Hedge against sanction risks:

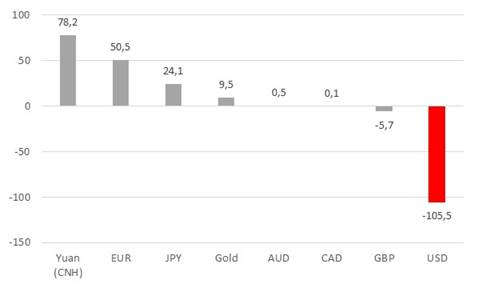

As of June 30, 2018 Russia’s central bank (CBR) dumped $106 bln in U.S. holdings from its FX and gold reserves and converted the equivalent of $148 bln into other currencies, primarily into Chinese yuan ($78 bln), euro ($50 bln) and Japanese yen ($24 bln) based on our calculations according to CBR latest report on management of FX assets and gold. The primary reason behind such radical move is to hedge against potential sanction risks related to freeze of Russian commercial bank accounts in USD held overseas.

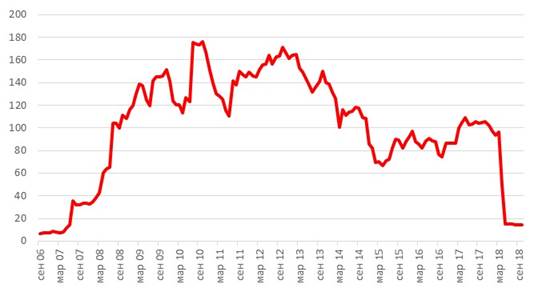

Russian holdings of U.S. Treasuries dropped by about $88 bln, from $103 bln, to $14,9 bln. What is clear is that the money raised was used to purchase the equivalent of $102 bln of South-East Asian currencies (Chinese yuan and Japanese yen). 70% of the overall foreign currency holdings growth came from yuan and yen purchases. Russian holdings of British pounds fell by $6 bln.

The shift from FX reserves denominated in USD does not mean that rouble will reduce its reliance on dollar. The move will mitigate foreign currency revaluation impact on CBR international holdings and increase rouble reliance on South-East Asian currencies and euro. It is important to note, that as of today yuan and yen are the least volatile global currencies.

As long as Russia’s economy heavily relies on commodities — oil and gas account for over 65% of the country’s exports as of latest 10 months of 2018, while 47% of budget revenue is derived from O&G. US dollar is still a major foreign-trade settlements currency with respect to export of O&G — and it will remain so. MinFin recent large scale FX-purchases make Russia’s reliance on oil even stronger.

Russia’s major shift from USD to South-East Asian currencies and euro

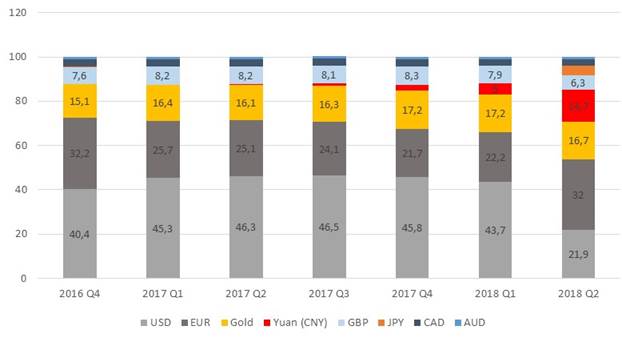

- Russia is making a shift in its FX reserves towards holding fewer dollars and more assets in the South-East Asian and European currencies, according to CBR’s latest data for Q2 2018

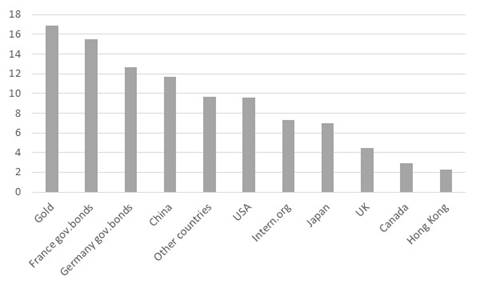

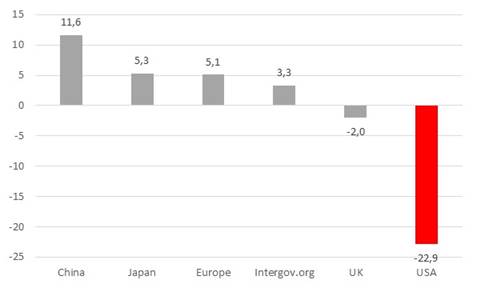

- The geographical structure of CRB’s assets changed dramatically for the year ending June 30, 2018, due to massive cuts in U.S. Treasuries holdings that fell by 23%, from 32,5% to 9,6%, the regulator’s foreign exchange and gold asset management report suggests. The cuts were offset by increased investments into government securities of China (the share is up from 0,1% to 11,7%), Japan and European countries (Germany and France) (+5%) and international organizations (+3,3%). Russia’s British pounds holdings declined markedly by 2%

- To recap, Russia was making massive cuts in its U.S. Treasuries holdings from the end of March through May, sending them from $96 bln to an all-time low of $14 bln. As a result, dollar’s share in CBR reserves reduced dramatically by the end of 1H2018

- As of today, the bulk of CBR’s FX-reserves accounts to three major currencies: euro (32%), US dollar (22%) and Chinese yuan (14,7%).

- Other currencies account for 14,7% of CBR’s FX and gold reserves, out of which British pound and Japanese yen accounted for 6,3% and 4,5% of the reserves respectively. Yen’s share rose strongly hitting a record high

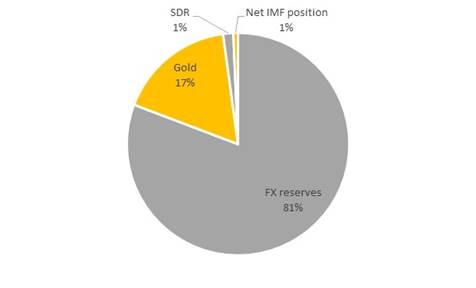

- It is important to note, that CBR’s overall structure of reserves including FX and gold and other assets remained almost unchanged: FX-assets (81%), Gold (17%), SDR (1,5%), IMF reserve position (0,6%)

CBR FX and gold holdings (% of market value)

Source: CBR, ITI Capital

US treasury securities holdings by Russia, $bln

Source: CBR, Bloomberg, ITI Capital

Geographical structure of Russia’s holdings, as of June 30, 2017, %

Source: CBR, ITI Capital

Net FX and gold purchases, June 30, 2017 — June 30, 2018, USD bln

Source: CBR, ITI Capital

Net change in geographical structure of Russia’s holdings, June 30, 2017 — June 30, 2018

Source: CBR, ITI Capital

CBR International reserves structure, as of June 30, 2018, %

Source: CBR, ITI Capital