Overview of short-term FX Liquidity in Russia

Main conclusion:

The major local factor that lead to ruble weakening in 3Q was shortage of currency liquidity, which has started in April till mid-September, we have seen significant outflow of funds from FX deposits, outflows by non-residents and, as a result, a temporary shortage of currency liquidity in the interbank market.

Our main conclusion is that banks have sufficient short-term FX liquidity (mostly short term liquid FX holdings) to fulfill all obligations on foreign-currency deposits of individuals. Besides the banks own foreign currency funding, the Central Bank has a substantial toolkit to provide FX funding.

If we focus on our baseline sanction scenario with neutral implications, we estimate pick up in short term FX liquidity and normalization in swap rates.

At any rate, it should be positively impacted by such local factors as the current account surplus, the Central Bank's moratorium on FX and the reduction of payments on foreign-currency liabilities.

Our forecast for USD/RUB is 64 at year-end. The RUB FX swap should be up by 80-100 bps and return to previous levels, thanks normalisation of $ rates

The shortage of currency liquidity in the interbank market is due to several factors:

- Active FX outflows has been observed for the fifth consecutive month since April, but it’s begun to attract attention only recently - on the eve of the second round of sanctions

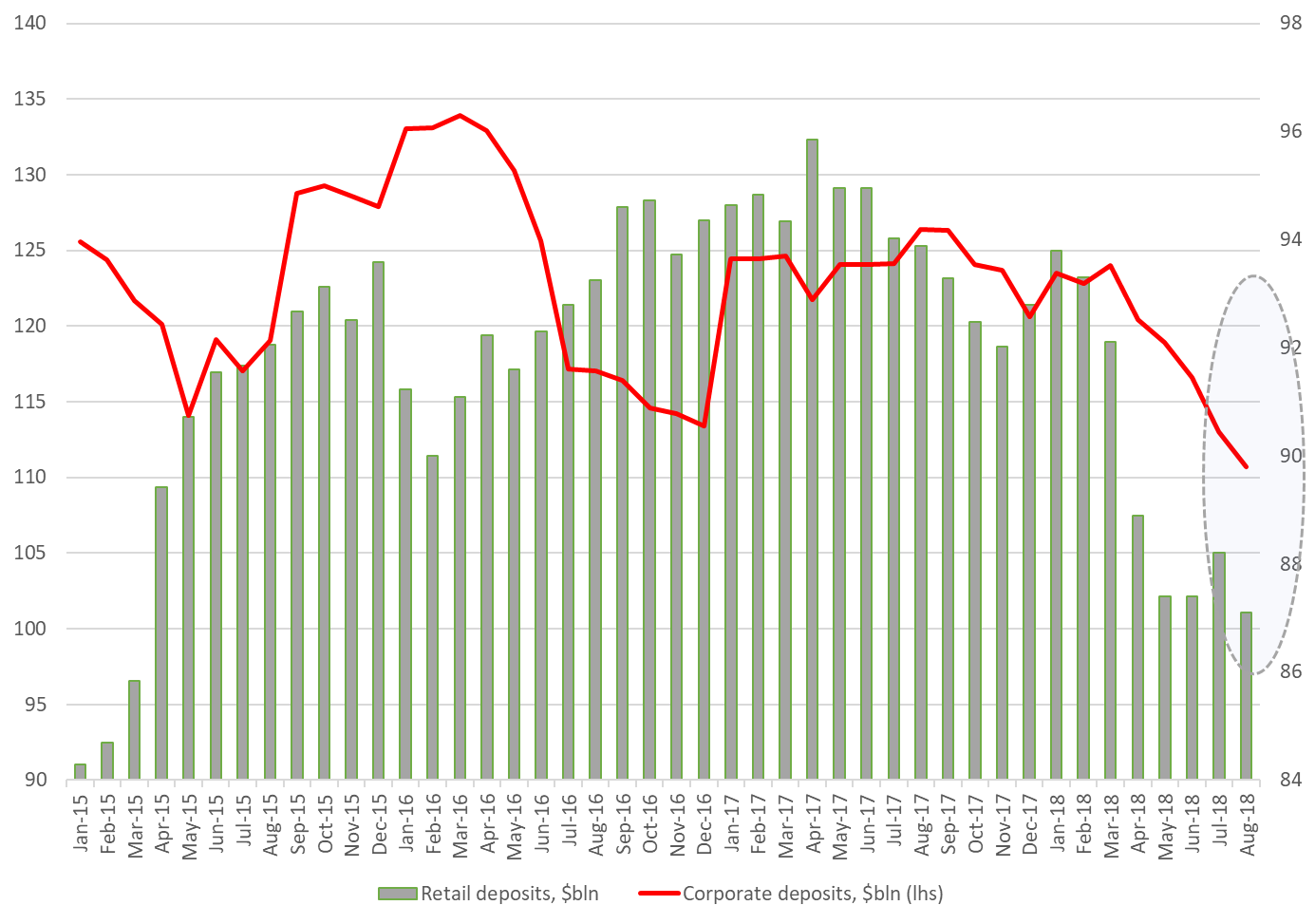

The first outflow wave was observed in April, after sanctions against RUSAL, in April-May, individuals and corporations withdrew FX from their deposits in amount of $ 10 bln.

- The next surge occurred in July-August. According to official data of the Central Bank, the volume of funds in foreign currency on personal accounts slid by $ 1.2 bln - to $ 87 bln, i.e. this figure fell to a three-year low. The funds were withdrawn mainly from foreign currency accounts in Sberbank. During this period, corporations withdrew $ 2.3 bln, thus, the total outflow of FX liquidity amounted to $ 3.5 bln. The outflow may have been due to fears that the US authorities would impose restrictions on Russian state-owned banks’ transactions in USD

- By August, the aggregate currency liquidity, which in March reached a peak of $ 216 bln, dropped by more than $ 18 bln, of which $ 13 bln was taken out by corporations and about $ 5 bln by retail

- Therefore, during this time - from April to August - the ruble weakened against the dollar by more than 18%, and the currency swap rates sharply went up. Foreign currency was mainly withdrawn from corporate accounts - this was due to the flight of non-residents and payments of $ external debt

- From April to August, FX outflow by non-residents amounted to RUB 400 bln (including RUB 272 bln in April-June), or about USD 6 bln, and payments on external debt exceeded USD 27 bln. According to our estimates, in September, non-residents withdrew another RUB 115 bln, or about USD 1,5 bln.Total outflows by non-residents from April to September was 558bln ($8,5bln), hence share of non-residents dropped to two year low of 25% from peak levels of 34% back in March 2018

- Therefore, the outflow observed since August is much less than, for example, that from March to June. Therefore the amount of currency funds on client accounts in all segments has fallen to a four-year low. This means that a significant portion of the funds have already been withdrawn

- The volume of available short-term FX liquidity in the banking sector has hit a fresh all-time low and amounted to $ 85 bln. In April, this figure was $ 96 bln, but, when there was an outflow of corporate funds due to sanctions, it began to shrink sharply, and by August was already down by $ 10 bln

In early September, VTB financed a large-scale foreign currency deal by approximately 60%, in which Qatar fund QIA bought a 19.6% stake in ROSNEFT for EUR 12 bln (USD 14 bln). The amount of financing totaled EUR 7.41 bln (USD 8.2 bln).

Outflows from $ deposits in Russia

How the shortage of currency liquidity affected the market

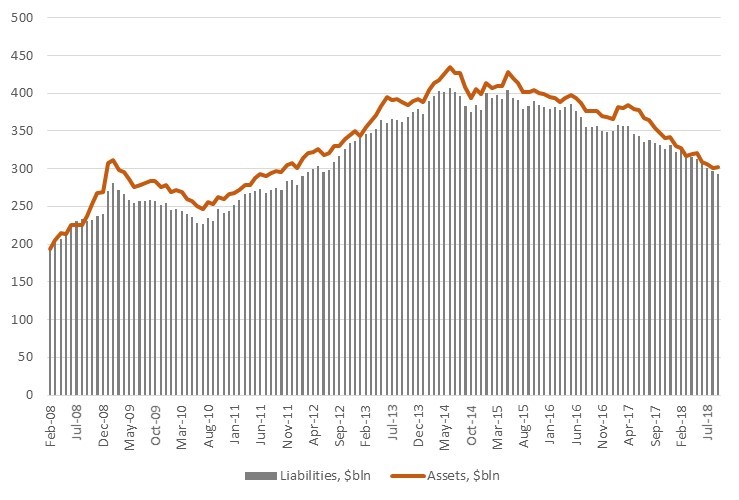

- Currency liabilities and assets of the banking system fell to the lowest levels in last six years. The liabilities decreased to USD 293 bln, and assets - to USD 301 bln

- The basis of the 12-month currency swap decreased by another 80 bps, up to –192 bps. At the same time, the currency swap rate rose, which indicates an increased demand for the conversion of ruble funds into foreign currency

- Currency rates on the interbank market (repo with MICEX) increased by 160 bps to 3.38%

Assets vs $ liabilities, $bln

Source: CBR, ITI Capital

Will the banking system have enough funds to fulfill its exchange commitments?

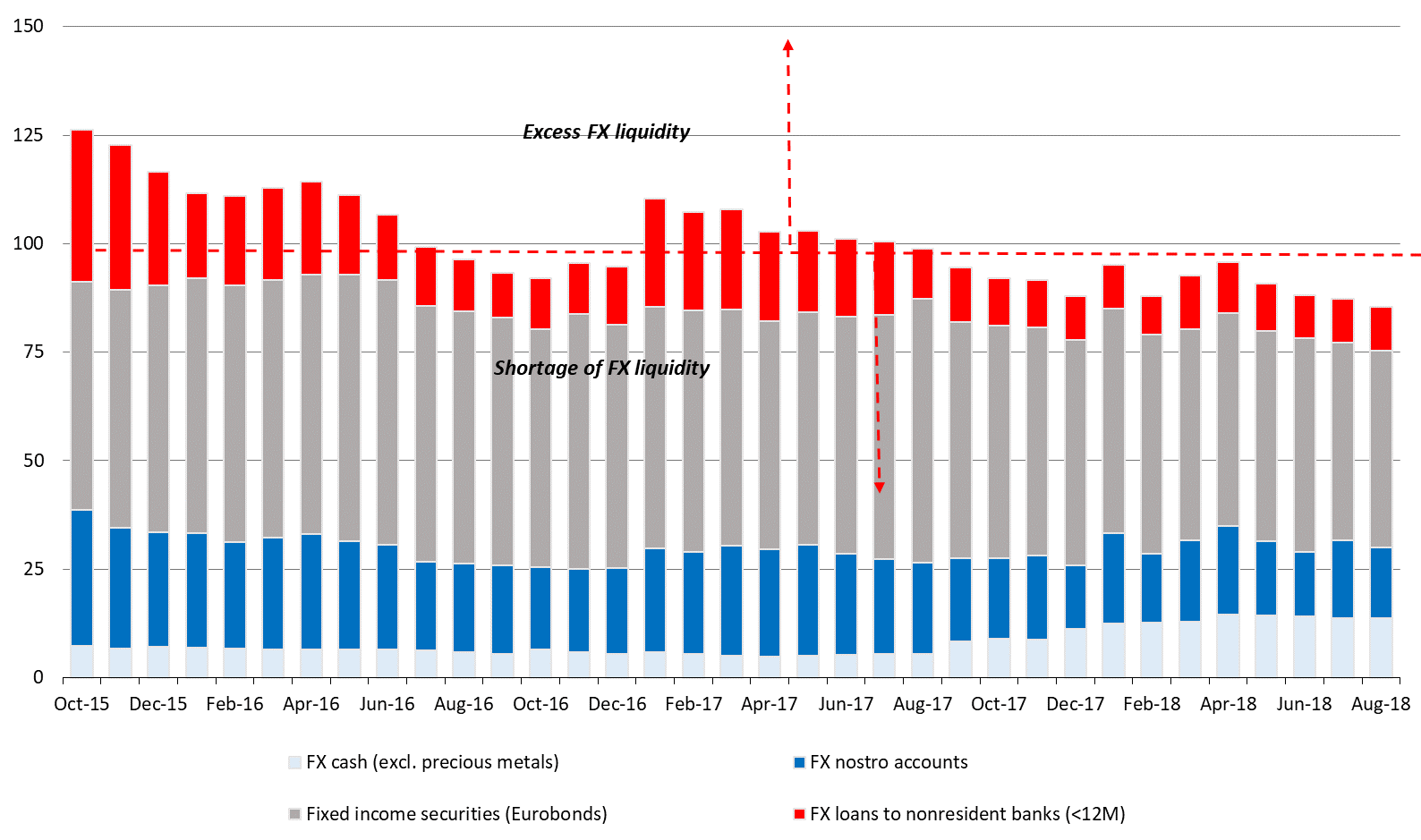

- To answer this question, one should calculate short-term currency liquidity of banks, which consists of the most liquid FX assets

- According to our estimates, the volume of available short-term currency liquidity is now a little over $ 85 bln. These are mostly liquid Eurobonds with a short duration ($ 45 bln) and maturities of up to 12 months, foreign currency funds on correspondent accounts ($ 16.3 bln) and in cash ($ 14 bln), as well as loans ($ 10 bln) granted to non-residents for up to 12 months

- This amount of available funds is enough to cover obligations to individuals in foreign currency by 97%, if there is no panic, and clients don’t massively withdraw the foreign currency from the banking system (in this case, the Central Bank will have to get involved)

Short-term FX holdings of banks, billion USD

Demand for FX and RUB dynamics

Source: Bloomberg, ITI Capital

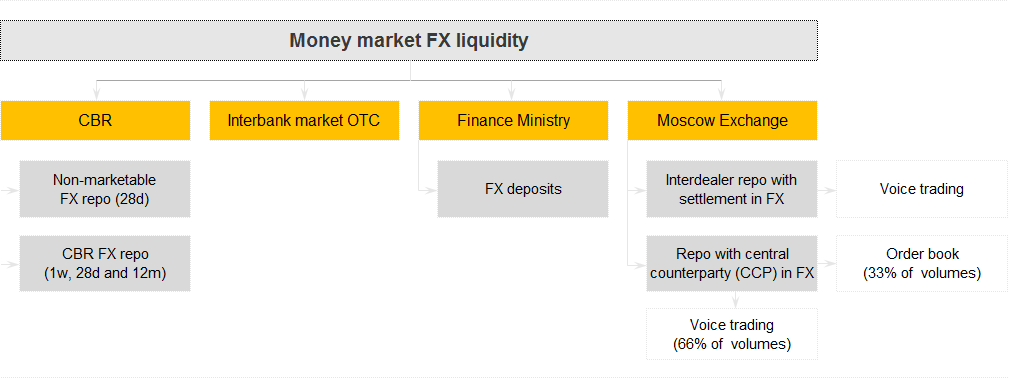

What tools do the CB have to sustain foreign currency liquidity?

After the crisis in December 2014, the Central Bank has build powerful toolkit to support the foreign currency funding of the banking system as a whole and, therefore, to ensure the fulfillment of exchange commitments to clients. However, these tools only allow to temporarily normalize the situation.

- FX repo with CBR, which the Central Bank has actively conducted since early 2015 at the lowest dollar rates at that time (0.8% for 28 days and 1-2% for 12 months). The limit on such operations was set at $ 50 bln, and the maximum demand for this limit was $ 33 bln was in April, when market participants actively attracted liquidity by pledging Russian-30 bonds in carry trade transactions, which also had a very positive effect on the ruble

- In addition to market assets repo, it was also possible to repo non-market, for example, export contracts

- The Central Bank also actively provided banks with foreign currency liquidity via currency swap transactions, and the limit of such transactions was quite high - up to $ 10 bln

- In addition, for the first time the Ministry of Finance held currency auctions for market participants, with the limits up to $ 3 bln at that time

- They also used a number of over-the-counter market transactions, for example, synthetic lending, when a bank attracts borrowed funds in rubles and converts them into dollars through a FX forward or a swap

Source: CBR, MICEX, ITI Capital