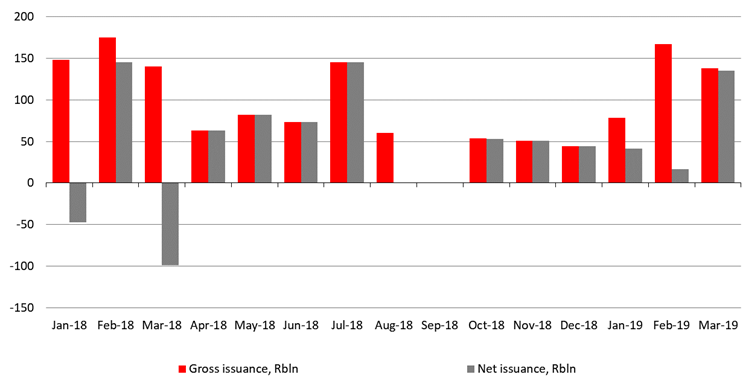

On Wednesday, March 13, Russia's Minfin pulled off a record bond placement, amounting to 85% of the Q1 borrowing target amid global demand on risky assets that have seen OFZ outperform other EM assets in local currency ytd.

During the auction, the Russian currency has gained 0.3 roubles against USD strengthening below 65.4 roubles. At the same time, the rouble's upside is limited due to external risks that are expected to realize in the beginning of Q2 2019.

Nevertheless, we do not rule out the rouble's short-term technical growth during tax payments at the end of March — the currency may add 0.30 roubles from the current levels.

March is the last opportunity month for the rouble to strengthen this year, which provides good opportunities for adding currency to their portfolio.

Minfin may continue to ramp up OFZ-sales amid geopolitical uncertainty, but local commercial banks will be generated the bulk of demand.

OFZ issuance, RUB bln

Source: MinFin, ITI Capital

MinFin unprecedent record placement

- On Wednesday, March 13, Russia's Minfin held a record bond auction, placing securities worth 94 bln roubles, the equivalent of $1.4 bln

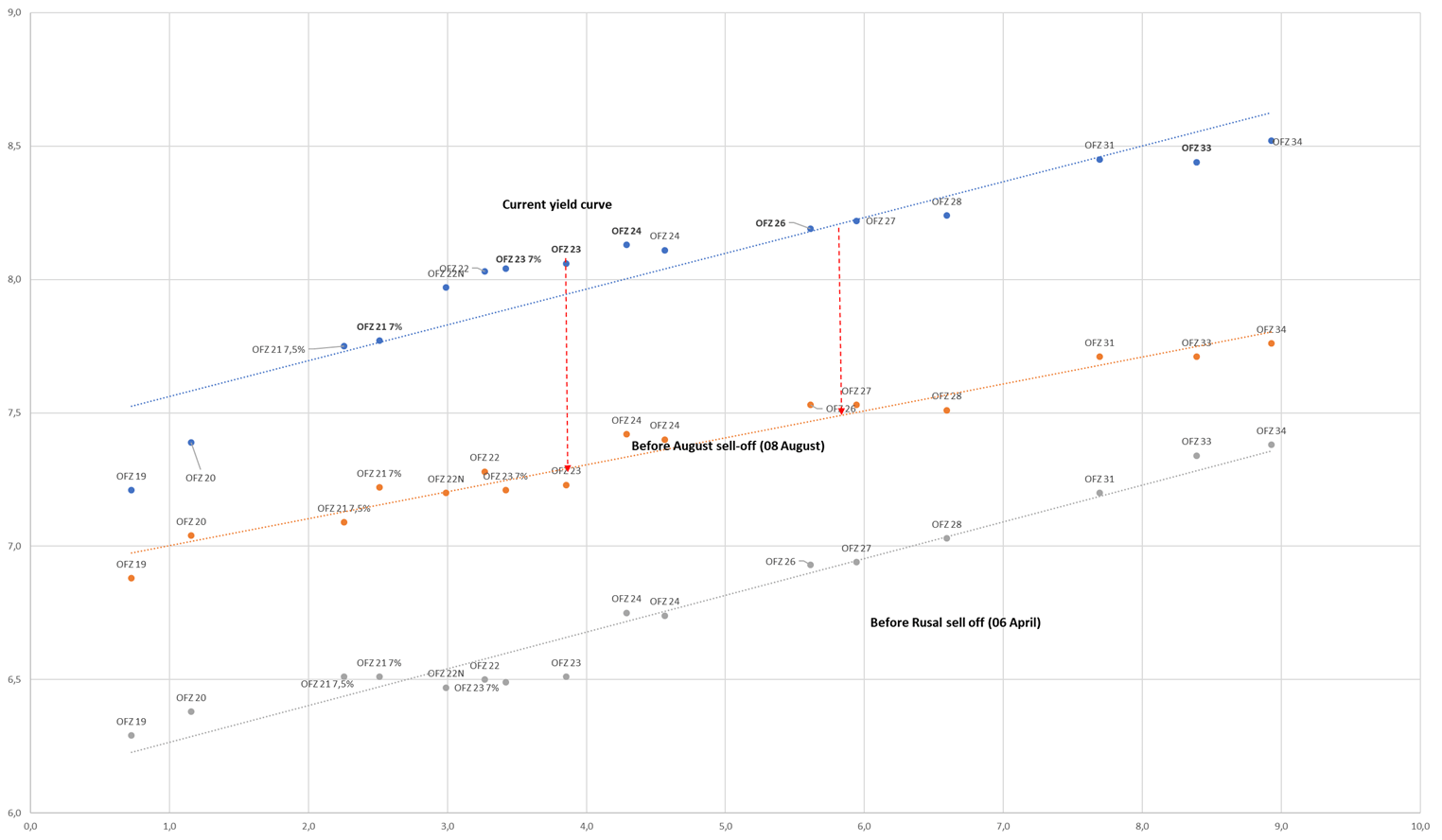

- At the first auction, the ministry placed OFZs, 26209 series, with maturity in July 2022, for 35 bln roubles. The demand was 61 bln roubles, the yield was 8% per annum

- At the second auction, the ministry placed the OFZ of the 26224 series (with maturity in May 2029) for 57 bln roubles. The demand was 84 bln roubles, the yield was 8.47% per annum

- Both issues were placed with almost no premium to the yield curve — 3–5 bps

- Total demand for two auctions reached 144 bln roubles, surpassing actual placement (92 bln roubles) by 1.5 times

Minfin borrowing plan and expected demand

- Wednesday’s placement of the equivalent of $1.4 bln in local notes eclipsed the ministry’s last bonanza on February 27. The auction surpassed both the previous placement by 34 bln roubles and favourable borrowing level by 12 bln roubles, which amount to 40 bln roubles per auction, or 80 bln roubles for two auctions a week

- Minfin has placed 383 bln roubles year-to-date against 450 bln roubles planned for Q1. Out of 2.435 trln roubles planned for 2019, the ministry will have to borrow 2.052 trln

- Due to record-breaking placement the ministry met the target for March. By late March it will have to borrow under 70 bln roubles. Given expectations of lower OFZ yields amid softer policy of CBR, the demand will remain strong, meaning the targets will be met

- The ministry may also take advantage of favourable climate to make further placement unless there is a correction due to sanctions and other factors

Who are the buyers?

- For the reasons outlined below, we believe that the bulk of the issue, including long notes, was bought by local commercial banks (NPFs are largely limited in terms of purchases due to liquidity requirements), the remaining bonds were bought by non-residents who are watching for geopolitical risks

- In future we believe that the bulk of demand will come from local players at least until there is certainty over new sanctions

Impact on local currency

- The Russian currency added 0.30 roubles following whopping demand from yield-hungry investors

- March is the last opportunity for the rouble to enjoy support ahead of what are traditionally the biggest tax payments throughout the year (last two weeks of March)

- Nevertheless, we do not rule out the rouble's short-term technical growth during tax payments at the end of March – the currency may add additional 0.30 roubles from the current levels

- The local currency is expected to dramatically weaken from beginning of next month (see our report at /analytics/currency/11366/)

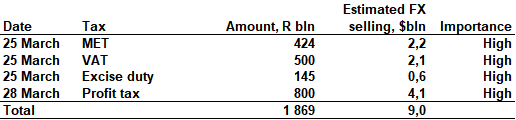

Major tax payment schedule, only FX sensitive payments

Source: MinFin, ITI Capital

The reasons behind buying spree

Local factors

1. Strong rouble liquidity surplus on the local interbank market — over 3 trln roubles.

2. Attractive return rate for short- and long-term OFZs, the current premium to the levels seen at end of July 2018 is 80 bps, to the April levels, preceding the sanctions against Rusal, is about 70 bps. Hence, the current country premium in local currency is about 150 bps to pre Rusal sanction levels.

3. Freeing up additional liquidity. From April 1, the Central Bank will lower by 0.25 p.p. to 4.75% the required reserves ratio for those on liabilities to individuals and other rouble-denominated liabilities — for banks; reserves on the banks' liabilities would go up.

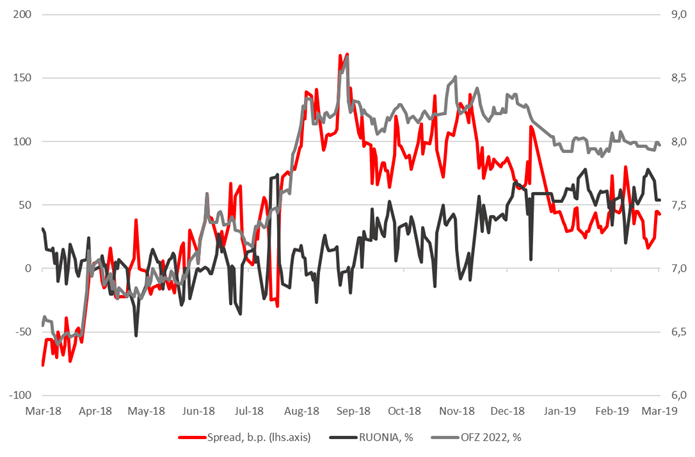

4. The gap between RUONIA and OFZ 2022 has narrowed to the level seen at end of July 2018. Therefore, if the OFZ yield go down, OFZ will outstrip RUONIA and MOSPRIME in terms of attractiveness for banks funding, when it comes to raising capital adequacy ratio.

5. Excess currency liquidity amid net-inflows due to low debt payments (-43% yoy), limited FX-buying by MinFin (5-6% of the daily FX-market turnover) and stronger current account balance (+$22 bln year-to-date).

Source: Bloomberg, ITI Capital

External factors

- The demand for EM assets is breaking records due to carry trade. In January — February 2019, investments into EM shares and bonds reached $86 bln, surpassing those for April – December 2018

- Steady and strong oil prices

- Lack of sanctions news

- The most profitable issuers across EM come from Mexico, South Africa, Russia, Columbia, Indonesia, Oman, the most overweight – in Brazil, Hungary, China, Korea and Chile

Russian OFZ yield curve, %

Source: Bloomberg, ITI Capital