CBR kept the key rate unchanged at 7.75% and took a more dovish stance. The move weakened the rouble, since dim rate hike prospects are curbing the demand for carry-trade. Inflation slowdown to 0.4% m-o-m in February is one of the reasons why the CBR is on track for a dovish stance.

Though inflation expectations despite slowdown in January-February still remain high. A sharp drop in consumer demand was offset by the effects of VAT hike, which led to a higher inflation in February (+5.2% yoy). Though delayed effect from increase in VAT could realise in later periods.

Short term inflations effects have declined and as a result CBR downgraded inflation expectation range for 2019 from 5-5,5, till 4,7-5,2%. CBR expects inflation could return back to 4% normalized target by 2020.

In its key rate decision-making, the Bank of Russia will take into account inflation and economic dynamics against the forecast, as well as risks posed by external conditions and the reaction of financial markets.

If the situation develops in line with the CBR baseline forecast, the Bank of Russia admits the possibility of turning to cutting the key rate in 2019. We think its most likely in September 2018. Inflation will continue to decline due to sharp drop in consumer spending. Real disposable incomes tumbled 1.3% in January after growing 0.1% in 2018. Consumer confidence dipped to the lowest in over three years.

USDRUB eroded over 30% of risk premium

- The rouble is now back to the levels seen before August. Back then the U.S. imposed sanctions against Turkey and sought to punish Russia for Salisbury incident. The average USDRUB rate from August 8 to March 7 was 67. Hence, the rouble eroded 3.5 roubles out of risk premium, which is strange, given higher risks of further sanctions, including against OFZs

- The premium increased (by 6 roubles) following designations of Rusal and En + on April 6. Therefore, the Russian currency added a 10-roubles risk premium in April, and eroded 33% of it since then

- In terms of risk premium the rouble essentially rebounded in line with the recovery of the Russian FX-eurobonds. Many of them have come back to the levels seen in late July. Further growth is conditional on lifting sanctions

The Rouble outlook

- We expect the rouble to weaken after testing 63.63 lows. The currency is expected to weaken to 64 and higher

- Special Counsel Robert Mueller, examining potential conspiracy between President Donald Trump’s 2016 campaign and Russia, is preparing to submit a report to U.S. Attorney General William Barr on his findings, Reuters reported on March 20. Barr will decide whether to publish the full or an abridged version. Barr also send a classified report to the Congress. The next Russia hearing is the Senate is scheduled for Tuesday, March 26

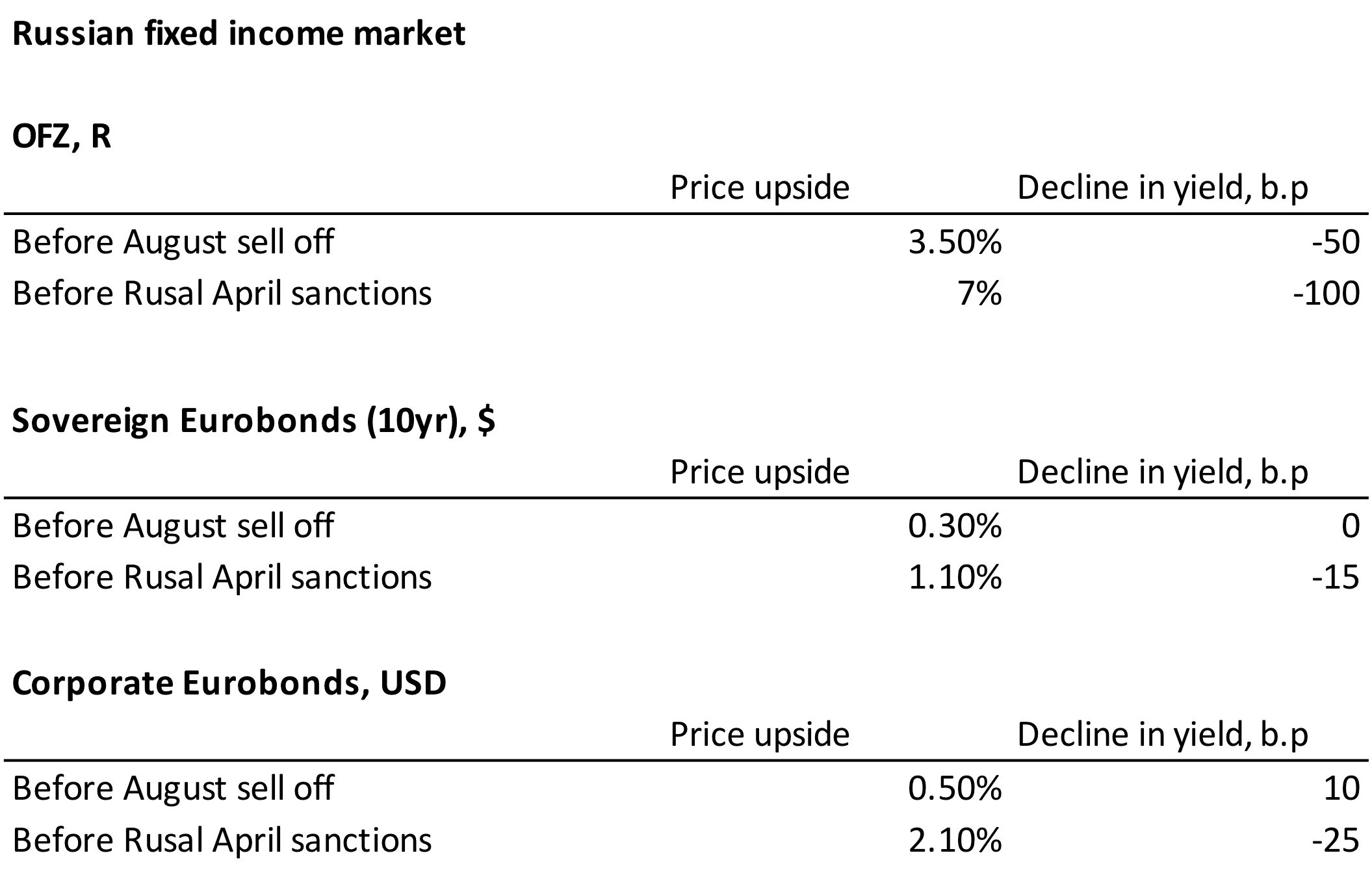

The most undervalued is OFZ, Eurobonds have already outperformed and eroded significant amount of country risk premium

Sources: ITI Capital