Russian Eurobonds demonstrated strong gains amid sell-off in US stock market that recorded its worst monthly performance in December since the 1930s. During the recent market turmoil since October, most investors preferred to keep the funds in US cash, in terms of risk aversion we seen good flow in highly reliable Russian Eurobonds (for example, VEB's debt), or pursue specific trade ideas in LATAM (Brazil and Petrobras). VEB’s long-term bonds issues are becoming attractive in near term due to recent ease in tensions over Rusal, postponement of Russian sanctions and recent allocation of R300bln of approved subscribed capital by the government.

Oil and ruble: We are not afraid of the big bad wolf

- Brent oil prices slide more than 40% since early October, as US oil production hit new record - daily production volume increased by 2,1 mln bbl YTD, and by 0,7mln bbl since October. The pressure on the oil prices mounted, as macroeconomic forecasts were revised down and global equity correction gained momentum. The number of short positions on the oil market surged by 16 million, or by 20%, since October, and reached April levels

- Despite oil prices decline, the rouble fell by as little as 5,5% over the period, and by 17% YTD. Oil prices dropped to lowest since October 2017, i.e. 3 716 roubles per barrel. The Russian government budget price of oil in ruble is 3 225/bbl (i.e. $50/bbl (Urals) * USD/RUB of 64,5)

- The correlation between the rouble and oil prices usually increases, especially if oil spot approaches closer to Budget oil level. The correlation was less than 50% until the market broke the $56/bbl mark ($54/bbl in Urals equivalent), but climbed further and reached 80% in the last ten days

- Now the correlation between the rouble and oil prices has weakened again due to the high supply of foreign currency on the market ahead of scheduled tax payments. Tax payments amounting 1,2 trillion roubles are expected from December 25 to December 28, and exporters can sell as much as $5,5 billion to finance them

- The seasonally high current account surplus also contributes to rouble strengthening (the surplus was over $ 104 billion in the first 11 months), creating additional FX liquidity due to suspension of MinFin FX purchases and large proportion of external debt refinancing

Russian Eurobonds are the best defensive asset amid stock market volatility

- The Russian Eurobonds have posted strong price growth of 3-4% on average since the sell-off in the beginning of October. VEB's bonds were the biggest gainers, climbing by 8%. MCB (Moscow Credit Bank) $ subords and Alfa-Banks perps unperformed the most. Russia sovereign debt in hard currency was flat despite weakness in the likes of Mexico

- For comparison, the US high-yield bonds and bonds of investment grade issuers posted losses along with equity sell off The EMBI Total Return Index slid by only 1%, due to a strong growth in late November, when it climbed by 2,5%

Investment ideas: Top picks

- Amongst the HY we recommend, VTB's subords and Alfa-Bank's perps. The securities have double-digit growth potential when aiming at pre August sell off levels. Amongst IG issues, we recommend VEB-23, VEB-24 and VEB-25 issues, that can gain by 3-4% in price in near term

- VEB bought back some securities from the market, but that move hardly had an effect on prices. VEB recently took the initiative to convert R212 bln of senior debt owed to the CBR (provided in 2008-09 for rehabilitation of the banks) into a subordinated instrument which will increase banks capital and is of longer maturity

- The high probability of further state support for VEB is already assumed by the rating agencies and priced in to the bank's traded debt .It should be noted that these funds will be provided on top of additional funding (100 billion rubles in 2019) from the federal budget

- VEB Eurobond issues in $ with a five years maturity have the strongest growth potential. Most corporate securities with up to three years are traded on average close to levels seen before the August sell-off

- The FX-denominated Latin America debt market is exhibiting mixed trends

- Pemex bonds fell by more than 6% over the past three months, while Mexican sovereign debt slid by 3-4%. At the same time, Brazilian sovereign bonds and Petrobras bonds of went up by 3% in price. As a result, the spread between Pemex and Petrobras grew wider - up to 62 points. In fact, it would be more reasonable to expect narrowing of this spread, since Pemex’s credit rating is four notches higher than that of Petrobras issues

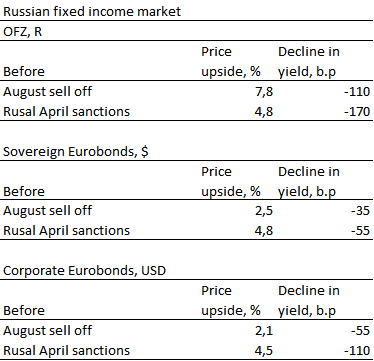

Potential price and yield upside estimate

Source: ITI Capital

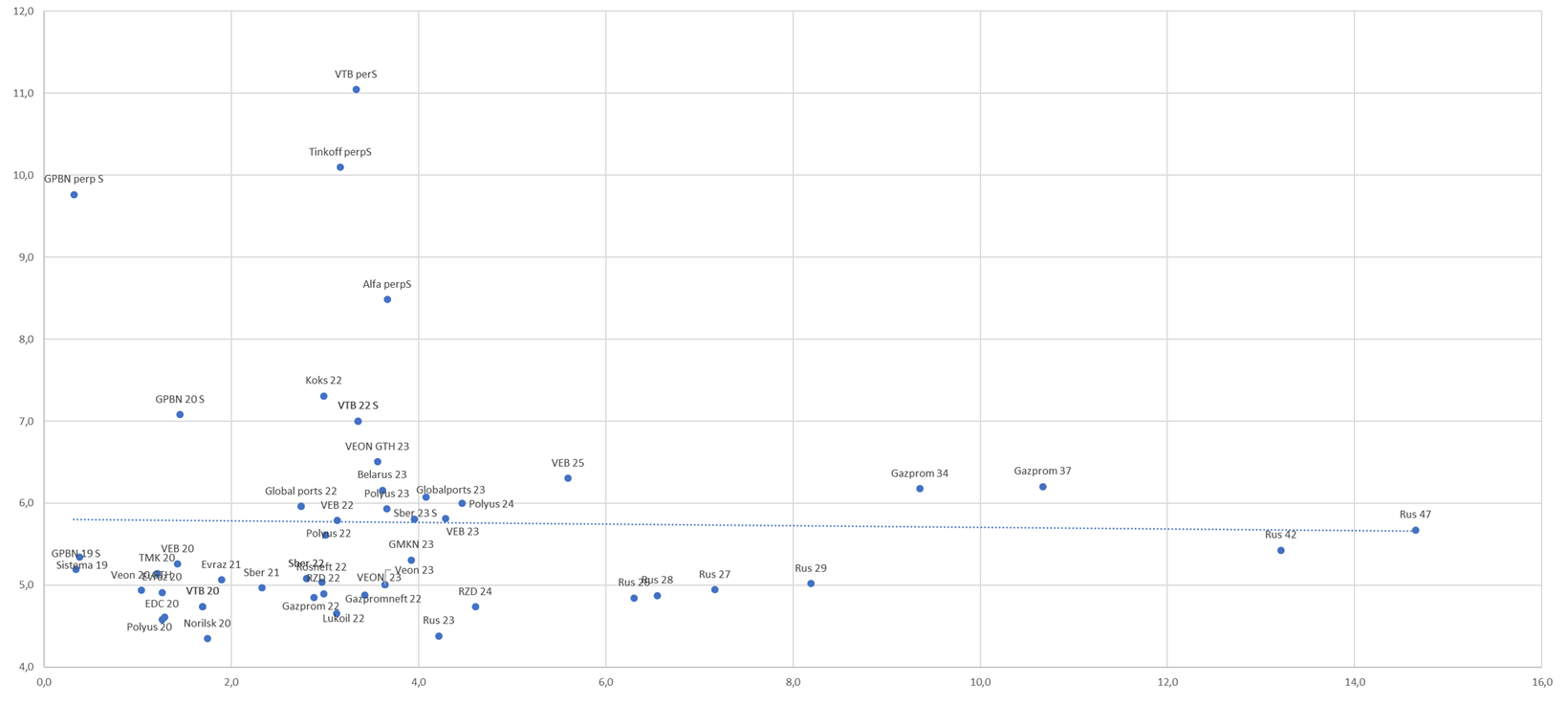

Russian Eurobond yield curve

Source: ITI Capital