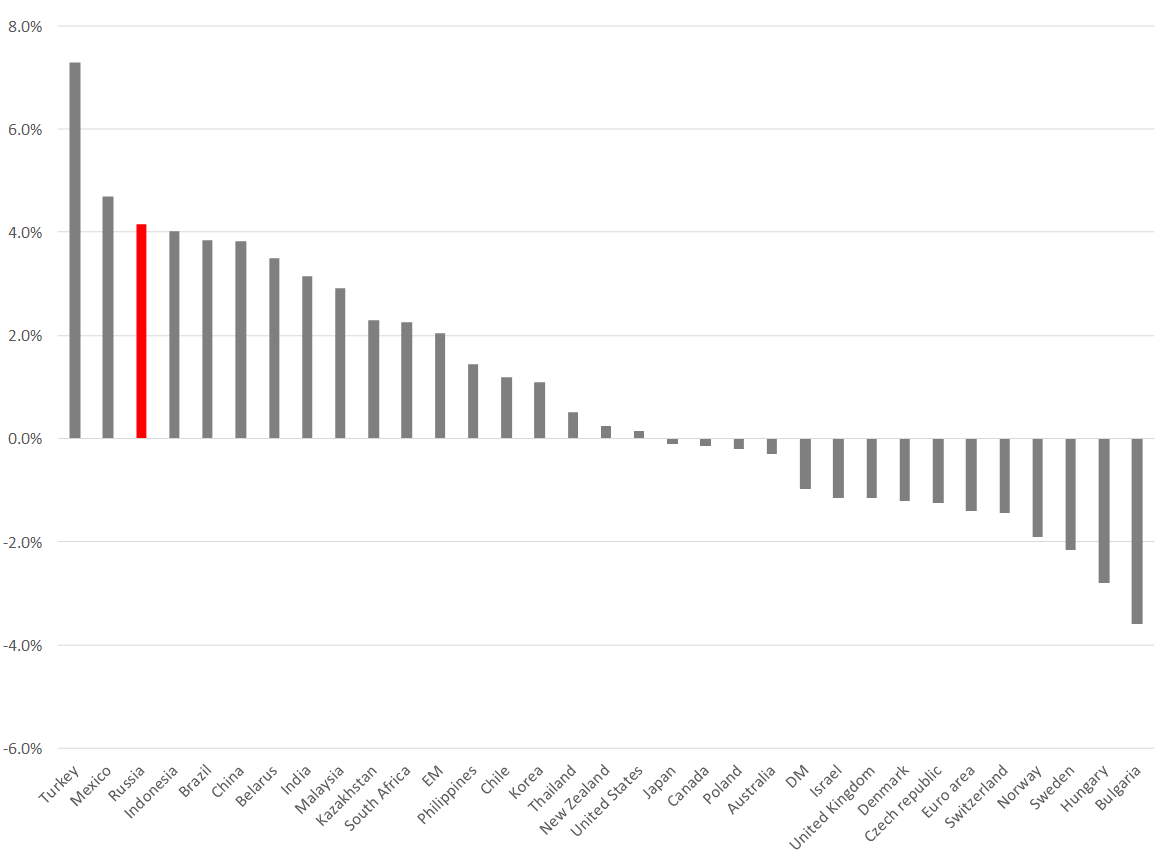

Rouble YTD performance and fundamental appeal

Source: Bloomberg, ITI Capital

Real rates, %